Deutsche Bank's Mapping the World's Prices report provides a fascinating overview of the cost of living in the world's major metropolises. This year's edition, published on June 24, covers more than 69 cities and highlights striking dynamics in the cost of living and the crucial role of currencies in the hierarchy of the world's cities.

Let’s take a closer look at where life is cheapest, where it’s painfully pricey, and how currency movements are drawing the map.

Most expensive metropolises: A matter of strong currencies

The United States and Switzerland dominate almost every table: salaries, rents, consumer prices, real estate, technological equipment... In a globalized economy, this outperformance is largely due to the strength of their respective currencies rather than local demand.

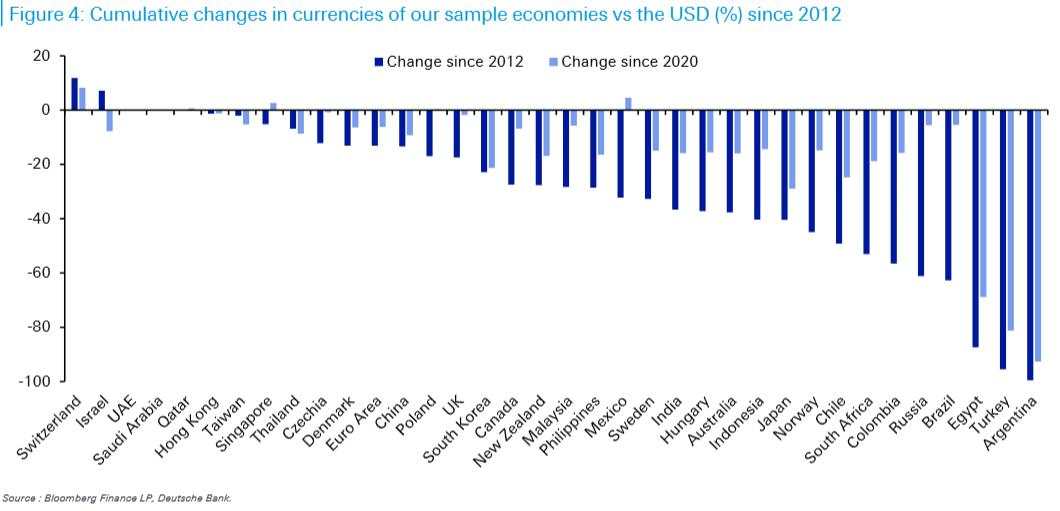

Since 2012, the Swiss Franc (CHF) has been the most stable and appreciated currency against the US Dollar (USD). This gain in value has been reflected in steadily rising prices in Zurich and Geneva.

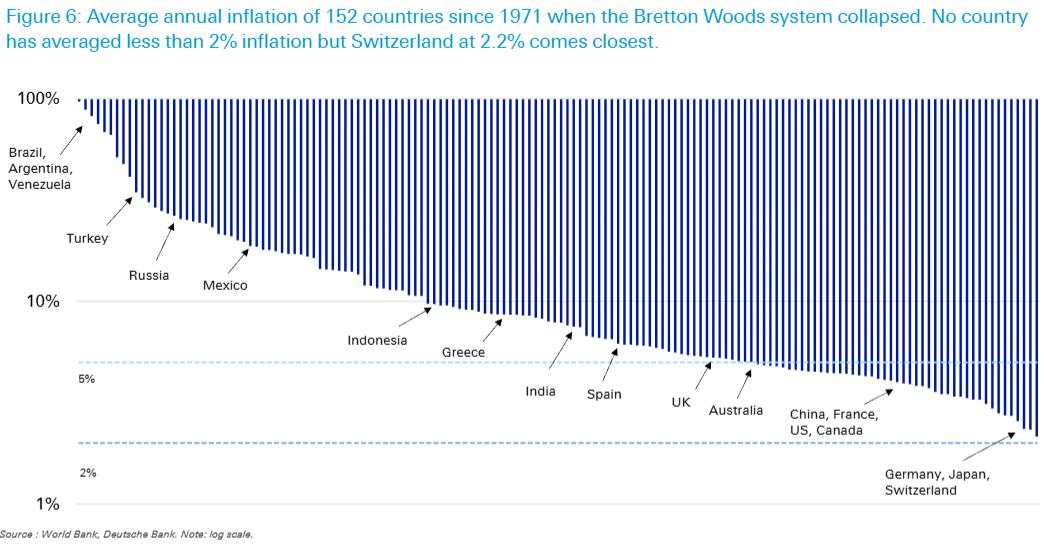

At the same time, Swiss monetary stability, with the lowest inflation averaging 2.2% since 1971, and also the lowest cumulative inflation since 2012, has boosted investor confidence and the attractiveness of its cities.

