The week is about to end and we have a look at what’s noted in next week’s calendar for the financial markets. On Monday we make a start with Japan’s preliminary industrial output for May, China’s NBS PMI figures for June, UK’s final GDP rate for Q1, Switzerland’s KOF indicator for June and Germany’s preliminary HICP rate also for June. On Tuesday we get New Zealand’s CPI rates for Q2, Japan’s Tankan indexes for Q2, China’s manufacturing PMI figure for June, UK’s nationwide house prices also for June, Euro Zone’s preliminary HICP rate for the same month, the ISM manufacturing PMI figure for June and JOLTS job openings for May, while Fed Chairman Powell is scheduled to speak. On Wednesday we get Australia’s building approvals and retail sales for May, and the US ADP national employment figure and Canada’s S&P manufacturing PMI figure, both for June, while ECB President Christine Lagarde is to make statements. On Thursday we note the release of Australia’s trade data for May, Switzerland’s and Turkey’s CPI rates for June, the US weekly initial jobless claims figure, May’s US factory orders, June’s ISM non-manufacturing PMI figure Canada’s trade data for May and the US employment report for June, which may be the crown of financial releases for the week. On Friday we get Germany’s industrial output for May and the Czech Republic’s preliminary CPI rates for June.

USD – June’s employment report to shake the markets

The USD was on the retreat over the past few days against its counterparts. On a monetary level, the Fed seems to maintain its doubts for further easing of its monetary policy despite current market expectations for the bank to proceed with three more rate cuts until the end of the year. It’s characteristic that Fed Chairman Powell stuck to the script in his testimony before the US Congress, as he mentioned the solid pace of economic activity expansion, the tightness of the US employment market and that inflation remains somewhat elevated. Overall the bank’s hesitation for further easing of its monetary policy tends to be supportive for the USD. We also note that within the Fed the wait-and-see stance may not be as solid as it seems. It’s characteristic that Fed policymakers Bowman and Waller seem ready for an easing of the Fed’s monetary policy, thus blurring the overall picture. Should we see more Fed policymakers expressing concerns for further easing of the bank’s monetary policy, we may see the USD getting some support and vice versa.

On a more fundamental level though we note the pressure exercised on the Fed to restart the easing of its monetary policy. US President Trump has embarked on a campaign to undermine Fed Chair Powell, as the Fed’s current monetary path is not aligned with the US President’s dovish demands. Should the US President announce the successor of Powell, that would practically create a shadow chairman until Powell’s tenure ends in May. The issue tends to weigh on the USD as the market’s worries for the independence of the Fed are on the rise. Should we see the market’s worries being amplified, we may see the USD weakening further. Also on a fundamental level and peculiar twist, Trump’s tariff intentions may be one of the key factors forcing the Fed to maintain rates high as inflationary pressures may intensify and at the same time darken the US macroeconomic outlook.

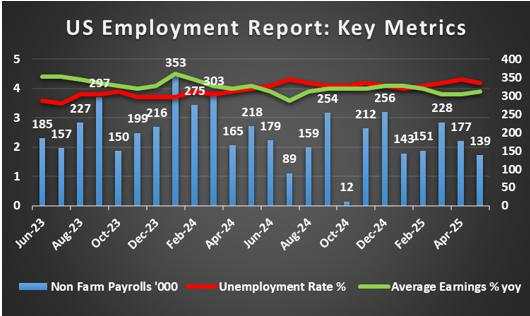

On a macroeconomic level, the outlook of the US darkened allready with the release of the final US GDP rate for Q1, which showed that the contraction of the US economy was deeper than initially estimated. The release tends to add more pressure on the Fed to cut rates, yet today the PCE rates for May are still to be released as these lines are written and a possible acceleration could provide some support for the USD as it could intensify the fed’s doubts for further easing of its monetary policy. In the coming week, we highlight the release of the US employment report for June on Thursday, instead of the usual first Friday of the month, as the Friday is a public holiday for the US as it is the 4th of July, the US Independence Day. Key metrics in the report are considered the Non Farm Payrolls figure, the unemployment rate and the average earnings growth rate. Should the data show that the employment market remains tight, we may see the USD getting some support while apossible wider than expected easing of the US employment market could weigh on the USD as it could enhance market expectations for a faster easing of the Fed’s monetary policy.

