Outlook: We get retail sales and the Fed minutes today. For some reason the Fed is getting more press ink than sales, as though the minutes are a crystal ball that will answer the question “75 bp in Sept or not?” The CME FedWatch tool has the probability of 75 bp at 60.5% from 41.0% yesterday. We bet it rises firmly after the minutes because the Fed’s resolve has not changed and the dovish hope arose from miscellaneous cover-your-back comments about data-dependence and nearing neutral, not the Fed voter stances that will be bolstered in the minutes.

July retail sales are forecast kind of feeble at 0.1% m/m (after 1.0% in June) and ex-autos, down 0.1% m/m. Retail sales on the weak side might be favorable because they can be interpreted as showing the consumer cooling off and demand for goods and thus inflation cooling off. Inventories might be interesting. We await discounts and sales, especially at big box stores.

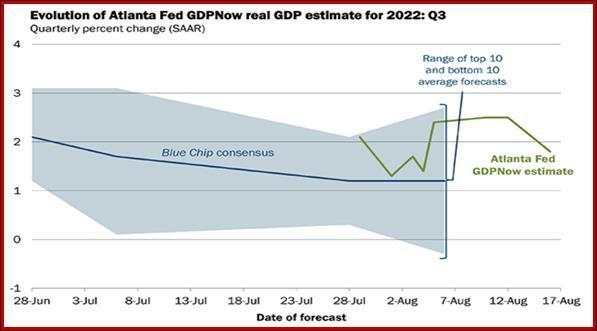

The Atlanta Fed GDPNow slid to 1.8% for Q3 from 2.5% last week–but we get another version today. This time the drop was due to the nowcast of real gross private domestic investment growth from 0.2% to -3.6%, only partly offset by government spending growth 1.7% to 2%.

Despite the litany of bad data–Empire State, housing, Atlanta Fed–the bond market went for the hawkish Fed stance yesterday and yields rose persistently, and more in the 2-year than in the 10-year. The dollar didn’t respond but had perhaps seen it coming the day before. Besides, European yields also went up, presumably on grim inflation outlooks. We get the eurozone CPI tomorrow.

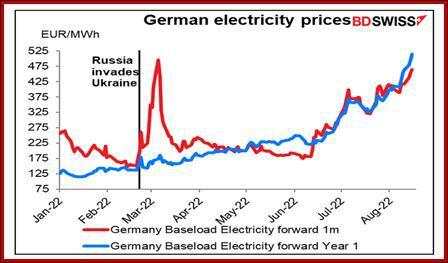

Markets are narrowing the focus to inflation, core inflation and the primary inflation driver, energy prices. In the UK, worries over household energy costs rise by thousands of pounds are mirrored by worries over hundreds of euros in Germany. See the chart from BDSwiss. (Never mind that the UK gets extra inflation from bottlenecks caused specifically by Brexit and now, perhaps, strikes.)

We are starting to see commentary that core inflation, meaning ex-energy, is the “real” inflation we should be watching and what the central banks are or should be watching, too. After all, central banks can’t do anything about oil and natural gas prices. This is tempting but probably not the right way to look at it, if only because oil and gas prices permeate into every nook and cranny of modern economies–transportation costs, but also the costs of plastic and polyester and a thousand other things.

And the FX market is sensitive to the degree of responsiveness of each central bank to its headline and core inflation. Sterling got a boost on its data because the BoE is seen as appropriately hawkish. The NZ dollar actually fell on the rate hike, presumably because the central bank hit the expected rate and tone. In Canada, the BoC is expected to hike by 75 bp at the Sept 7 meeting and end somewhere around 3.75% next year, more than current expectations for the US. The one mystery is the euro, where the ECB is likely to do something this fall but nowhere near the amount of hiking expected elsewhere. We are befuddled by the euro failing to return to below parity given high and rising inflation and a central bank held back by recession expectations.

Sentiment: Mace News reports the BofA Global Research monthly fund manager survey yesterday shows a net 58% expect a global downturn in the next 12 months, up from 47% in July. A net 67% see “weaker economic growth,” fewer than 79% who saw things that way in July.

As for the Fed, managers expect another 100-125 bp, down from 150 bp in July., driven by PCE inflation falling under 4%. 80% of managers see lower global CPI ahead, more than in July, but 90% see stagflation as a concern–the same as in July. A high percentage–72%--see corporate profits slipping, too, but this is under 79% seeing that in July.

An interesting tidibt–Commodity allocation fell to a net 10% overweight, the smallest overweight since November 2020. This is down from a 17% overweight in July and compared to the record 38% overweight seen in April.”

The managers prefer US equities over eurozone names and are also underweight Japan, the UK, and emerging markets. Before brushing off what the managers say, consider it’s a very big survey--284 panelists with $836 billion in assets under management.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

作者:Barbara Rockefeller,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发