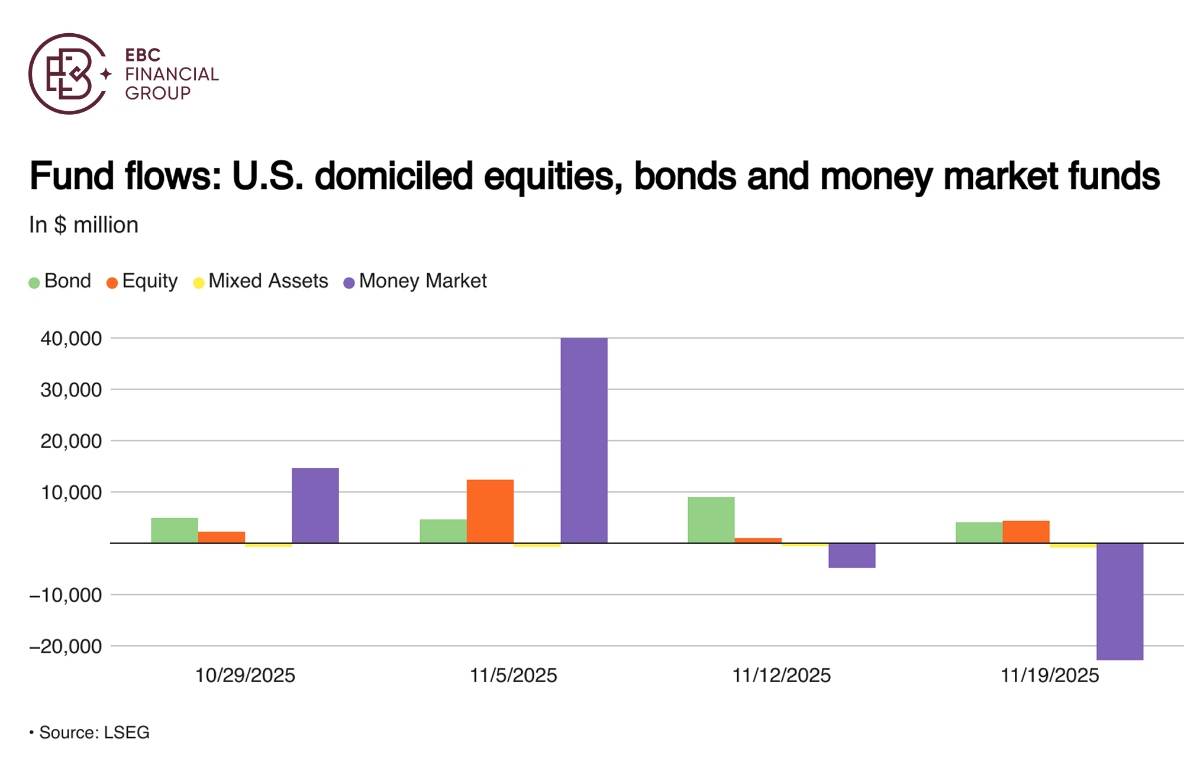

US investors poured nearly $92 billion into long-term funds in October, the largest inflow of 2025. Meanwhile, net US bond fund inflows cooled to a seven-week low of $4.11 billion in the week., LSEG Lipper data showed.

But the 10-year Treasury yield has fallen to 4% for the first time in a month, after White House National Economic Council Director Kevin Hassett takes the lead as Fed Chair Powell's successor.

Traders boosted bets on lower interest rates over the next year, reflecting the consensus view that Hassett would carry out the aggressive monetary loosening to satisfy Trump's demand.

Fed Governor Christopher Waller said the job market was weak enough to warrant another 25-bp cut in December, though action beyond that depended on a flood of data that was delayed by the government shutdown.

The latest economic data bolsters the case for further inflation cooling. Retail sales for September missed forecast; PPI came in line with expectations, but undershoot at the core level.

Julius Baer said the tariffs would have a transitory impact on import prices due to higher costs, but ultimately leading to lower consumer spending and driving rate lower in 2026.

In a low interest rate environment, US equities and bonds tend to rise in tandem, while the non-yielding commodities, which are typically used to hedge against price increases, tend to lose its appeal.

Big debtor

New data from the Treasury Department showed continued appetite among foreign investors for US securities. Net capital inflows were over $300 billion in August and September.

"That 'Sell America' thing was a one-week trade back in April. Since then, it's absolutely been 'Buy America Back,'" wrote Benjamin Schroeder, senior rates strategist at the Dutch bank ING.

Inflows from bond funds into the US have actually outpaced those in Europe in recent months, TD Securities noted. Benchmark Treasury yield is still higher than that of the German peer by more than 100 bps.

