Outlook

We have no fewer than nine Feds speaking today but it seems unlikely any of them can upstage Mr. Powell’s hawkish hold. If the data continues to show a good labor market and decent growth (defined as not negative), then the remaining factor is inflation. A June rate cut continues to fade. The CME Fedwatch tool has a probability of almost 60% expecting a cut a month ago. That has fallen to 17% today. Clearly these traders expect rising inflation even if the Fed can’t admit it yet.

The always-to-be-read Authers at Bloomberg points out that the Nasdaq gained more on the Thursday chips news than it lost on the hawkish hold from the Fed the same day.

Markets care more about tariffs than central bank decision-making or actual hard data. This is weird, and wrong.

He also points out that the market’s inflation expectations are restrained by the price of oil, and as we point out a lot, that’s not wrong. What’s peculiar and rare is that gasoline prices are not matching the price of crude.

As for the recessionary effects of tariffs on US GDP, he quotes Standard Chartered’s Steven Englander:

US imports from China are about 1.6% of US GDP in value terms. If inbound cargo stays at early-May levels, then H2-2025 imports will be 85% of 2023 levels (in volume terms) and 67% of 2024 levels. So the import volume shock would be 0.25% of GDP relative to 2023 and 0.5% relative to 2024…. We agree that disruption is likely from tariffs and that any benefits are uncertain, but we don’t think that the US economy will fall off a precipice because of a shock of this magnitude.

This is the argument that the US economy is so resilient that even Trump can’t wreck it.

We never argue with top guys like Englander. His presentation has merit. But let’s just note that Chinese imports are not the problem. The problem is the US business decision-maker and the consumer. Consumption is two-thirds of the economy. If business decision-makers absorb tariff costs at the expense of their earnings and cut back only a little on capital projects, the argument will be correct.

But if business decision-makers use tariffs as an excuse to raise prices (even those with zero imports, and don’t laugh, we saw it during Covid), then prices will rise and consumers will balk. Some will run up their credit cards to personal ruin. Another cohort will stay home and increase savings instead.

Tariffs are not only a tax, but a regressive tax, meaning the poor get hit in the budget by proportionately more. We expect the majority to pull back spending—delay replacing clothes, home goods and haircut appointments. Those consumers are more than 50% of the population.

The rise in income inequality is not its point, although that’s measured in the same article. What we want to gauge is the drop in consumption due to inflation. The three lowest earning groups make up 54.3% of the population. This encompasses those earning under $25k to $74.9k.

By summer, we will start seeing empty shelves and much higher prices. The consumer is going to scream. Small companies that depend on imports will go bankrupt. Okay, this is not falling off the cliff, as Englander says, but it can very well be enough to drag the economy to a limp. By that we mean a growth rate of under 1% by Q3 and Q4. This could be the result of the US consumer, fresh from Covid inflation misery, simply deciding not to spend. Hard to believe in the endlessly materialistic population, but by now everybody knows inflation is coming. The consumer can reject inflation by cutting way, way back, whether from choice or necessity.

Bottom line, this would result in lower growth but also lower inflation. If the labor market remains more or less the same, the Fed will have no reason to cut--or hike. Mr. Powell would be happy but Trump will not. He wants cuts. We get CPI next week. It’s too early to expect signs of serious inflation. A decent number (like core at the same level) would leave the Fed on hold.

Let’s not neglect the reasons why foreigners have very little choice in placing their capital in the US. Yes, scale, liquidity, and variety to an extent nobody else matches, plus that legal system that protects private property. But a fifth factor is the robustness and resilience of the US economy, proved after Covid when the US economy came roaring back years ahead of all other major economies.

We can add a sixth factor: a sane and reasonable government that supports foreign allies and treats sovereigns with respect. A seventh factor is the rule of law, something Trump is challenging.

To the extent that Trump’s incompetence wrecks at least four of the six factors, including the private property one and the rule of law, the US markets are left with size, liquidity and variety.

