Oil prices were set to close lower for a second straight week, as rising prospects of a Russia-Ukraine peace deal offset concerns over supply disruptions from a blockade of Venezuelan oil tankers.

Putin warned Wednesday that Moscow will seek to extend its gains in Ukraine if Kyiv and its Western allies reject the Kremlin's demands in peace talks. He also took a swipe at European leaders.

Trump said he believes talks toward ending the war in Ukraine are "getting close to something," though allies are worried that he could appease Russia and leave Europe to foot the bill for supporting a devastated Ukraine.

Maduro ordered navy to escort ships carrying petroleum products from port, risking a confrontation with Washington on the high seas as he defied Trump's declaration of a "blockade."

US crude oil stockpiles decreased by 1.3 million barrels in the week ending 12 December, surpassing expectations for a 1.1-million draw, while gasoline and distillate inventories rose, he EIA said.

Global oil demand jumped in October from the previous month and from October last year amid a rebound in India's product demand, the latest data by the JODI showed on Thursday.

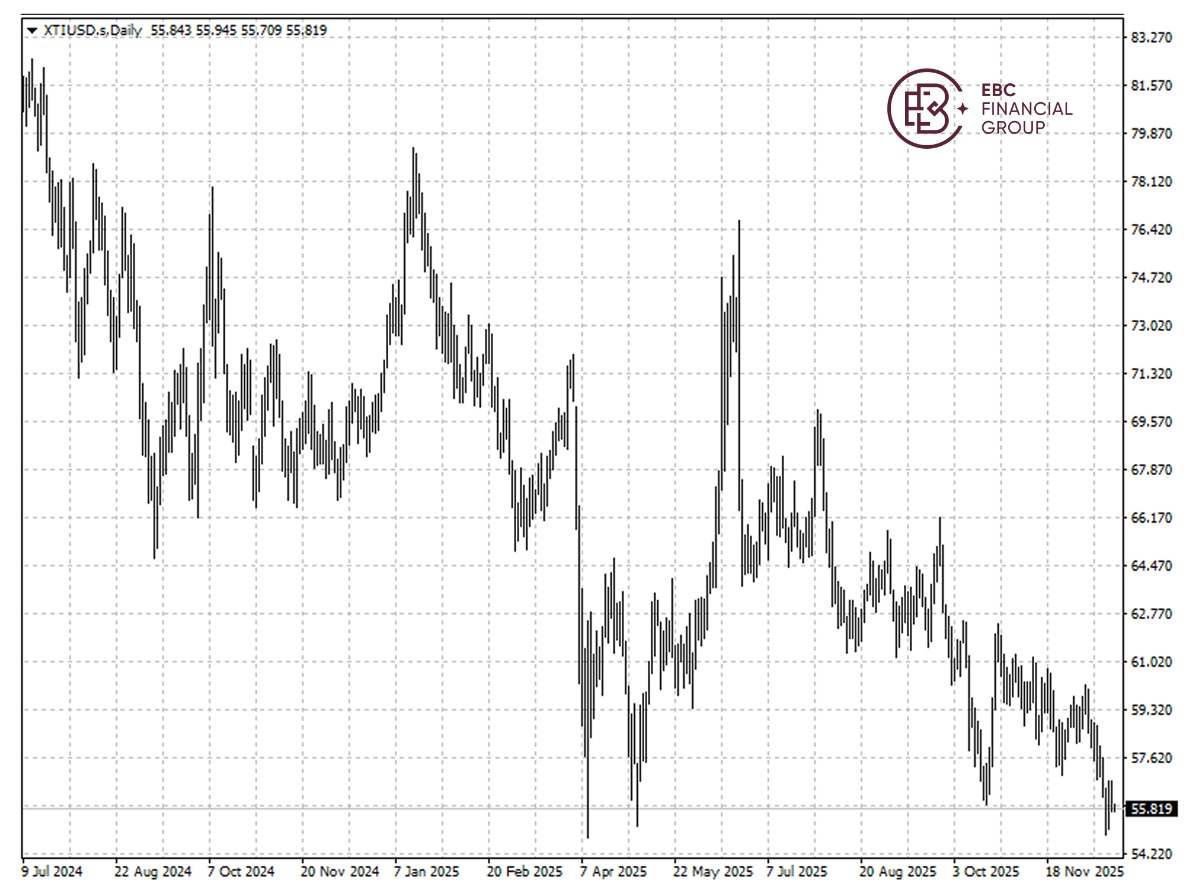

WTI crude was hovering around the low of $56 hit in 20 October, with a falling wedge pattern in the making. As such it is likely that the price dips below $55 going forward.

Asset recap

As of market close on 18 December, among EBC products, ProShares UltraPro QQQ ETF led gains. The Nasdaq 100 jumped as Micron's blowout forecast signalled strong AI demand.

According to a report, deep in the heart of Texas, Elon Musk's SpaceX is snapping up tens of millions of dollars' worth of Tesla Cybertrucks to work at its Starbase spaceport.

Japan's stock market took a sharp hit, dragging the Nikkei 225 to its lowest close in three weeks, as the earlier wave of skepticism about the economics of the AI boom spilled into Asia.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

#WTICrudeOil##NASDAQ##EBCFinancialGroup##EBCGroup##EBCGlobal#

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发