Asian stocks extended their record climb on Tuesday, taking the baton from Wall Street where gains for oil companies and financials helped the Dow hit an all-time peak.

The Nikkei 225 remained in favour, but its deep ties to the global AI supply chain leave it exposed to any sharp reversal. Policy divergence will be another key driver, with a bias towards curbing inflation.

BOJ Governor Kazuo Ueda said on Monday the central bank will continue to raise interest rates if price developments move in line with its forecasts. He added economy sustained a moderate recovery last year.

Finance Minister Satsuki Katayama said Japan was at a critical stage of shifting to a growth-driven economy, from one mired in deflation. Bank stocks would benefit from the trend if so.

Nomura Holdings said the Nikkei could rise to around 59,000 this year, citing strong corporate earnings; Daiwa Securities Group projected the index could reach 62,000 this year.

However, retail investors have ignored the equity rally at home and have placed their faith in overseas stocks. Some of them are excessively overweight US stocks, pointing to a potential rotation.

Firmly supported by 50 SMA, the Nikkei 225 looks poised to challenge the previous high around 52,660. But it is questionable whether we will see a fresh peak in the short term.

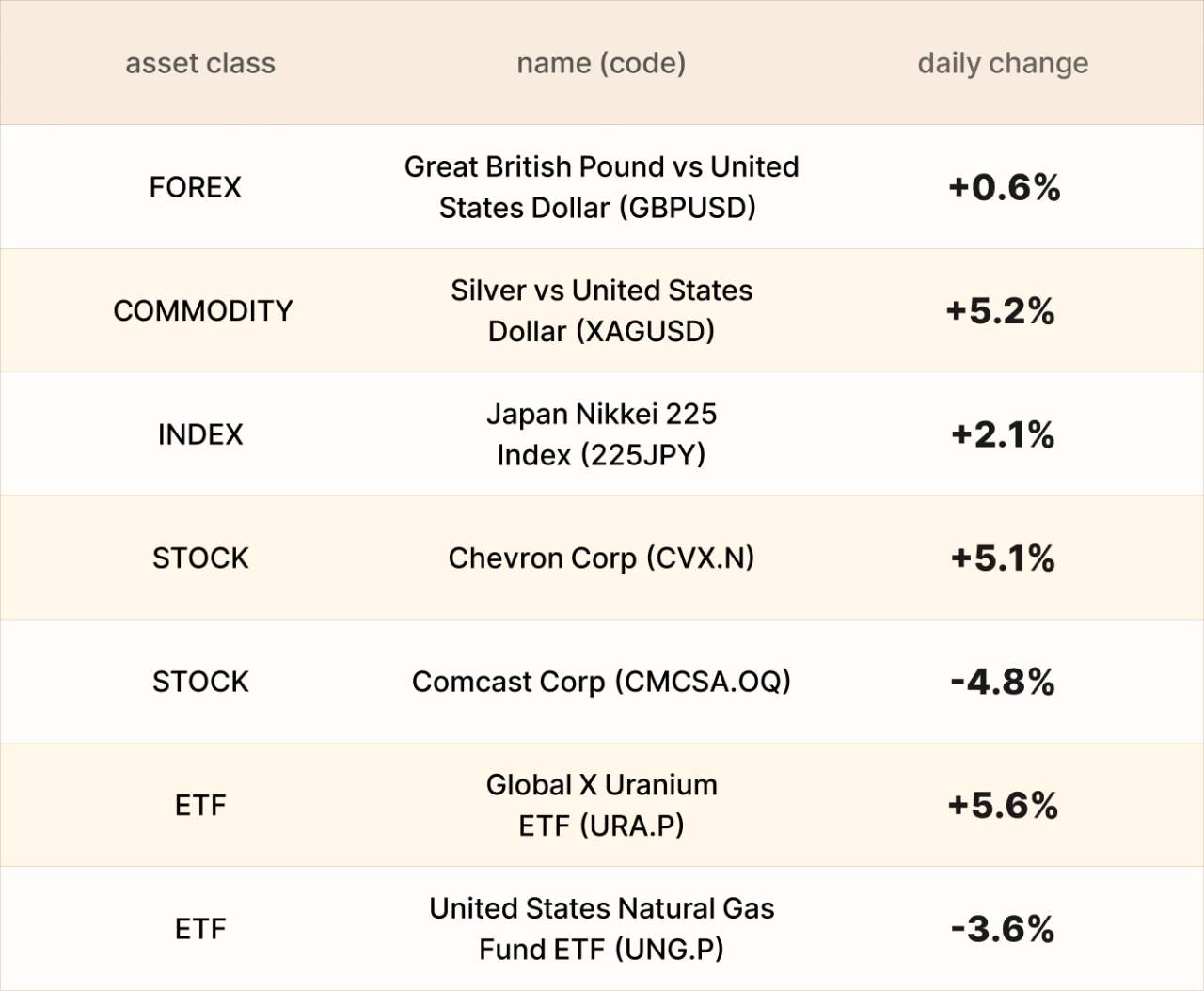

Asset recap

As of market close on 5 January, among EBC products, Global X Uranium ETF still led gains. Chevron is viewed as one of the biggest winners after Trump said the US took control of Venezuela's oil reserves.

Precious metal prices also jumped on heightened geopolitical tensions. Demand for safe-haven assets swelled as Trump threated Iran, Cuba and Columbia following seizure of Maduro.

Versant Media Group, the portfolio of cable TV networks and digital assets spun off by Comcast, joined the small cohort of public media companies as the industry reckons with ongoing disruption.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发