For several years now, Italy has had to generate primary budget surpluses in order to stabilize its public debt. The current level of fiscal deficits and the foreseeable increase in interest payments are likely to put the United States, the United Kingdom, and France in a similar situation in the coming years. These countries will ultimately have to balance their primary budgets if they want to stabilize their public debt.

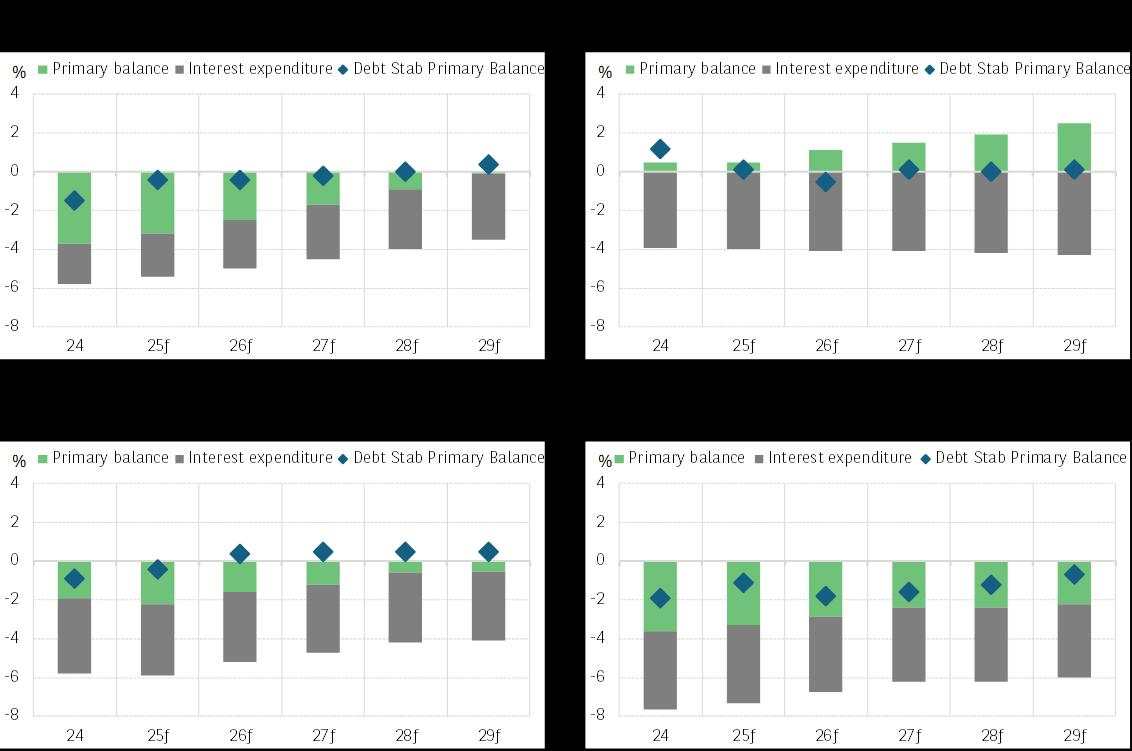

Breakdown of public deficit and debt-stabilizing primary budget balance (% of GDP)

Before the end of the decade, the United Kingdom and France will face a situation that Italy has been experiencing for many years: the need to have a balanced primary budget, or even a surplus, in order to stabilize the public debt-to-GDP ratio. If nothing changes between now and then, the United States is likely to find itself in a similar situation at the beginning of the next decade.

In 2025, only Italy's planned budget will bring it close to the primary balance needed to stabilize its debt. From 2026 onwards, it would even be able to reduce its debt-to-GDP ratio, even if the interest burden worsens. This particular situation gives a fiscal space to increase its military budget (1.5% of GDP in 2024) without increasing its public debt.

For other countries, interest payments will account for an increasingly large share of the budget deficit. With interest rates rising and given its high fiscal deficit, France will no longer benefit from the relative advantage it has enjoyed until now in the form of more moderate debt servicing. The latter will rise by the end of the decade when most of the securities issued before the increase in interest rates will have been refinanced at higher rates.

For France, as for the United States and the United Kingdom, this rising interest burden will significantly increase the fiscal consolidation effort required to stabilize the public debt-to-GDP ratio. This effort will have to be sustained over several years, given how far the primary balance was in 2024 from the level needed to stabilize the debt ratio. In the United States, the expected rise in inflation this year and next one should moderate the increase in this ratio, but without halting it. In these countries, public debt ratios are therefore likely to continue to rise, a prospect that is already weighing on long-term interest rates.

Download The Full Eco Flash

作者:BNP Paribas Team,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()