S2N Spotlight

While the stock market is super excited and bullish again, the bond market is far more wary. The US 10-year yield is continuing its steady climb up at a time when the amount of debt the government will need to refund is at unprecedented levels. I will be diving in a bit more over the coming weeks. If inflation starts to show, as I am sure it will with the current tariffs in place, then there will be even more pressure on yields. Remember CPI is still considerably above the Fed’s 2% inflation target.

What we need to keep an eye on is the Japanese bond market. For a decade plus, they were getting no return on their 10-year bonds, which made US bonds attractive. However, at a time when the US desperately needs foreign investors, this source might be pulling back to invest locally. By the way, this surely cannot be good for the Japanese government, which has more than 200% debt to GDP. I guess we can expect a slowdown in the world’s 4th largest economy as well. By the way, it was only this year that Germany overtook it for the 3rd spot- Achtung.

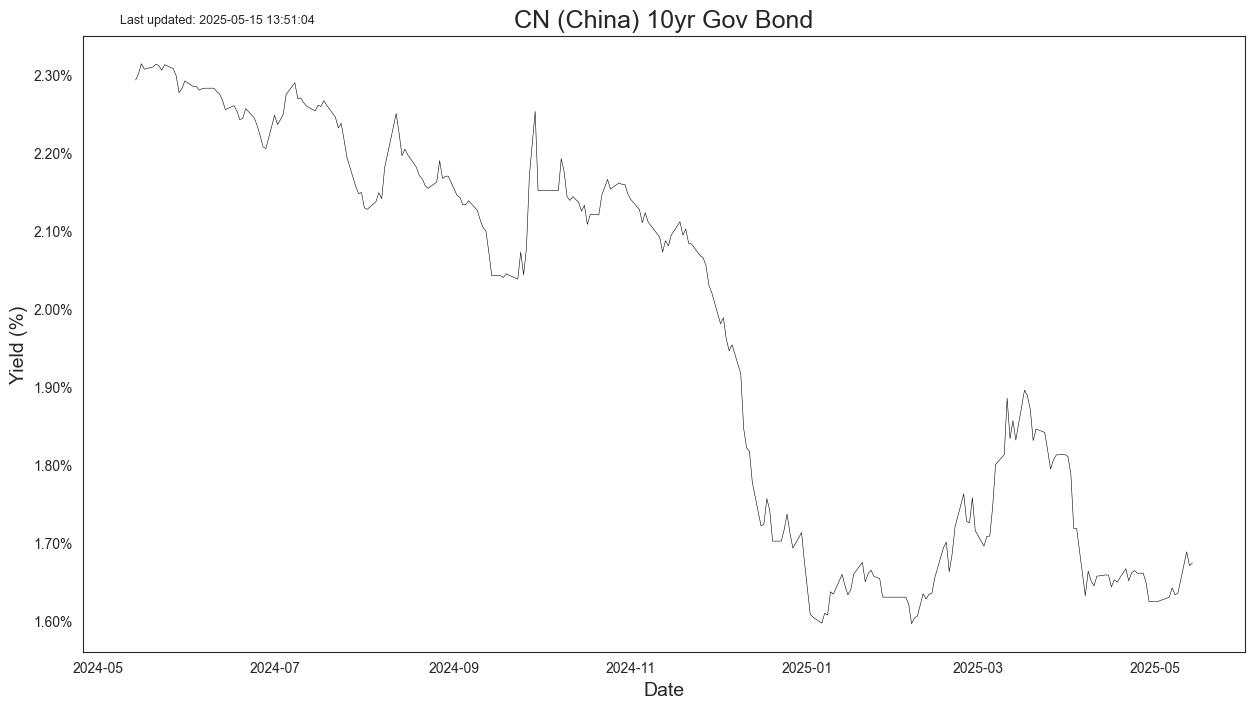

Finally bucking the trend with declining interest rates is China. I actually don’t know why. Is it domestic purchasing driving up prices and yields lower? Is it money printing QE - Chinese style? Is it an attempt at currency manipulation? Is it just plain and simple fear of deflation? I think the property bubble in China was/is far bigger than they will allow the Western world to see and the level of deflation coming is beyond expectation.

S2N observations

FX prices are fundamentally driven by interest rate differentials. You can see in this chart that the FX price of the EURUSD has largely followed in line with the fundamentals.

However, over the last few months the EURO has strengthened significantly against the DOLLAR. This shows that the dollar has been dramatically oversold from a fundamental point of view. Perhaps it foreshadows a weakening of the US economic superiority to the rest of the world; at least that might have been the case with a trade war targeting the entire world until last week.

Having said that, judging by the way the Middle Eastern countries have welcomed President Trump, it would be hard to think that the US has anything but a bright economic future with the Emirates.

The VIX has come out of backwardation, where the front months are more expensive than the later months, to the more normal contango, which is yet another sign that the market’s animal spirits are feeling intoxicated.

I spoke about jobs yesterday as being the glue keeping this whole debt bubble from collapsing. It’s interesting to see how software development jobs are faring. I would say not so well if you are a programmer.

I love the access that major hedge funds like Bridgewater give to the man in the street. I listened to Karen Karniol-Tambour CO-CIO of Bridgewater, talk about their take on the markets and the economy. This kind of access is gold and truly helps level the playing field. In the old days you would need to pay for a conference to hear this kind of presentation.

S2N screener alert

The Hong Kong dollar dropped significantly for the 3rd day in a row.

S2N performance review

S2N chart gallery

S2N news today

作者:Michael Berman, PhD,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发