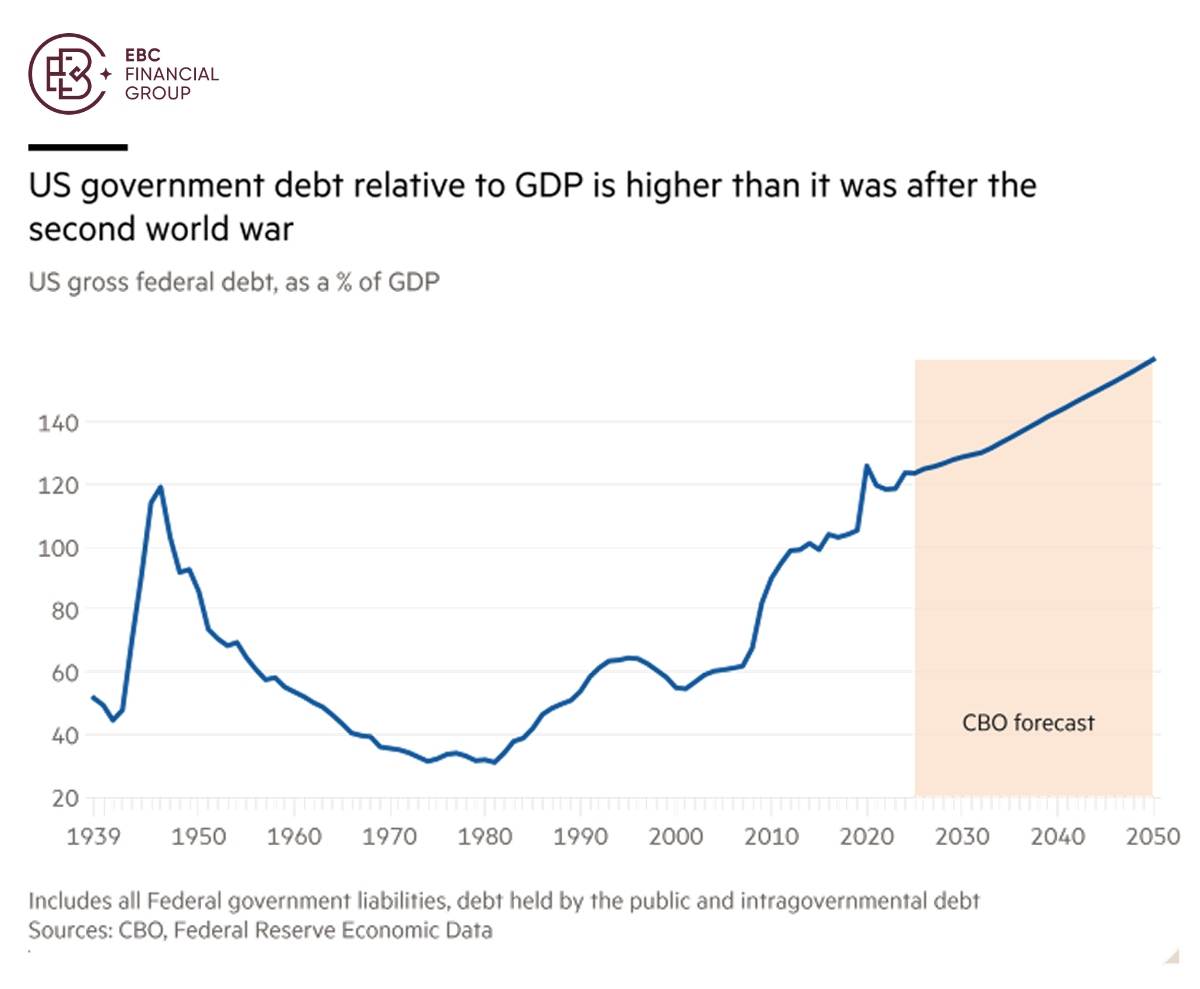

Trump is on course to push US debt levels above those of Italy and Greece by the end of the decade after wide-ranging tax cuts and increased defence spending, according to the IMF.

Amid tax cuts for high earners, the US is expected to run annual budget deficits of more than 7% over the next five years. Elon Musk was strongly opposed to the proposal on the ground of unsustainable fiscal path.

New tariffs are expected to raise $4 trillion between 2025 and 2035, according to the CBO's analysis as of August. But the bill is expected to cost about $4.1 trillion over a similar time period, according to the Bipartisan Policy Center.

On top of that, only Congress has the power to authorize and appropriate money from the general fund. "But Congress does not do this in practice," said Reilly White, a finance professor at the University of New Mexico.

