While the Gold price continues to break all-time records, another metal is increasingly attracting attention: Silver. Long overshadowed by its Golden cousin, Silver price momentum is increasingly convincing.

Could Silver be the next big thing in the precious metals markets?

A rare split between Gold and Silver

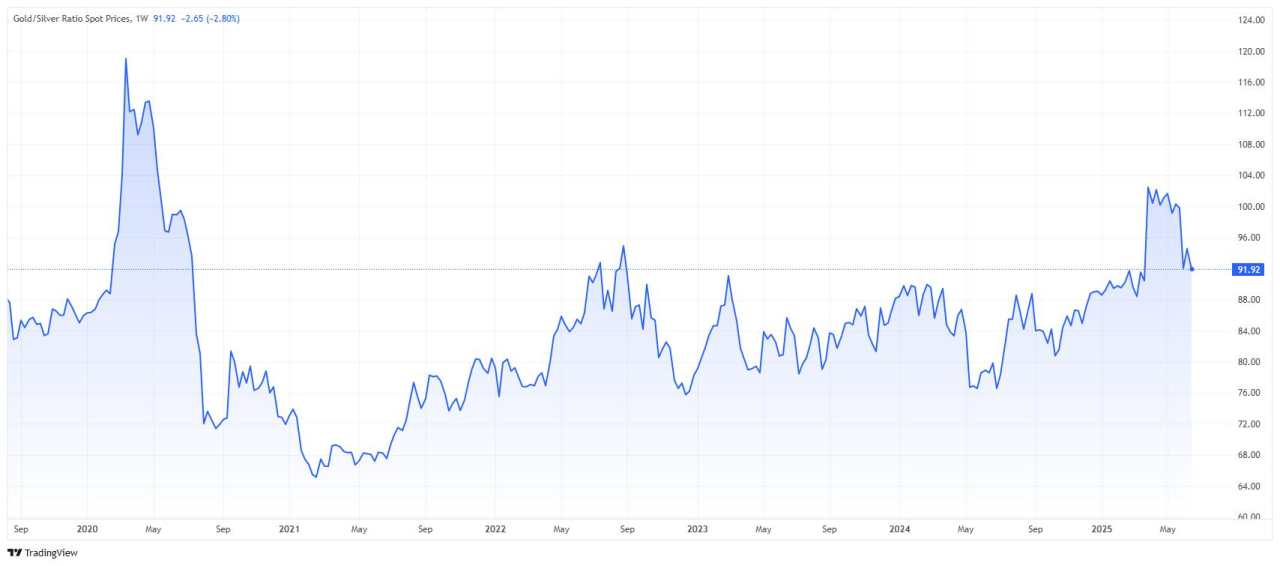

The split between Gold and Silver prices recently reached extreme levels, the longest gap since 2020. The Gold-to-silver ratio – which measures how many ounces of Silver it takes to buy an ounce of Gold – surpassed 100:1, well above its historical average of between 50 and 70.

In previous similar episodes (notably in 2020 or during the 2008 crisis), Silver has always ended up outperforming Gold in the following months.

Gold/Silver Ratio. Source: FXStreet.

"Whenever the Gold-to-Silver ratio reaches these extremely high levels, investors who prioritize Silver tend to be handsomely rewarded in the medium term", said Stefan Gleason, CEO of Money Metals Exchange, according to MarketWatch.

Silver's dual strategic status

One of Silver's strengths lies in its unique hybridity: it is both a safe-haven asset, like Gold, and an industrial metal with growing uses. This dual status results in more volatile market behavior, but also potentially higher returns in certain phases of the economic cycle.

Today, industrial demand for Silver is booming: electronics, armaments, batteries, electric vehicles, and above all, solar panels, where the metal is indispensable thanks to its exceptional conductivity.

"Half of all Silver is used in high-tech and industry, especially in solar energy. And unlike platinum or palladium, Silver hasn't yet been replaced", according to BullionVault.

The Silver Institute estimates that global Silver demand will still exceed supply in 2025, marking the fifth consecutive year of structural deficit.

Catching up... but far from over

Since the start of the year, the Silver price has risen by over 30%, reaching its highest levels since 2012. But it still lags far behind its all-time highs: around $37 an ounce currently, compared with nearly $50 in 2011.

Silver price chart. Source: FXStreet.

"Silver is the one starting to show much better strength technically... and we're starting to see shortages in market," said John Ciampaglia, CEO of Sprott Asset Management, to CNBC.

Conversely, Gold has already surpassed its previous highs, peaking at over $3,500 an ounce. For many analysts, this gap creates a catch-up opportunity for Silver, which is still undervalued.

"Silver now presents a vastly better investment opportunity than even Gold - as long as one's investment horizon is more than a few months", said Stefan Gleason, president and chief executive officer at Money Metals Exchange, in comments reported by MarketWatch.

A dynamic driven by flows and macroeconomics

Several macroeconomic factors are supporting the trend:

- Weakening of the US Dollar since Donald Trump's re-election and his tariff policy, fuelling real metals as a safe haven.

- Expected rate cuts by the US Federal Reserve, which favor yield-free assets such as Gold and Silver.

- Growing geopolitical tensions, particularly in the Middle East, are boosting interest in precious metals.

- Flows into Silver-linked ETFs are on the rise again, while physical supply remains constrained.

Volatility, but explosive potential

Silver is more liquid, more speculative and more exposed to industrial cycles than Gold. It can therefore experience sharp corrections in the event of a macro turnaround, but this is also what makes it so attractive to investors prepared to bear a little more risk.

Historically, Silver outperforms Gold in the second phase of a bull market. However, according to several market players, we're still in the early stages:

"This bull market in Gold is still quite young. If it continues, Silver will start to outperform Gold soon", says Stefan Gleason.

An awakening in the making

After years in the shadows, Silver may once again be the strategic asset par excellence. More volatile, more cyclical, but also more promising, it now offers a unique catch-up profile against Gold, which is already highly valued.

With history showing that Silver rallies often follow those of Gold, albeit with leverage, many are wondering: What if the real potential of 2025 lies in the white metal?

作者:Ghiles Guezout,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()