Zurich has thus become the most expensive city in which to buy a home, a café or even a pair of Levi's jeans. A coffee in Zurich or a night out in Geneva can cost up to three times more than in Lisbon or Rome.

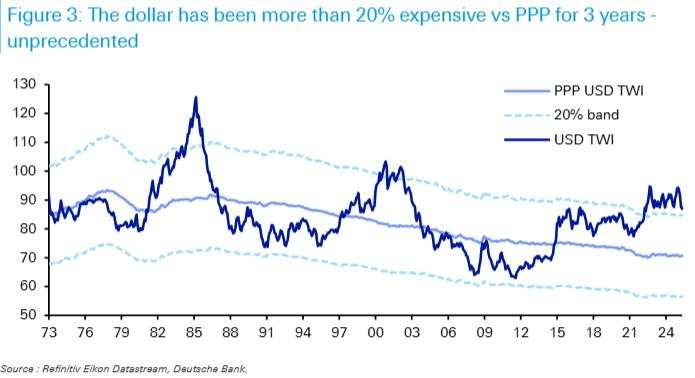

The US Dollar, meanwhile, has entered a bullish cycle, overvalued by more than 20% compared to the Purchasing Power Parity (PPP). The combination of rising interest rates, sustained growth in the technology sector and unique financial attractiveness has made cities like New York and San Francisco as expensive as Geneva or Zurich, without offering the same quality of life.

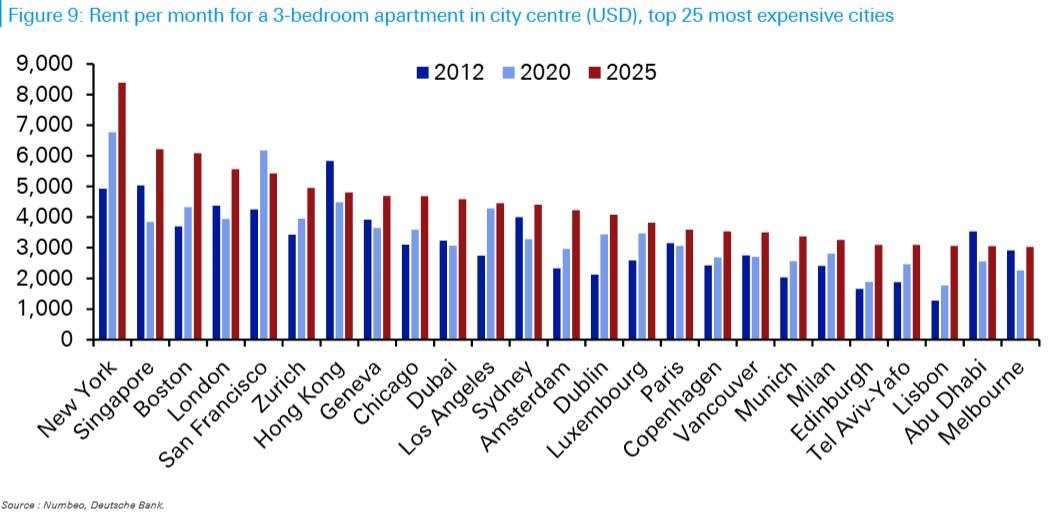

In New York, renting an apartment or going out to dinner now costs more than in London or Paris. But this high cost could be short-lived. According to DB House View, we're close to an "American peak", with a potential retreat by 2030 if American exceptionalism becomes normalized.

At the other end of the spectrum: The cheapest cities

The cheapest cities – Cairo, Bangalore, Delhi, and Jakarta – are also those where the local currency has lost the most value over the long term. In Egypt, for example, the average take-home pay has fallen below 200 USD/month.

Yet these countries boast strong demographic and economic growth, long-term currency catch-up potential and growing competitiveness.

India, in particular, is attracting attention. It remains one of the cheapest countries in the world, despite its economic ascent. Its low prices and low wages are a factor of industrial attractiveness, but could also signal, for Forex, a bullish potential for the Indian Rupee (INR), and for stock markets, a continued rise in the local Sensex and Nifty stock indices, if fundamentals continue to improve. Such appreciations could ultimately lead to higher living standards.