Yield curve shift

Higher debt serving costs have led to Trump's push for a protracted easing cycle. Traders are betting big that the Fed will cut interest rates again next month, setting the stage for gains in US bonds.

There are signs of division and dissent among policymakers. Stephen Miran, Michelle Bowman and Christopher Waller have voiced support for another rate cut, while the other four FOMC members stay cautious.

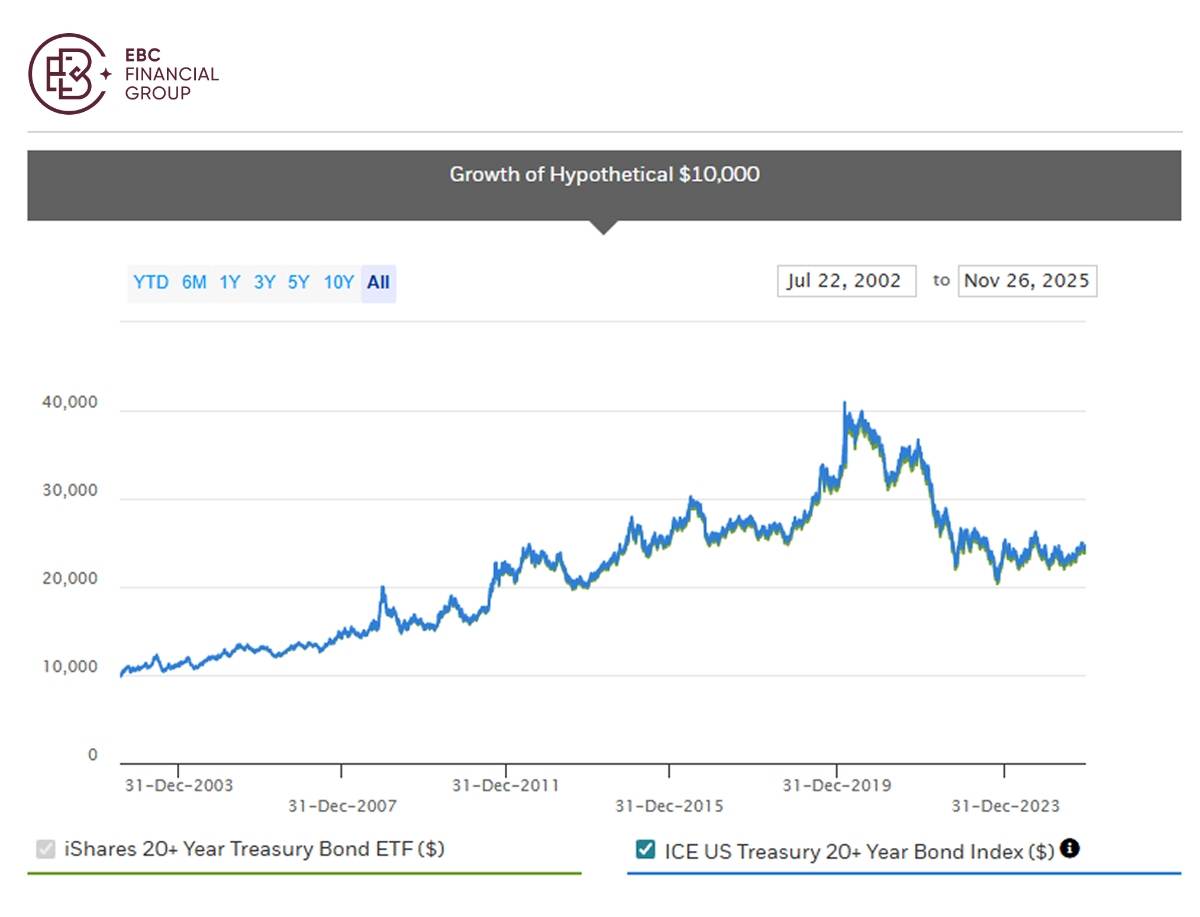

The short end of the US yield curve is skewed towards the downside, while the long end could reach a new high by the end of Trump's term. Thus steepening of the curve seems likely in 2026.

It is simple to construct a portfolio via EBC offerings based on the assumption, which involves selling iShares 20+ Year Treasury Bond ETF and buying iShares Barclays Short Treasury Bond Fund.

The type of structure bodes well for the financial/real estate sector in that the differentials can increase the profitability of their core business models, which rely on borrowing short-term and lending long-term.

Financial Select Sector SPDR Fund has lately notched a fresh all-time peak, mainly driven by big bank earnings. However, Vanguard Real Estate Index Fund has been trading sideways for years as data centre REITs faltered.

Weaknesses in the real estate ETF makes risk-reward attractive. CRE loan originations are rising after years of stagnation heading into 2026, which adds to the optimism on a potential rally.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发