- USD pushed above 99.129 ahead of JOLTS, signaling early bullish sentiment.

- Stronger-than-expected JOLTS print reinforced the dollar’s upward momentum.

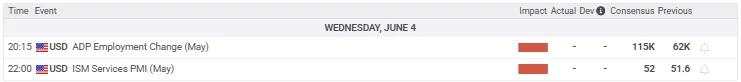

- All eyes now on ADP and ISM data for confirmation of a broader dollar recovery.

The U.S. dollar extended its upward momentum on Tuesday, continuing a trend that had already begun at the opening of the trading day, well before the JOLTS report hit the wires. The greenback pushed above the key 99.129 resistance level, suggesting that sentiment had already turned bullish early in the session, invalidating the level together with the 4-hour FVG situated between 99.112-98.871 level.

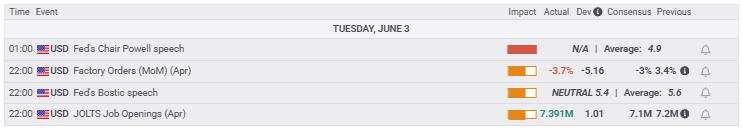

That move was later reinforced by stronger-than-expected labor data. April’s JOLTS Job Openings report came in at 7.391 million, topping both the 7.1 million forecast and the 7.2 million prior. The print reinforced the idea that the U.S. labor market remains resilient, adding weight to the intraday dollar strength that was already building.

Four-hour FVG invalidated as potential recovery builds

The U.S. dollar is currently exhibiting signs of potential recovery despite an overall weakness looming around the greenback.

After the 4-hour FVG resting at between 99.112-98.871 level has been invalidated, bullish FVGs in the 4-hour has also been created:

- 1st Layer FVG - 99.040-99.103.

- 2nd Layer FVG - 98.939-99.026.

Either these 2 FVGs will act as support levels or if broken down, could act as a resistance for further downside move.

Unless we reach the 99.668 up-to the 100 level, recovery is still slim for the U.S. dollar.

Key high impact today and what this means for the majors

If the upcoming U.S. data releases (ADP and ISM Services PMI) come in stronger than expected, it would reinforce the dollar’s recovery, potentially pushing the greenback higher against major currencies. In that case, we could see foreign currencies lose ground, favoring continued downside in EUR/USD, GBP/USD, and gold, while USD/JPY, USD/CAD, USD/CHF may strengthen further. On the other hand, if the data disappoints, the dollar’s recent strength may prove unsustainable. This would open the door for foreign currencies to regain momentum, potentially lifting pairs like EUR/USD and GBP/USD, while gold could catch a fresh bid and USD/JPY may stall or reverse lower.

But here’s the key caveat

Fundamental news alone doesn’t move the market without technical confirmation. Even if the data leans bullish or bearish for the dollar, price still needs to respect key support or resistance levels. Watch for confirmation around mentioned levels before committing to any directional bias.

作者:Jasper Osita,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()