Analyst’s opinion (USD)

We expect the USD to be affected by the Fed’s stance as well as the undermining of Fed Chairman Powell by US President Trump, as well as Trump’s tariff intentions, with the latter two issues weighing on the USD. Market interest could peak on Thursday as the US employment report for June is to be released and a possible tightening of the US employment market could provide support for the USD.

GBP – Rebellion grows among UK Labour Parliament Members

The pound seems to be on the rise against the USD, the JPY and the EUR, signalling a wider strength of the sterling in the FX Market. On a monetary level, we note that after Bank of England decided to remain on hold in the past week, the market is pricing in the possibility of a rate cut in BoE’s next meeting. The market’s dovish expectations are understandable given also that BoE Governor Bailey highlighted signs of a slow down in the UK employment market, with employment tax hikes hitting pay and jobs. Also the BOE Governor stated that the direction of the bank’s rates is still downwards, yet with some caution given the prementioned possible easing of the UK employment market. Should we see BoE policymakers in the coming week, highlighting the bank’s dovish intentions we may see the pound losing some ground.

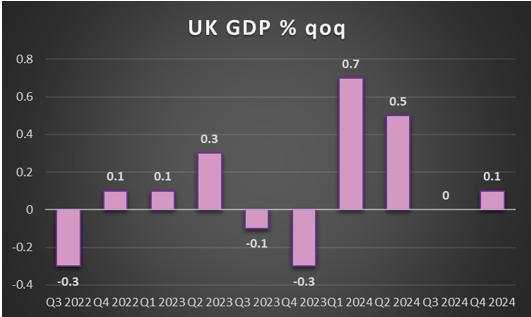

On a macroeconomic level, we note the improvement of the PMI figures on a preliminary level for June, with special focus on the services sector, as its reading rose indicating a faster pace of expansion of economic activity in the UK services sector. The release tended to be supportive for the pound as it lifted the outlook for the UK economy. Somewhat worrisome was the wide drop of the CBI indicator for distributive trades, in a signal of fatigue of the UK retail market for the current month. In thecoming week, we note the release of the UK final GPD rate for Q1 and should the rate show a slowdown if compared to the preliminary release it could weaken the pound.

On a fundamental level, we maintain our worries for the UK Government of Prime Minister Starmer, given the UK Government’s intentions for welfare reforms. Yet 120 Labour bank benchers seem to be preparing for a rebellion as they are reported to have signed an amendment calling for the proposals to be scrapped. The issue makes the possibility of an embarrassing defeat for the UK Government visible. The UK government seems to be on shaky ground, which in turn could weigh on the pound should market worries intensify, as the UK is seeking for political stability given the uncertainty of the past Tory governments.

Analyst’s opinion (GBP)

On a fundamental level, BoE’s dovish intentions and the uncertainty simmering under the surface for the UK Labour government tend to weigh on the sterling. On a macro level, we note the release of the UK final GDP rate for Q1 and a possible slow down could weigh on the GBP.”

JPY – Q2 Tankan indexes to watch out for

On a monetary level, we note that Japan’s CPI rates are above BoJ’s inflation target for practically three years and BoJ responded by raising rates by only 60 basis points in the same period. The bank seems to be in a difficult spot as on the one hand there is pressure to hike rates further given the elevated inflation, yet on the other hand may have a supportive role for the Japanese economy given the wider fundamental uncertainty. It should be noted that BoJ Board Member Naoki Tamura sounded quite hawkish warning that BoJ may need to raise interest rates decisively, given the inflationary pressures in the Japanese economy and despite the uncertainty caused by the US President’s tariffs intentions. Yet the market seems to remain unimpressed as it still does not expect a rate hike until the end of the year. Nevertheless, should we see BoJ policymakers providing further hawkish comments we may see the Yen getting some support.

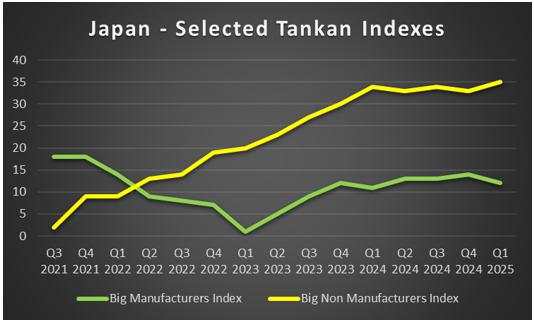

On a macroeconomic level, we note the slowdown of Tokyo’s CPI rates for June which could act as a prelude for the nationwide CPI rates. In the coming week we highlight the Tankan indexes with special interest being on the industrial sector. Should the indicators’ readings rise implying improving business conditions we may see the JPY getting some support.

