The yen languished around its 11-month trough on Monday, after BOJ Governor Kazuo Ueda stuck to his usual cautious rhetoric following an interest rate hike last week.

Japan's top currency diplomat, Atsushi Mimura, said on authorities will take "appropriate" action against excessive exchange-rate moves, warning of the chance of intervention.

The remarks followed those by Finance Minister Satsuki Katayama that Tokyo would act, showing its concern over sharp yen falls that push up import prices and households' cost of living.

A Japanese media poll has found that nearly 60 percent of respondents believe PM Takaichi's remarks about a "Taiwan contingency" have negatively impacted Japan's economy.

The country's consumer inflation rate dropped to 2.9% in November, staying above the 2% target for a 44th straight month, thus further strengthening already strong prospects of a rate hike.

Furthermore, exports to the US rose for the first time since Trump announced baseline tariffs in early April, the latest indication that economies are faring better than expected in a protectionist trade environment.

The double top pattern, coupled with bearish MACD divergence, suggests more gains for the yen is very likely. A push below 157 per dollar could trigger another leg lower.

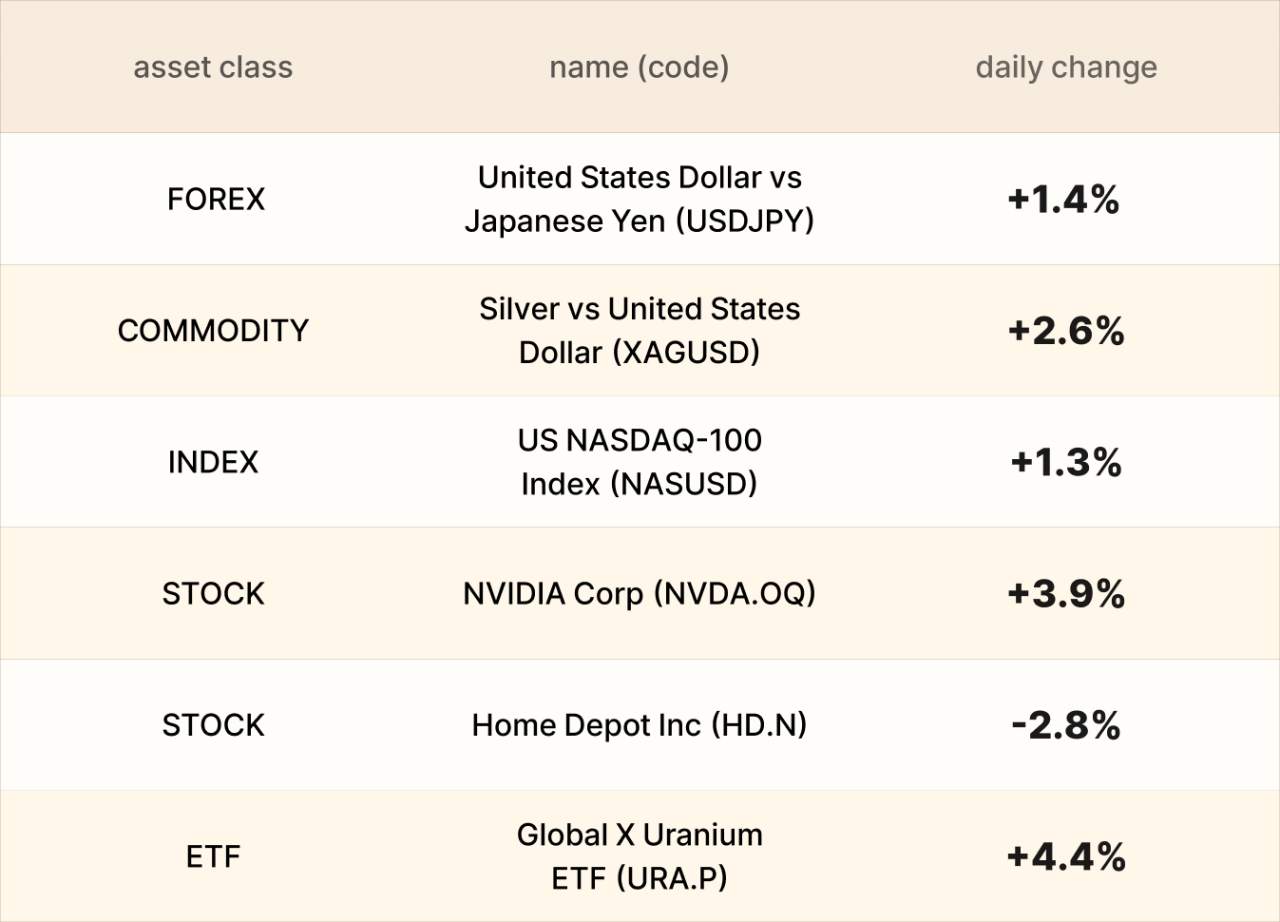

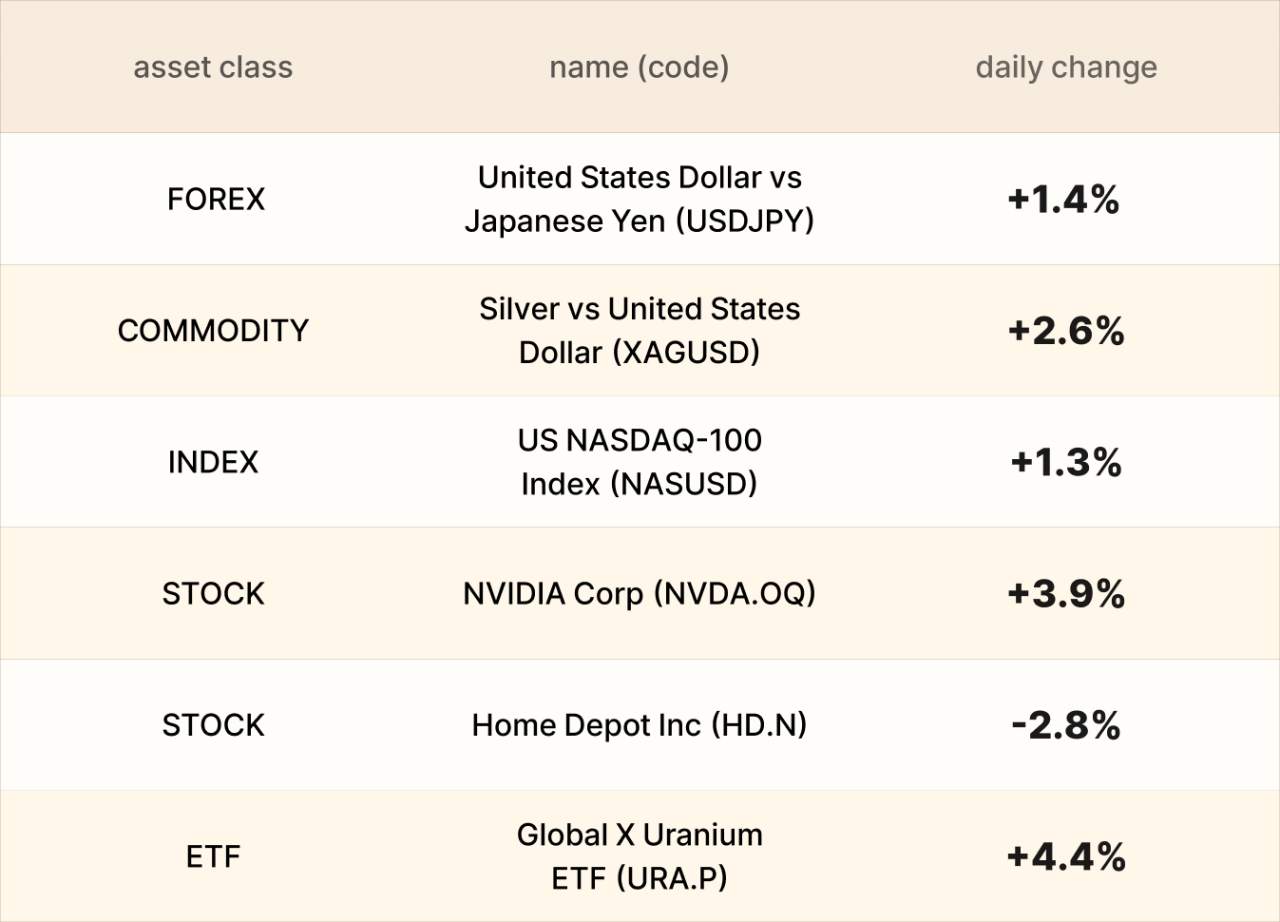

Asset recap

As of market close on 19 December, among EBC products, Global X Uranium ETF led gains. Signals are intensifying for a persistently tight supply amid growing demand, according to a report by Sprott.

Trump was moving ahead with his promise to allow Nvidia to sell advanced chips to China in exchange for a 25% fee to the government. Chipmaker stocks rallied in response to the headline.

Silver soared to another record high, bolstered by investment demand and a supply tightness, while gold posted a weekly gain buoyed by increasing expectations of interest rate cuts by the Fed.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发