The European currencies were largely unchanged on Monday after two weeks of selling of the greenback, ahead of a week crammed with central bank meetings, where a Fed's interest rate cut is all but priced in.

Central Europe's main currencies including the Polish zloty may be close to a ceiling after hitting fresh multi-month highs in the past month, a Reuters poll of analysts showed last week.

Analysts forecast a slight retreat back to 4.25 per euro in 12 months, which has been the centre of the currency's range trading this year. The currency has gained 12% against the US dollar in 2025.

The governor of Poland's central bank argues against the country adopting the euro in the near term on the grounds that it would risk economic instability. One in four Poles backs EU exit, according to a survey.

Poland's seasonally unadjusted real GDP expanded by 3.8% in Q3, accelerating from 3.3% in the previous quarter. Private consumption remained the main driver of the large increase.

A major reason that the economy eclipsed larger EU countries is refugees. Transparent tax system is attracting entrepreneurs from Ukrainians relocating during the ongoing war with Russia.

The Polish zloty has consolidated around 50 SMA for several months. Given signs of the dollar's resilience, we expect the pair to rally soon within trading range before a breakout is seen.

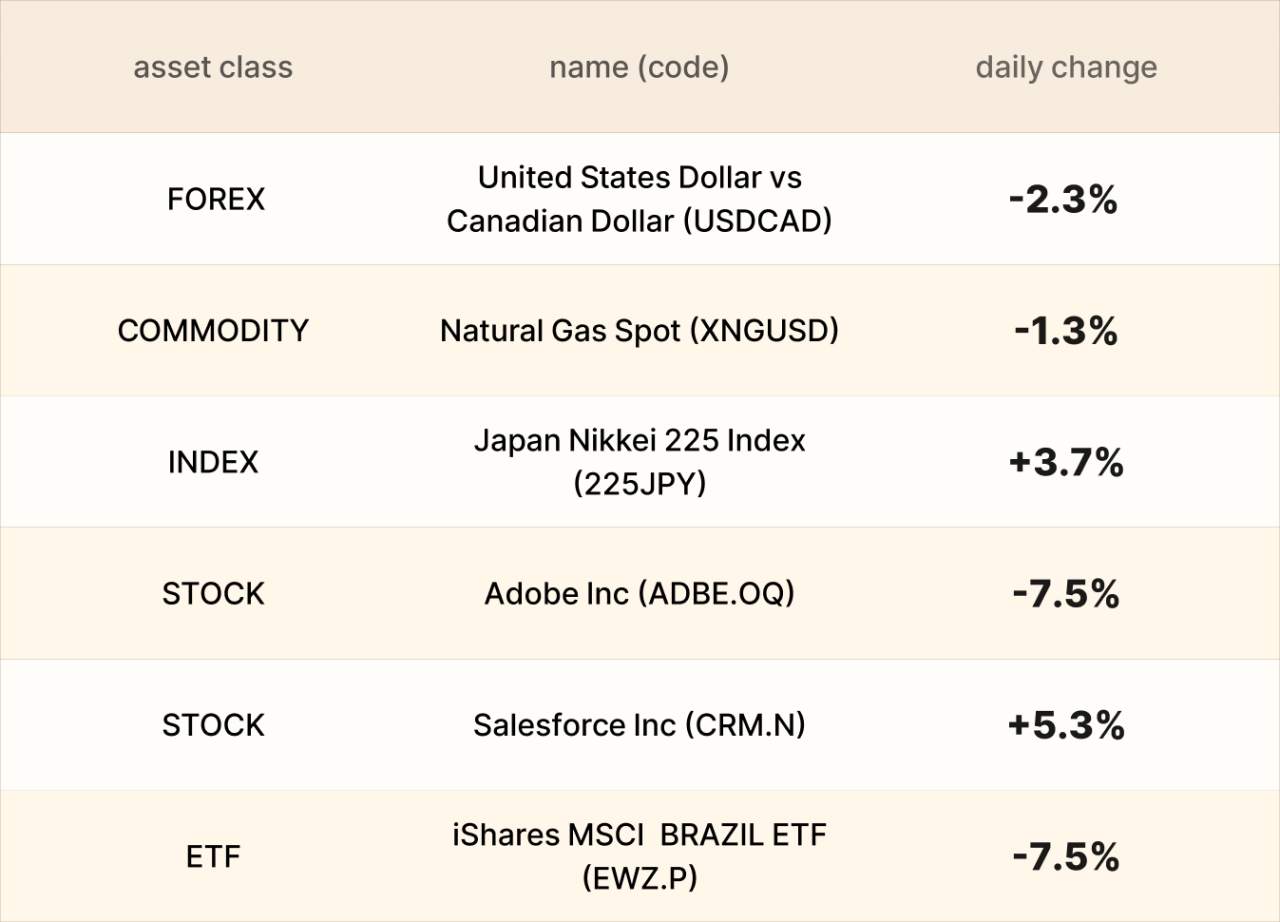

Asset recap

As of market close on 5 December, among EBC products, Adobe shares led gains. Investors looked confident before the company reported fourth-quarter fiscal 2025 results on 10 December.

The Canadian dollar strengthened by the most in six months, as stronger-than-expected domestic jobs data and rising oil prices boosted bets the BOC would begin raising interest rates next year.

Brazilian stocks saw their worst day since 2021 after former President Jair Bolsonaro endorsed one of his sons as the right-wing's name in presidential elections next October.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发