市场遇到另一轮定位风险

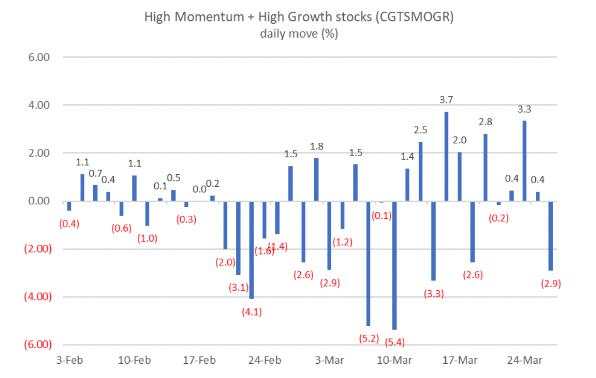

势头,增长和核心持有量都有下降,而低风险资产的大量集会占3个标准偏差。我们仍然谨慎,认为将来会有更好的进入机会,目前购买蘸酱的风险/回报率是不利的。 QQQ仍然是脱离风险的首选。

市场结束了为期三天的平静时期,几乎相同地重复了最近的风险会议。标准普尔500指数(SPX)下降了1.1%,低于200天移动平均水平,自3月13日低点以来删除了5%的反弹。基本细节几乎没有比标题表现的改进,因为动量(-0.3%),增长(-0.9%)和较低的风险(-1.9%)部门恢复了以前的弱点模式。

行业绩效反映了这一趋势,技术(-2.5%),消费者酌情(-1.7%)和通信服务(-2.0%)的趋势趋势急剧下降。同时,防御性部门(例如公用事业,消费者主食和房地产)的收益为50至150个基点。但是,由于为期10年的国库收益率略微上升了3个基点,因此没有明显的安全飞行,黄金下降了0.1%。欧洲股票还与美国市场同时出售,为低迷增长了一层新层。

当今的市场行动是一个明确的例子,说明了为什么我们在此阶段继续建议不要购买股票的下跌。核心高增长领导者面临着新的销售压力,下降了2.9%,强调了当前市场环境中仍然存在的风险。

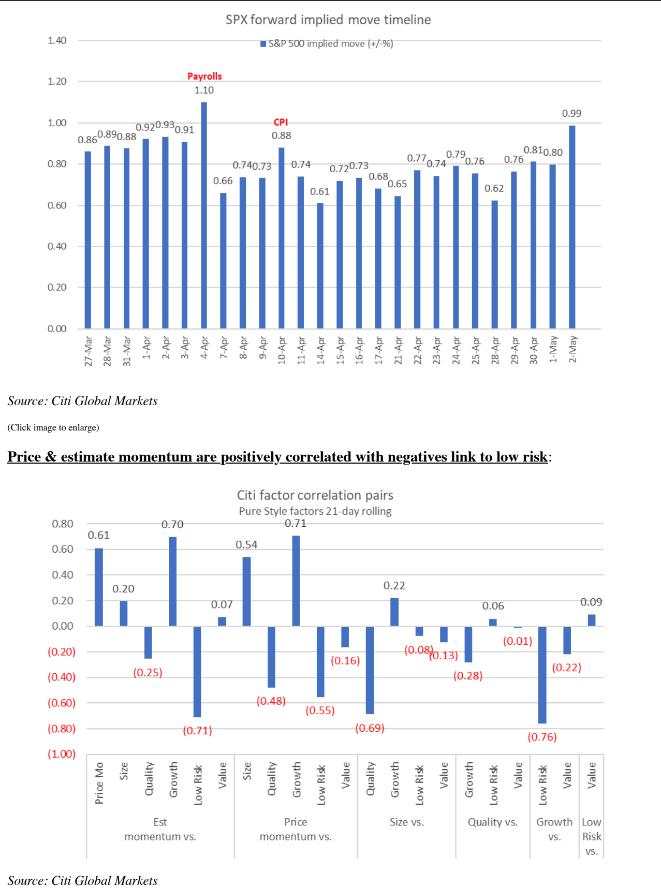

Equity and credit implied volatility outpaced other assets during the recent move lower. The VIX rebounded sharply, closing at 18.3 (+6.9 points) after a 10-point decline since March 10. Similarly, the VVIX climbed back to 90 but has remained surprisingly below 100 for nine consecutive sessions.

Cross-asset implied volatility showed mixed trends. Developed market (DM) equity 1-month implied volatility rose by nearly 2 points, driven by QQQ (positioning), and EWG and EWJ (tariffs). Meanwhile, HYG was a relative outperformer, increasing by 0.8 points and nearing the 6% level. However, implied volatility eased across emerging market (EM) equities, precious metals, and currency markets.

As a result, risk-asset implied volatility experienced the most notable shifts. Our relative value estimates highlight EWG, FXC, FEZ, and HYG as high on a global cross-asset basis. Conversely, implied volatility in commodities, EM equities, and US rates appears attractive on a relative basis.

What to do?

We remain cautious here. While the risk/reward positioning has improved significantly compared to two weeks ago, it is still not entirely "clean" given today’s price action. More importantly, markets do not decline solely based on positioning. The underlying triggers for this sell-off remain intact: concerns surrounding the US consumer and the unpredictability of tariff-related news continue to dominate. Additionally, earnings season and looming congressional budget and tax negotiations add further uncertainty.

Taking all factors into account, we believe better entry points are likely ahead, and the current risk/reward scenario for buying the dip remains unfavorable.

加载失败()