Real estate: Unaffordable even for the world's elite

Hong Kong remains the most expensive city in the world in which to buy an apartment, despite a 20% drop in prices in the past five years. Zurich, Singapore, Seoul and Geneva complete the top 5.

Significantly, New York, Boston and San Francisco, although expensive to rent, are lagging behind for property purchases, notably due to more flexible urban sprawl and a more fluid credit market.

Conversely, cities such as Dubai, Lisbon and Prague are recording spectacular price rises. Dubai has gained 15 places in five years, boosted by the appreciation of the dollar-indexed Dirham (AED) and an influx of foreign capital.

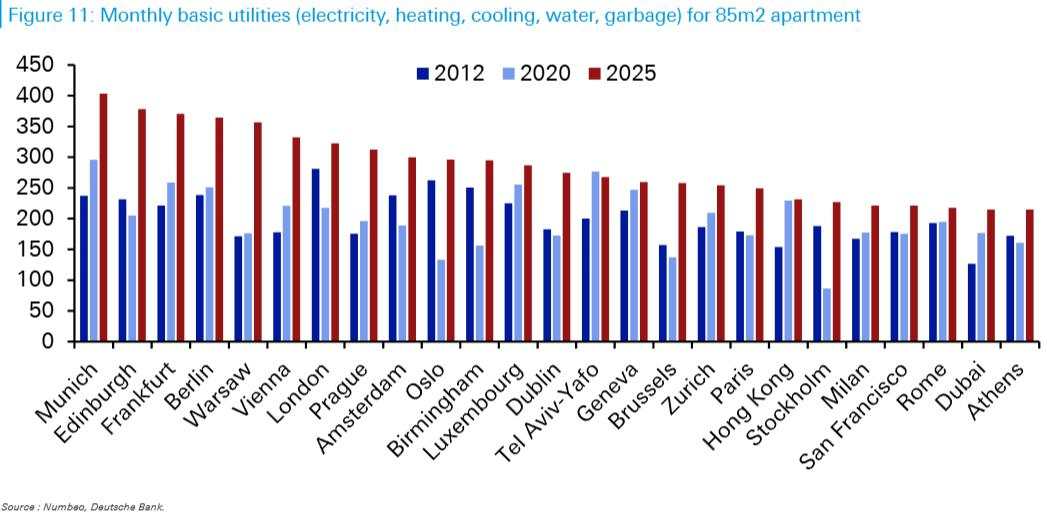

When it comes to utilities, three German cities (Munich, Frankfurt and Berlin) are in the top five most expensive cities, highlighting the impact of Europe’s recent energy shock, the phasing out of nuclear power and the shift towards more expensive renewables.

Warsaw, Vienna, and Prague also rank high and have climbed a lot over the last five years, which makes sense given their prior heavy exposure to cheap Russian gas.

Salaries: High incomes, low purchasing power

Unsurprisingly, Geneva, Zurich, New York and San Francisco offer the highest net salaries in the world. But once rents have been deducted, the picture changes: Frankfurt and Luxembourg become more attractive, alongside Geneva and Zurich, which remain at the top of the ranking.

New York falls to 41st place in terms of disposable income after rent, penalized by record rental prices.

This discrepancy between nominal incomes and real purchasing power underlines a key truth for Forex investors: a strong currency does not guarantee a high quality of life if local costs soar.

Cities that make the top 10 for both quality of life and salary-after-rent include:

- Luxembourg (1st, 4th, respectively)

- Copenhagen (2nd, 6th)

- Amsterdam (tied 3rd, 10th)

- Geneva (6th, 1st)

- Frankfurt (7th, 5th)

- Zurich (8th, 2nd)

No US city makes the top 10 in both metrics, though top earners in major financial hubs may have a very different experience.

Daily life: coffee, wine, jeans... the cost of small pleasures

- A cappuccino costs over 6 USD in Zurich, compared with less than 1.5 USD in Rome.

- An iPhone is 60% more expensive in Istanbul than in Seoul or New York.

