Summary

Argentina's shift to technocratic and market friendly policies under President Milei has been remarkable. “Shock Therapy” has been effective, and has us asking if Argentina is transforming from an economy persistently plagued by indequate policy decisions and imbalances to one of potential prosperity. Milei's recently negotiated IMF agreement should support Argentina's reform agenda, at least in the near-term. But, we also wonder if the decision to lift capital controls and float the peso ahead of local elections could be politically costly. Is this time really different for Argentina or is Milei just another chapter in the same book? Time will tell, but any evidence that a return to Peronist ideologies is forthcoming would likely send Argentina back into another economic slumber.

Argentina's tidal wave of a sea change

We haven't said this too often, but the recent policy mix in Argentina has been remarkable. Remarkable in the sense that Argentina's economy is on the path to being transformed from perpetually challenged to one of potential prosperity.

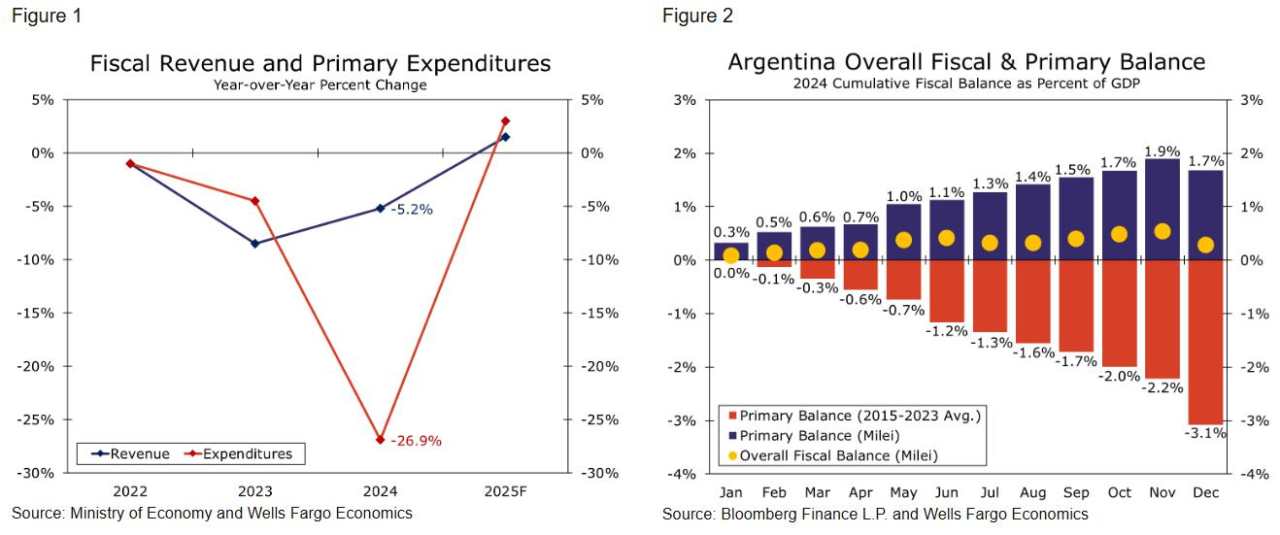

The inflection point was the 2023 presidential election and the subsequent reforms initiated under President Milei's “shock therapy” policy agenda. Milei's shock therapy platform contains multiple parameters all designed to put Argentina on a different policy and economic trajectory relative to prior administrations. Arguably the cornerstone of Milei's policies is making a more concerted effort toward implementing fiscal responsibility. For decades, Argentina operated primary balance deficits and overall fiscal deficits that complicated sovereign finances. Limited willingness to reconsider fiscal outlay decisions, address a poor public finance position or rethink broader fiscal philosophy worsened market participants' confidence toward the country. Public finance mismanagement was key to—but not solely responsible for—runaway inflation, currency depreciation, capital flight, and ultimately, multiple events of sovereign defaults. But Milei has made a start to changing Argentina's fiscal narrative. Over the course of a little over a year in office, Milei has cut household subsidies, trimmed the federal government workforce and ended a significant number of public investment projects. Cash transfers to local provinces have also been scaled back. On a year-over-year basis, Milei's efforts resulted in a ~27% reduction in federal expenditures in 2024, an impressive decline (Figure 1). To make the fiscal adjustment more impressive, Milei's government is the first administration in decades to achieve an annual fiscal surplus. In just the last ten years, on average, Argentina has operated monthly primary balance deficits that accumulated into an average annual primary deficit of a little over 3% of GDP. During his first twelve months in office, Milei flipped Argentina's primary balance to surplus. Primary balance surpluses were achieved every month last year, and the annual primary surplus hit 1.7% of GDP by the end of 2024 (Figure 2). A primary balance surplus also led to an overall fiscal surplus of ~0.3% of GDP. In the early months of 2025, data indicate that the primary surplus remains intact and Argentina is on pace to achieve a second consecutive annual fiscal surplus.

Download The Full International Commentary

作者:Wells Fargo Research Team,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()