The real question is whether that is enough. It’s enough for the short run, as we see with Treasury auctions going about the same as pre-Trump, with decent bid-offer ratios and plenty of foreign bids. How long can it last?

It can last quite a long time, say to year-end, especially if Trump backs down on a lot of things, as he is wont to do. He calls his every failure a victory and just having a decision, any decision, is enough for many in the asset markets. This has strange implications, like the stock market indices having already hit bottom because the worst news is out and traders reckon things can’t get worse.

This is perhaps the triumph of hope over experience. Trump just loves to shock. He thinks it’s good show biz. He isn’t done. But at the same time, he is aware of protests in every state and the precipitously falling poll approval numbers. Hence feeding more uncertainty, like saying one day he won’t offer anything to China and then the very next day he is open to a deal, and then even further, a giant deal from 145% to under 60%.

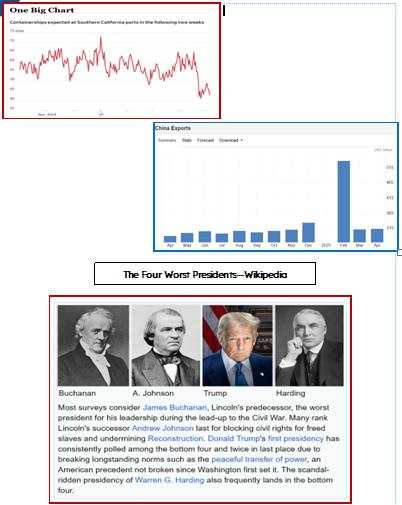

This makes it look like Trump is in retreat in the face of the US-China trade talks this weekend in Switzerland. He will pretend this was his intent all along—shock and awe to get China’s attention, then a far better deal. It’s not clear China needs any deal at all. See the export chart—China has replaced all the US demand with demand from elsewhere. The question is how is the US going to replace Chinese supply—baby strollers and dolls included.

The probability of a real deal is very low. The issue is whether the markets chose to believe things are going well, which is what the Trump camp is sure to project. So far China has mostly kept an amused silence.

Forecast

We are still at risk of the dollar’s renewed rise being a false breakout. We are not changing any signals just yet because we await confirmation, which would come if next week we get a lower low than the previous intermediate low, all the way down at 1.0733. Today this seems unlikely, but if by some remote chance there is actually a China deal, not out of the question. It’s the tariffs and the chaotic mismanagement that is mostly to blame for driving the dollar down. Tariff relief is mostly a fiction but still a contagious disease.

The point is not to be right about the facts, but to be right about the markets’ response to the narrative, however ridiculous. So far the markets want to be hopeful. This favors the dollar—for now.

Tidbit: Trump does and says so much that is outrageous and not true that his grifting has faded into the background noise. Presidents are not supposed to profit from the office but Trump doesn’t care about that norm.

While campaigning he sold Bibles, gold sneakers, cards with his face imposed on superheroes, watches, etc. He sold a government agency to his biggest campaign contributor—Musk. The cost was on the order of $200 million. He has suggested to tariff relief seekers they might consider using Musk’s internet service, as though the $38 billion in federal contracts is not enough. Heaven knows what Kennedy or the others paid.

In office, he is selling dinners at the White House. This is literally illegal. Then there’s the crypto. Yesterday CNBC reported “Fifty-eight crypto wallets have made millions on Trump’s meme coin while 764,000 have lost money.”

Finally, Politico reports Ken Griffen, head of hedge fund Citadel and big Republican donor, says Trump is unleashing crony capitalism with tariff exceptions and exemptions (and denying exemptions to those who don’t bend the knee). The word is corruption.

Remember that in the Teapot Dome scandal 103 years ago, the official taking bribes went to jail but none of those doing the bribing did. The president then, Harding, is among the four worst presidents. So is Trump.

Tidbit: The WSJ is tracking activity at California ports to gauge the loss of imports. Here is the chart from yesterday. Some points: why the 2-week measure? Notice the surge in December/January and again in March. This is a ragged response to expected losses.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

作者:Barbara Rockefeller,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()