The yen looked wobbly on Wednesday after a sudden spill overnight, pressured by wide interest rate differentials between Japan and the rest of the world.

The BOJ is likely to raise its policy rate at its December meeting and the government is set to tolerate the decision, sources told Reuters. Governor Ueda said economy weathered US tariffs.

Japan's economy contracted faster than initially estimated in Q3, primarily due to new data dragging down capital spending figures, though economists said the blip is not enough to sway the central bank.

Looking ahead, economists said the world's fourth-largest economy is likely to return to growth in the next quarter, anchored by a slow recovery in private consumption, though geopolitical tensions loom large.

Beijing just upped the economic stakes with a new ban on all imports of Japanese seafood. Moody's Analytics economist warns that a sharp drop in Chinese travel to Japan would lower GDP by 0.2 ppts immediately.

Opinion polls suggest consumers are already fed up with inflation, reining in spending as a result. Takaichi's plan to hasten wage gains and cut taxes is likely to spook bond market already on edge.

The yen has failed to find a robust support, which bolsters the case for a repeat of late 2024. We see another leg lower following a short period of consolidation around the current level.

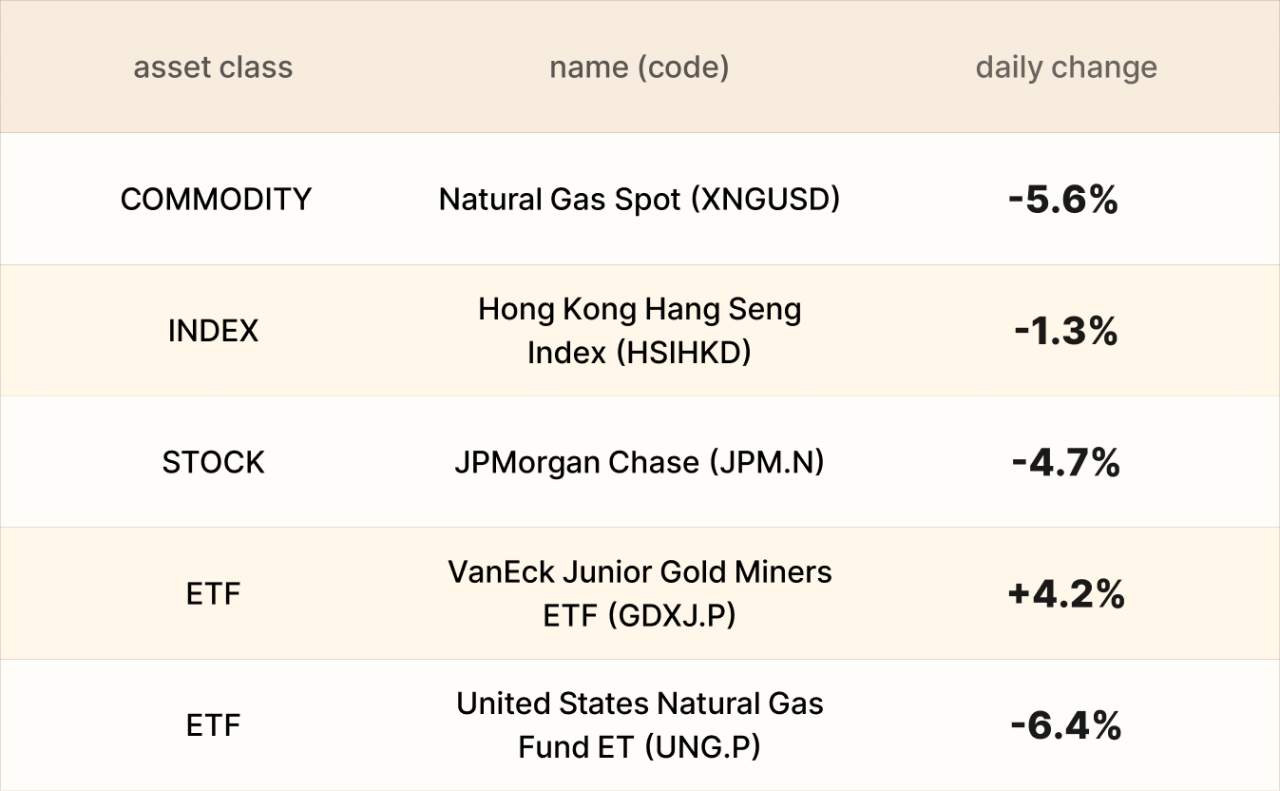

Asset recap

As of market close on 9 December, among EBC products, VanEck Junior Gold Miners ETF led gains. The latest WGC report says the gold market in 2026 depends on whether Trump's reflation policies will succeed.

JPMorgan executive Marianne Lake warned that costs at the bank would rise next year as competition in the credit card space and investments in AI drive higher spending at the firm.

The Hong Kong market extended losses as investors cautiously looked for clues on the Fed's policy path ahead. A set of survey data pointed to more economic slowdown in the country.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发