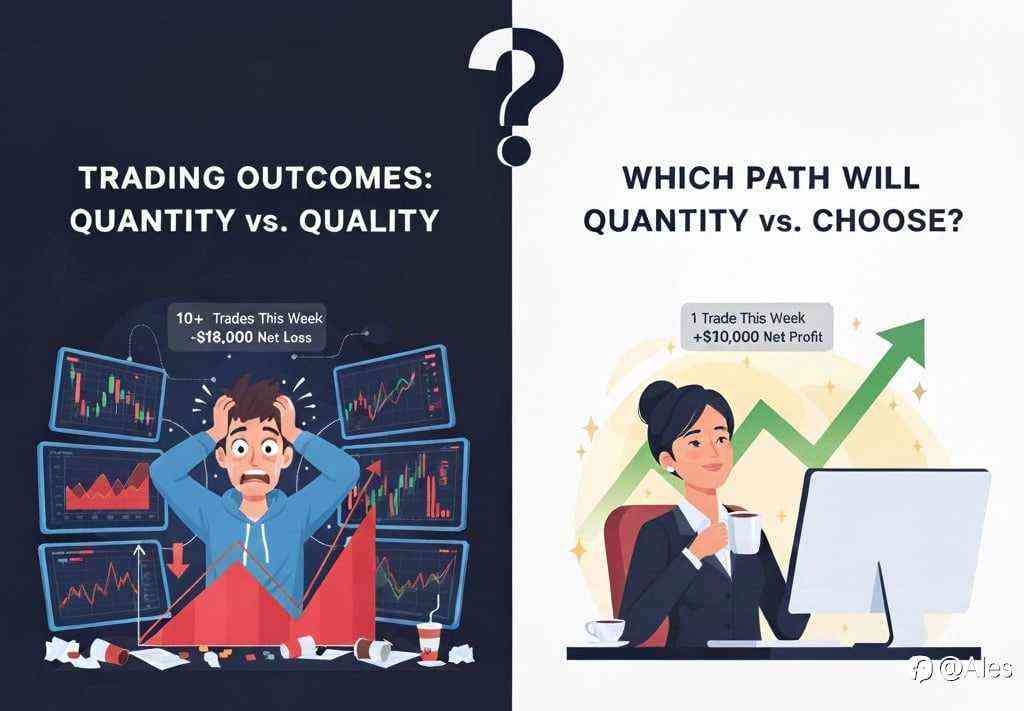

A paradox often occurs in trading: the more you trade, the less you earn. Beginners frequently confuse trading with a regular job, where income is directly tied to hours worked or tasks completed. In the market, it’s the opposite.

"The fastest one in trading is the one who is the slowest."

This phrase is the foundation of professional trading. What matters isn't how fast you click buttons, but your ability to wait for your specific setup and execute the trade according to your plan without hesitation.

A pro might sit in front of the monitor for 8 hours a day and not open a single position if the market is "unclear." This isn't a waste of time - it is the preservation of capital, both mental and financial.

Why does "Quantity" not equal "Wealth"?

- Mathematical Expectation: Every extra trade is a risk. The more trades you make, the higher the probability of making an error or hitting a losing streak.

- Emotional Resources: Trading means working in a zone of constant uncertainty and high emotional tension. Your brain is like a battery. By the 10th trade of the day, it runs out of juice, and you start making "stupid" mistakes.

How to find your "norm"?

Adopt the "One-Trade Rule" based on your system.

- If the system gives no signal - no position is opened.

- Once one trade is made (regardless of whether it’s a profit or a loss) - the trading day is over, and you move on to analyzing the position.

- If you feel discomfort after hitting a Stop Loss, take a break and perform your analysis afterward.

This approach builds systematic habits and discipline.

Trading is hunting, not assembly-line work. A hunter can sit in ambush for days just for one precise shot. Be the hunter, not the target.

The Bottom Line: Remember, profit is not proportional to the number of mouse clicks. The biggest money is made during 10% of the price movement.

已编辑 19 Dec 2025, 21:40

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发