Forex news for NY trading on September 17, 2019

- US stocks break 2-day slide. Close near day highs.

- Doublines Gundlach: Fed will embark on QE light

- Could an expanded Fed balance sheet be behind the dollar's fall today?

- WTI crude oil futures settle at $59.34 down $3.56

- Pres. Trump: Does not think release SPR is necessary

- Saudi energy minister: Oil supply have resumed as before

- More Villeroy: Monetary policy cannot be the only game in town

- Aramco source: Saudi's Aramco's Abqaig restored 2M barrel capacity

- Dollar continues to soften. Fed decision 24 hours away.

- ECB Villeroy: Great uncertainty remains around Brexit

- French Central Bank keeps 2019 keeps growth forecast at 1.3%

- European major indices are ending with mixed/modest results

- US VP Pence: US is military is ready after Saudi oil attacks

- Irish foreign min: Ireland won't sign up for permanent border checks

- New Zealand GDT price index +2.0% at auction

- Fed takes $53.2B in repo operation

- NY Fed restarts repo operation

- US Sept NAHB housing market index 68 vs 66 expected

- Fed will conduct first overnight repo in years

- US August industrial production +0.6% vs +0.2% expected

- Canada July manufacturing sales -1.3% vs -0.1% expected

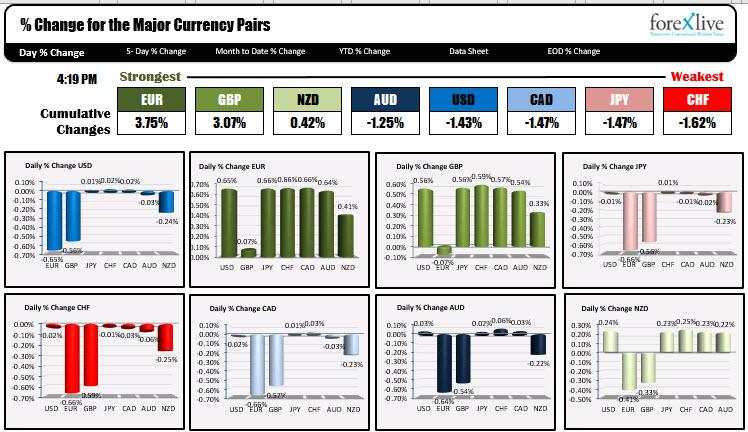

- The EUR is the strongest and the AUD is the weakest as NA traders enter for the day

In other markets, the snapshot near the close is showing:

- spot gold is up $3.12 or 0.21% at $1501.51.

- WTI crude oil futures are trading down $4.17 or -6.65% at $58.73. The prices down from the settlement level as private inventory data shows a surprised build in crude inventories.

The long awaited September FOMC decision is less than 24 hours away and a tight Fed Funds market had traders thinking that perhaps it is indicative of a market that is tighter than the Federal Reserve wants. As a result, they may announce not only a cut but perhaps the resumption of QE to help address the liquidity issue. We will find out at 2 PM ET tomorrow when the Fed will announce their decision.

PS the chance for a 50 BP cut rose to 15.3% from near 0% yesterday (and last week). The most recent high % was up at 43% on around August 15.

As a result, the dollar fell overall with most of the declines coming versus the EUR (-0.65%),the GBP (-0.56%) and the NZD (-0.24%). The dollar near unchanged vs the JPY, CHF, CAD and AUD after being higher vs. those currencies earlier in the day.

The decline in the USD came despite what was some decent Industrial Producation and Capacity Utilization data. The IP rose 0.6% vs 0.2% estimate while the Cap.Utillization rose to 77.9% from 77.6% (last month at 77.5%). In the only other US data, NAHB Housing Market index also beat to the upside at 68 vs 66 estimate. Data was better but the USD did not really care.

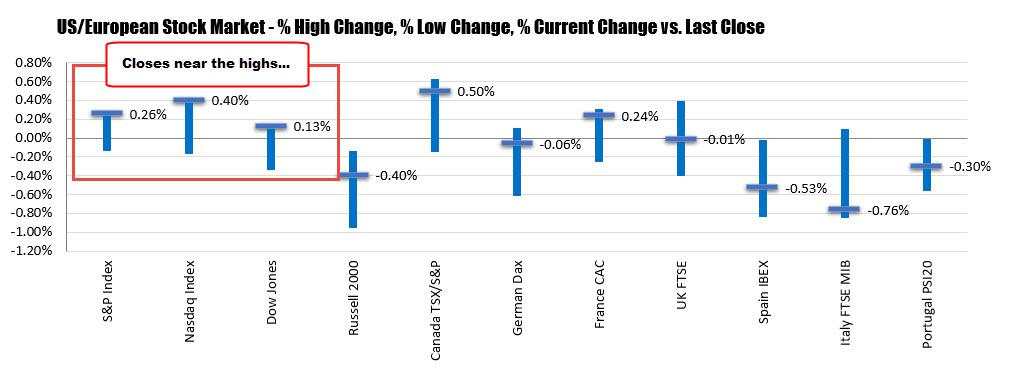

The hope for a softer Fed (with QE) helped to give the US stocks some lift. Admittedly, the indices muddled along for most of the day, but did close near highs for the day. The Nasdaq led the charge. Below is a snapshot of the % changes (low, high and close).

In the US debt market today, the yields started lower and moved back toward unchanged levels before moving back to the downside in afternoon trading. The yield curve flattened a bit, but it was not a material change.

In the US debt market today, the yields started lower and moved back toward unchanged levels before moving back to the downside in afternoon trading. The yield curve flattened a bit, but it was not a material change.

The technicals for some of the major indices shows:

EURUSD: The EURUSD started to move higher in the early NY session only to run into some teemporary resistance at the 100 and 200 hour MAs ata 1.1039 area. After a brief and shallow correction, the price extended above those converged MAs and trended higher for the rest of the day. The price is closing near the highs for the day at 1.1071 with the next targets at 1.10847-886. About that and the familiar 1.1100 to 1.1110 area will be eyed. Recall the swing lows from April, May and July all bottomed in that area. Last week, the high stalled at 1.1109.

MORE....

作者:Greg Michalowski,文章来源Forexlive,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

喜欢的话,赞赏支持一下

暂无评论,立马抢沙发