The yuan eased on Thursday in a holiday-shortened week after data showing strong growth in the world's largest economy failed to shift sentiment on a currency under pressure from expectations of Fed interest rate cuts next year.

Options pricing has also turned more negative. So-called risk reversals, which depict market positioning and sentiment, show that options traders are the most bearish on the dollar in three months.

China's central bank kept its loan prime rates steady on Monday, even as the world's second largest economy has seen weak economic data and an extended slump in its property sector.

Surging yuan lending is poised to overtake overseas dollar loans at Chinese banks as attractive pricing helps drive a sustained push by Beijing to put the yuan on the global stage.

Yuan funding costs have run below those of the dollar since 2022, as US rates have climbed to curtail inflation and Chinese rates have fallen to try and stave off deflation

China's exceptional export growth is unlikely to be sustainable over the long term as global trade normalizes and protectionist pressures mount, Nomura said in a note.

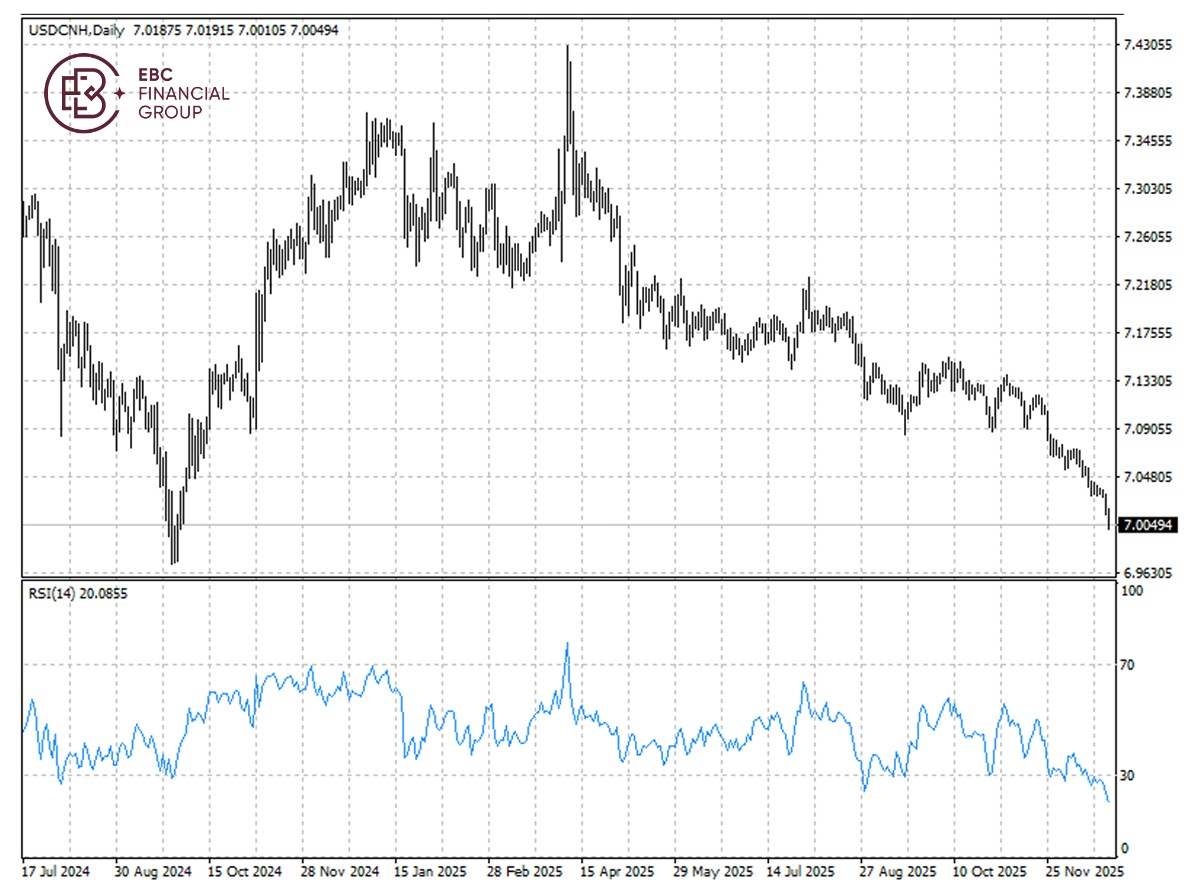

Having increased for months, the yuan closed in on the major psychological hurdle of 7 per dollar. Considering the signal of overbought, a retreat towards 7.01 per dollar could be in store.

Asset recap

As of market close on 24 December, among EBC products, iShares MSCI SOUTH KOREA led gains. Foreign investors are snapping up large-cap semiconductor makers and auto companies.

US natural gas futures edged down in thin pre-holiday trading, after touching a near two-week high. LSEG projected average gas demand in the lower 48 states would keep climbing over the next two weeks.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发