On a fundamental level we note JPY’s safe haven qualities in the international markets. Should we see the markets turning more risk on we may see JPY suffering outflows, while any intensification of the market’s worries and a more cautious approach could provide some support for the JPY.

Analyst’s opinion (JPY)

We expect the market’s expectations for BoJ’s intentions to be maybe the main factor behind JPY’s direction, yet we also note the release of the Tankan indexes for Q2 and on a deeper fundamental level, JPY’s safe haven qualities could also play a role in its direction under certain circumstances.

EUR – Eurozone’s preliminary HICP rates for June to move the EUR

On a macro level Euro Zone’s preliminary PMI figures for June sent out some mixed signals with the services sector coming into the positives in regards to economic activity and the manufacturing sector showing now progress and remaining in contractionary mode. In the coming week we highlight the release of the preliminary HICP rates for June and a possible acceleration could provide some support for the EUR as it could ease market expectations for a rate cut by the ECB in its October meeting. On the other hand, a possible easing of inflationary pressures in the Euro Zone could weigh on the EUR.

On a monetary level, we note that ECB chief economist Philip Lane stated that the process of disinflation is almost over, noting that some pockets of inflation still exist, citing the services sector.Yet overall should the disinflation process be nearing its end, we may see any hawkish intentions being erased, hence we see Lane’s comment as leaning more on the dovish side. Overall, we see the bank starting to seek a balance, through a neutral level of interest rates yet should we see the macroeconomic outlook of the Euro Zone deteriorating, we may see the bank easing its monetary policy further. Should we see ECB policymakers proceeding with dovish comments in the coming week, we may see the EUR losing ground.

On a fundamental level, we note the turbulence in the EU Commission as a no confidence vote against the von der Leyen is to held in the EU Parliament. EU Parliament Member Piperea has secured the 70 votes required to file a motion of no confidence against von Der Leyen over her texts in the pandemic period with Pfizer CEO Bourla. The motion may come to a vote in the EU Parliament yet political analysts highlight the unlikelyhood of the scenario getting the necessary majority of two thirds to succeed. Nevertheless, von der Leyen may have to make concessions to the left and the far right which tends to create some degree of uncertainty for the political outlook of the Euro Zone and may potentially weigh on the EUR on a fundamental level, should market worries intensify.

Analyst’s opinion (EUR)

We see the case for the preliminary HICP rates for June to be the main event for EUR traders in the coming week and a possible slowdown could weigh on the common currency. Also we note ECB’s intentions as an issue that could affect the common currency’s direction.

AUD – Financial data that could affect the Aussie

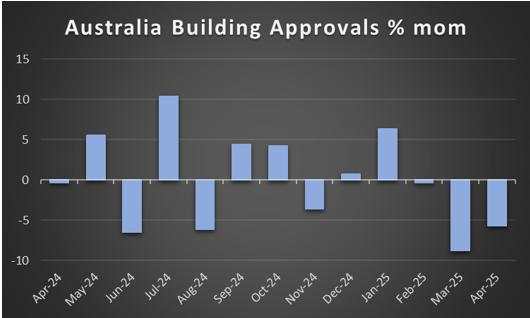

On a macro level, we note the improvement of the readings of the preliminary PMI indicators for June, implying an expansion of economic activity in the land of the down under, with the services sector noting a faster pace of growth. In the coming week, we note the release of Australia’s retail sales and building approvals growth rates for May, and both indicators are expected to accelerate which could provide some support for the Aussie. On the flip side, Australia’s trade surplus is expected to have contracted in the past month, which could weigh on AUD. Last but not least we note that the CPI rates for May showed an easing of inflationary pressures in the Australian economy, which in turn may allow RBA to be more dovish.

On a monetary level, we note that the market’s expectations for RBA to deliver three more rate cuts until the end of the year, as expressed in the our last report, remain unchanged. Hence the dovish inclination of the market remains, which could be weighing on the Aussie especially if the dovish expectations are enhanced by a possible easing of inflationary pressures or any possible dovish statements by RBA policymakers.