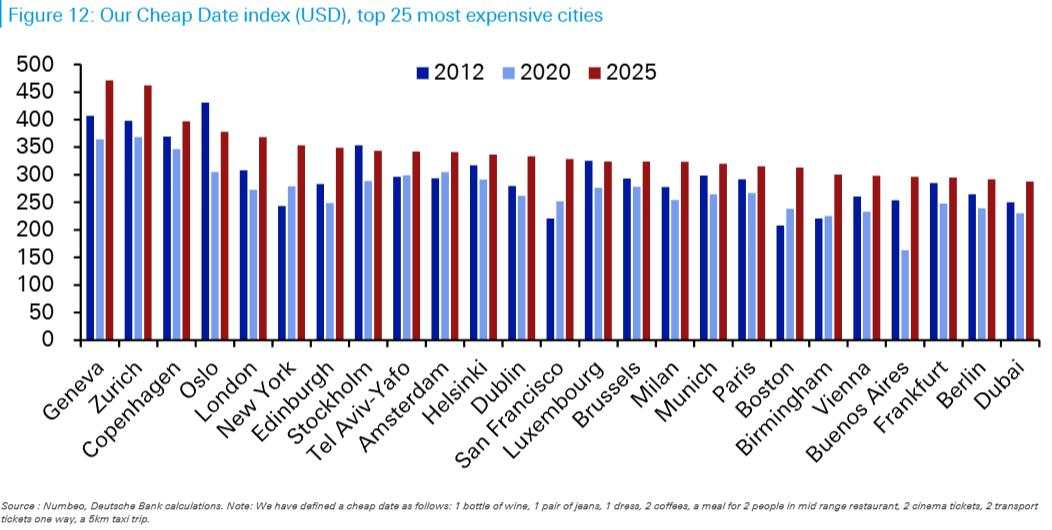

- A romantic dinner in Geneva or London can cost over 400 USD, compared with less than 50 in Bangalore.

- Alcohol and cigarettes, highly taxed in Sydney, London or Oslo, reflect tax policies more than the local economy.

These differences are not insignificant. They reflect taxation policies, wage differentials, but also the relative value of currencies.

The most expensive cities for a night out with a partner are Geneva, Zurich, Copenhagen, Oslo, London, and New York. If you're in India, dating costs are among the lowest globally.

Forex as a prism of analysis

The report clearly shows that price levels in a city are not just a local matter, but also reflect the balance of power between currencies. A strong currency makes domestic goods and services more expensive for foreigners, but protects the purchasing power of residents abroad.

For Forex traders, this data offers a useful insight into PPP imbalances, likely to influence capital flows, carry trade strategies and multi-currency arbitrage.

A weak Japanese Yen (JPY) relative to its PPP could signal an opportunity for future appreciation, while the current strong US Dollar is scrutinized as a potential anomaly.

However, other forces are often at play when it comes to currency movements, especially in the short term.

In other words, this report is not just a travel guide for expatriates, but a map of global value flows. At a time when monetary policies diverge and interest rates oscillate, knowing where it's good to live, and why, becomes macroeconomic data in its own right.

Monitoring currencies, not just prices

The report confirms that macroeconomic analysis cannot ignore the monetary prism. Cities don't become expensive just because of their real estate or taxation; their currencies, too, tell a story of power, politics and international perception.

A Global snapshot of the world prices

Category | Most Expensive City | Least Expensive City |

Overall Cost of Living | Zurich (CHF) | Bangalore (INR) |

Rent for 3-Bedroom Apartment | New York (USD) | Cairo (EGP) |

Price per square meter to Buy Property | Hong Kong (HKD) | Cairo, Johannesburg (EGP/ZAR) |

Average Net Salary | Geneva (CHF) – $7,984/month | Cairo (EGP) – $165/month |

Net Salary After Rent | Geneva (CHF) | New York (USD) – falls to 41st place |

iPhone 16 Pro | Istanbul (TRY) – 100% above US price | Seoul (KRW) – cheaper than US |

Cappuccino | Zurich (CHF) – ~$6+ | Rome (EUR) – ~$1.5 |

Mid-Range Bottle of Wine | Singapore (SGD) | Lisbon, Cape Town (EUR/ZAR) |

"Cheap Date" (Dinner + Cinema for 2) | Geneva, Zurich – >$400 | Bangalore – <$50 |

Public Transport | London (GBP) | Luxembourg (EUR) – free |

Monthly Utilities | Munich (EUR) | Cairo, Mumbai (EGP/INR) |

Gasoline Price | Hong Kong (HKD) | Dubai, Riyadh (AED/SAR) |

Monthly Internet Cost | Abu Dhabi, USA (AED/USD) | Mumbai, Moscow (INR/RUB) |

Cinema (Ticket) | Zurich, Geneva, London (CHF/GBP) | Bangalore, Jakarta (INR/IDR) |

Restaurant (Meal for 2) | Zurich, Geneva, New York (CHF/USD) | Jakarta, Cairo (IDR/EGP) |

作者:Ghiles Guezout,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()