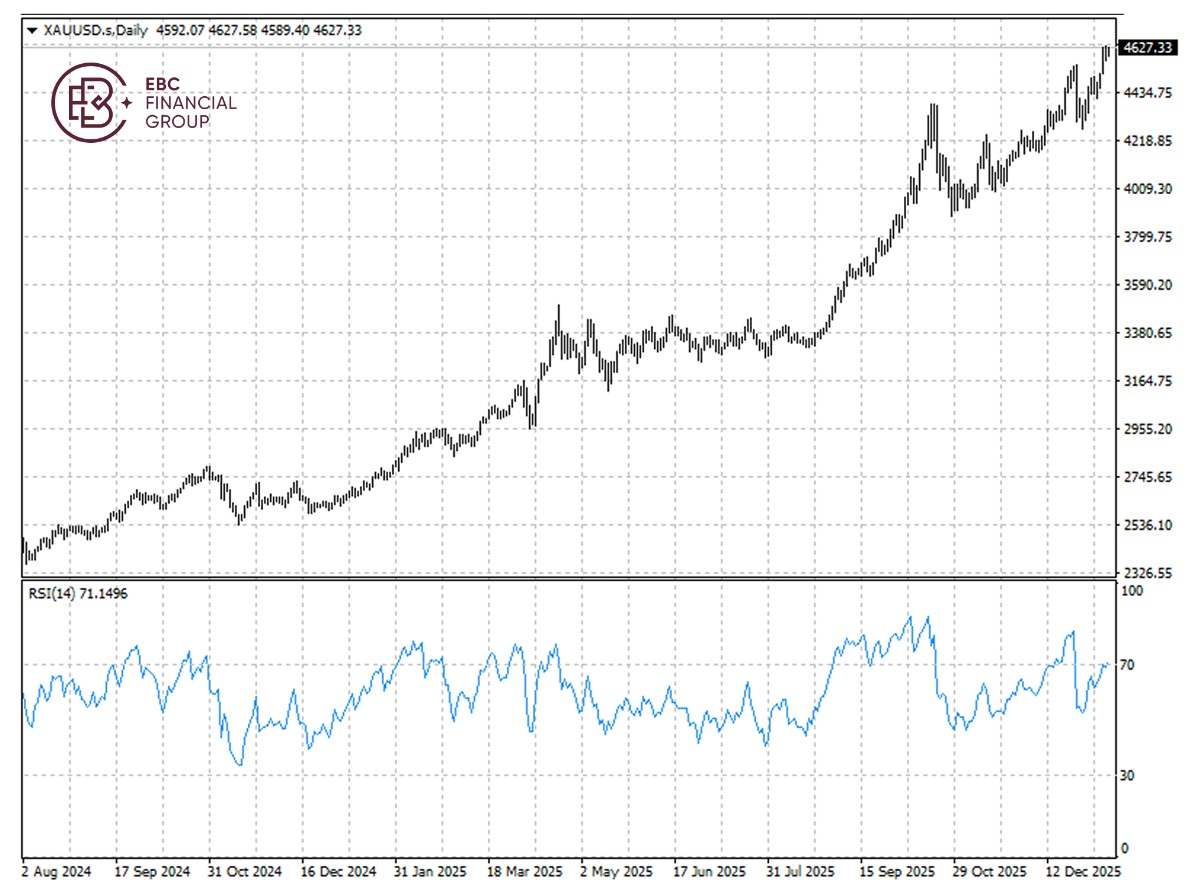

Gold prices stayed above $4,600 on Wednesday although the dollar recovered ground to near a one-month high. Trump promised Iranians that help was "on its way" as violent crackdown is escalating.

After months of publicly threatening Iran, Israel has gone quiet, waiting to see how the protest movement develops. Several nations have urged their citizens to leave Iran as soon as possible.

CPI was broadly in line with estimates, firming up expectations that the Fed will remain on hold later this month despite unprecedented pressure from the White House to lower interest rates.

Volatility in most currency pairs was subdued in early Asian trading ahead of a possible Supreme Court ruling on the legality of Trump's emergency tariffs which brought trade deficit to a 16-eyar low in October.

The White House has said that officials will find alternative avenues, if the court does not rule in its favour. That could include existing legislation which allows the president to put tariffs of up to 15% in place for 150 days.

Central bank gold demand remained firm in November, which cements the ongoing rally. Net purchases totalled 45 tons as emerging-market central banks continued their significant gold buying this year.

Gold has not entered overbought area despite rising to a record peak, signalling more gains ahead in the upcoming sessions. We believe $4,650 is within easy reach.

Asset recap

As of market close on 13 January, among EBC products, Intel shares led gains again. Analysts upgraded its shares to Overweight, citing advances in its manufacturing business and demand for its chips from AI data centres.

Salesforce tumbled, making it the Dow's weakest link. That underscored how quickly enthusiasm can sour on major software firms betting on AI as their growth engine.

Silver is now approaching the $90-an-ounce mark as market participants maintain their bullish views on the safe-haven metal amid geopolitical and economic uncertainties.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发