On a fundamental level, we highlight the improvement of the market’s sentiment which in turn may be a platform for the Aussie to recover, given the market’s perception for the Aussie as a riskier asset. Also on a fundamental level, we have some worries for the outlook of the Chinese economy which in turn given the close Sino-Australian economic ties could affect also AUD’s direction. It’s characteristic how China’s industrial profit growth rate for May showed a contraction while in the coming week, we note the release of China’s June PMI figures, with special focus being on the manufacturing sector. Should we see the manufacturing PMI figures retreating implying a deeper contraction of economic activity, we may see the Aussie losing ground.

Analyst’s opinion (AUD)

We expect in the coming week a possible improvement in the market sentiment to provide some support for the AUD. Ona monetary level, the market’s dovish expectations for RBA could clip some of the possible gains on the Aussie, while on a macro level, financial releases could also affect its direction.

CAD – Fundamentals to lead

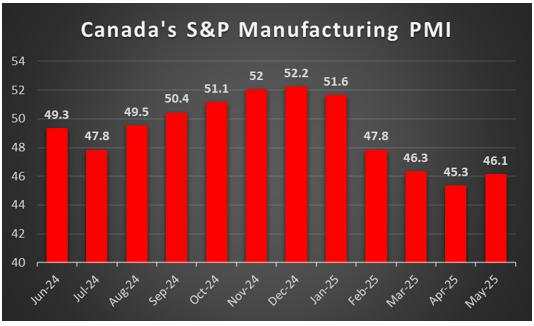

On a macroeconomic level, we note the unchanged Canadian CPI rates for May, which in turn may imply a relative persistence of inflationary pressures in the Canadian economy. Please note that as these lines are written Canada’s GDP rate for April is still to be released and could affect the Loonie’s direction. In the coming week we have a number of interesting financial releases, yet we expect fundamentals to lead.

On a monetary level, we note the market’s expectations for BoC to remain on hold in the July meeting and deliver a rate cut in the September meeting. Yet the so-so CPI rates may allow for BoC’s inflation worries to be maintained. We see the case for the bank to increasingly focus on the inflation outlook and the case for a more hawkish BoC could be made should the US tariffs and Canadian countertariffs boost inflation.

On a fundamental level, we maintain our worries for the US tariffs on Canadian products, intended and existing. At this point its not sufficient to note the US tariffs but also the Canadian countertariffs matter. It’s characteristic that Canadian steel producers warn of possible massive lay offs. Hence we see the case for the tariff issue to be the main issue for Loonie traders in the coming week on a fundamental level. A second issue that could affect the Loonie could be the path of oil prices. Oil prices dropped heavily after the announcement of the Iranian-Israel ceasefire as market worries eased substantially for the supply side of the international oil market. Yet the drop has been halted over the past two days. Should we see market worries easing further, we may see oil prices retreating even lower, yet the oil market’s attention may start turning towards other issues like OPEC’s meeting on the 6th of July. Should we see oil prices gaining substantial ground in the coming week, we may see the Loonie also getting some support given Canada’s status as a major oil producer.

Analyst’s opinion (CAD)

Despite some interesting Canadian financial releases being included in coming week’s calendar, we expect fundamentals to lead the Loonie. On a monetary level, any doubts of the BoC for further rate cuts, could provide some support for the Loonie, while on a fundamental level, the path of oil prices and the tensions in the US-Canadian trade relationships could also play a role and any sign that the two sides are nearing a trade deal could support the Loonie.

General comment

As an epilogue, we expect in the FX market to take the initiative and lead as the frequency and gravity of US releases intensifies, especially with the release of the US employment report for June. We expect market interest to intensify as Thursday nears, and the release could have wider market effects beyond the FX market. A possibly tighter than expected, US employment market could weigh on gold’s price and US equities markets. As for gold we note that the precious metal’s price is in a downward motion for a second week in a row, a first for 2025. The negative correlation of the USD with gold has been interrupted and should we see market sentiment improving further it may have a bearish effect on gold’s price. Also any statements of Fed policymakers that tend to lean on the hawkish side may weigh on the precious metal’s price and vice versa. Also we note the rise of US stockmarkets as all major indexes, S&P 500, Nasdaq and Dow Jones prepare to end the week in the greens, with S&P 500 reaching new All Time Highs. A possible improvement of the market sentiment in the coming week could add more support for US equities.

作者:Peter Iosif, ACA, MBA,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()