Oil prices were flat on Friday with both Brent and WTI crude prices moving only a few cents from their closing prices after the likelihood of a planned strike on Iran receded.

Both contracts rose to multi-month highs earlier this week after protests flared up in Iran. Trump said Tehran's crackdown on the protesters was easing, though he may be playing a stall tactic.

The US is securing about 30% higher prices for Venezuelan crude, Energy Secretary Chris Wright said Thursday, as the country has started selling it after capturing its former President Maduro.

Shell released its 2026 Energy Security Scenarios with a bullish case for oil markets. It estimated that primary energy demand by 2050 could be 25% higher than last year.

The study is at odds with the EIA newly outlook for 2027 that shows the inventory builds and downward pressure on oil prices it expects this year to continue into the next before moderating as the year unfolds.

Crude oil inventories in the US increased by 5.27 million barrels during the week ending 9 January, sharply reversing a 2.8 million-barrel draw in the prior week. Petrol price has dropped below $3.

Brent crude eased from its 200 SMA, indicating the price has been primarily influenced geopolitics. Still we do not see Khamenei Khamenei get away with it, so the upside risks remain.

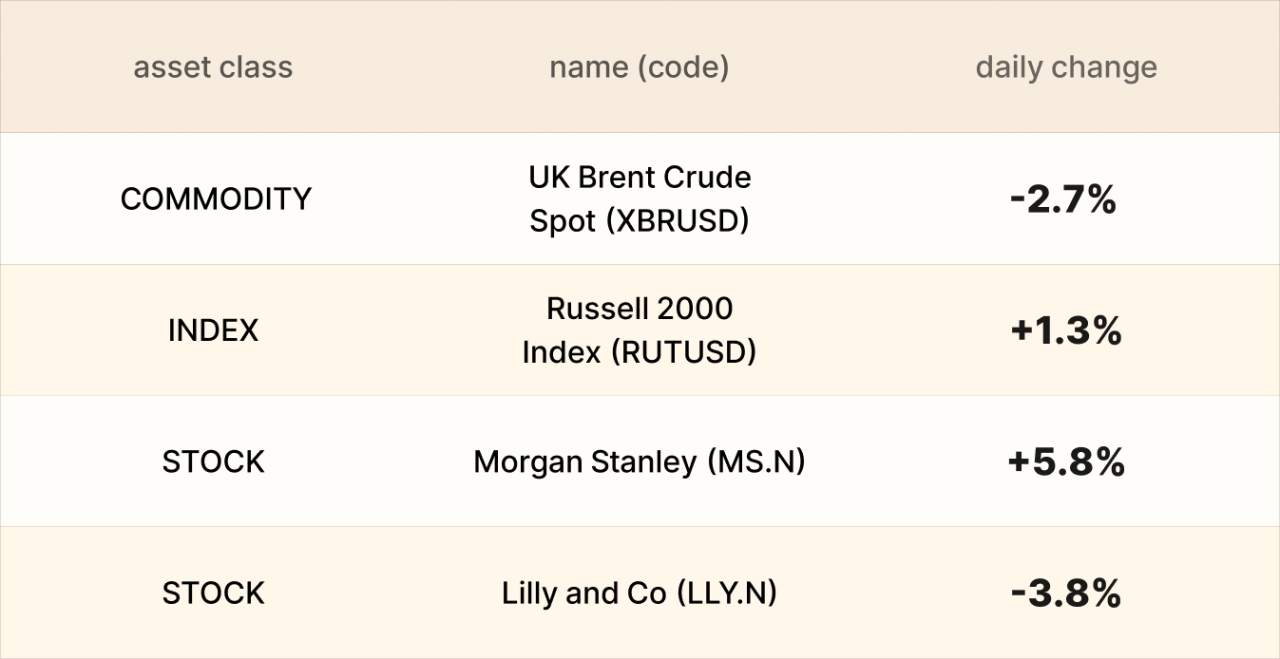

Asset recap

As of market close on 15 January, among EBC products, Morgan Stanley shares led gain. The bank reported Q4 results that exceeded expectations on the back of strong revenue from wealth management.

Lilly and Co is reportedly being sued in Texas by compounding pharmacy Strive Specialties, which alleges they are illegally blocking access to customized versions of their blockbuster weight-loss medicines.

The number of Americans filing new applications for unemployment benefits unexpectedly fell last week, lifting the Russell 2000. The labour market remains in a "low-hire, low-fire" state.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发