Despite tentative signs of improvement, the US real estate market remains trapped in a familiar dilemma: high prices and dissuasive interest rates. The latest data published on home sales, house prices and loan applications confirm one fact: activity is stabilizing, but at a historically low level, with little chance of a real recovery without a marked easing in mortgage rates.

A deceptive improvement in existing home sales

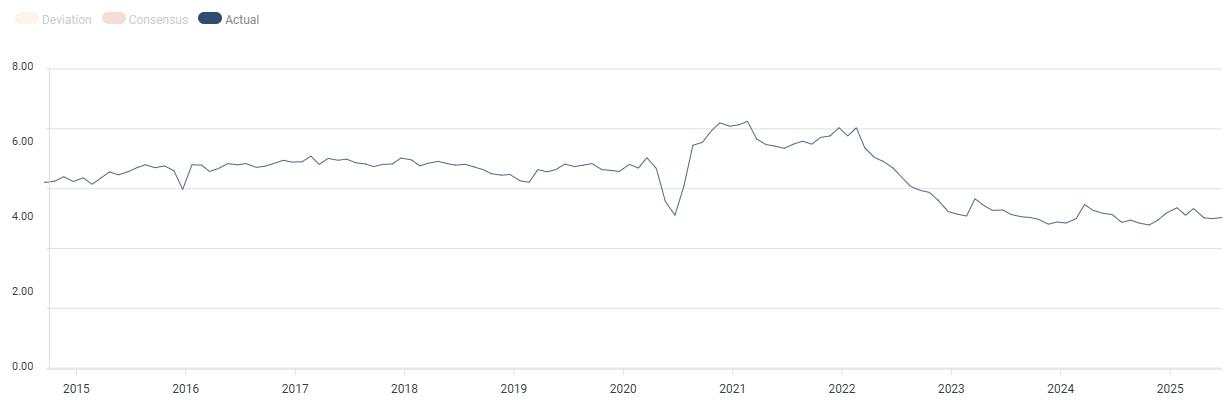

In May, sales of existing homes rose by 0.8% month-on-month, reaching an annualized rate of 4.03 million transactions, according to the National Association of Realtors (NAR). This figure, slightly ahead of expectations, nevertheless masks a gloomier reality: year-on-year, sales are down 0.7% and remain 25% below pre-pandemic levels.

Existing home sales. Source: FXStreet

Regional contrasts are striking. While the Northeast (+4.2%) and Midwest (+2.1%) posted increases, the West registered a 5.4% decline compared with April and a 6.7% drop year-on-year. The South, on the other hand, is stagnating.

This breakdown illustrates a changing geographical dynamic, with historically overheated markets struggling to adjust to new financial conditions.

Source: Mortgage News Daily

Hopes of a rebound are compromised by falling new home sales

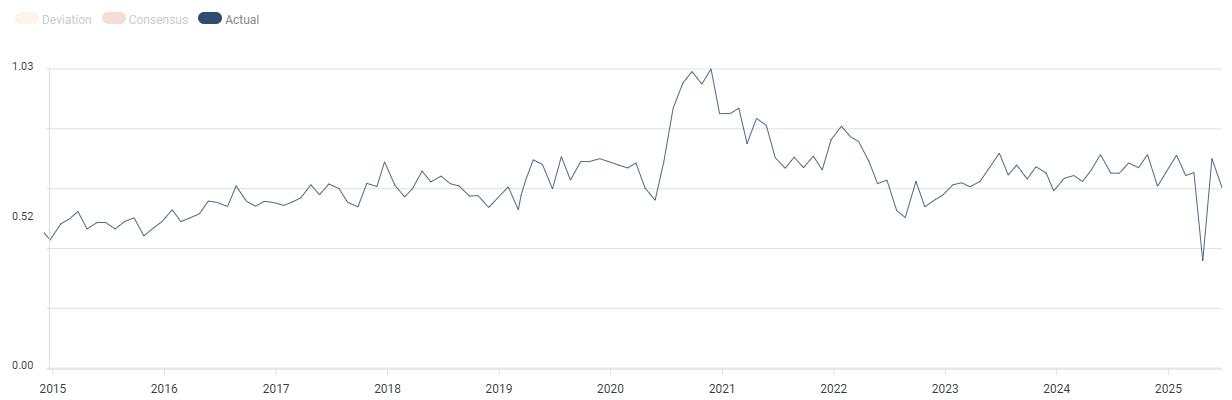

While sales of older homes are showing a slight improvement, sales of new homes are plummeting. In May, they fell by 13.7%, to their lowest level in seven months, signalling a further deterioration in demand in a segment that is essential to the revival of the housing stock.

New home sales. Source: FXStreet

Builders, faced with declining buyer appetite, are increasing sales incentives and cutting prices. But even these efforts are struggling to offset the shock of high interest rates.

As a result, the stock of unsold new homes has climbed to 507,000 units, equivalent to 9.8 months of sales, 15% more than in May 2024 and a level not seen since the 2009 crisis, notes CNBC.

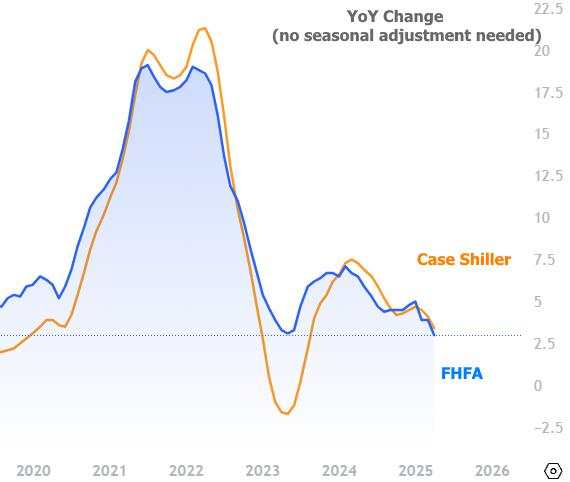

Prices are still high, but the momentum is slowing

The median price of older homes stood at $422,800 in May, according to NAR data, a new record for the month and up 1.3% year-on-year. But this growth masks a turning point.

According to the Case-Shiller index, prices fell by 0.4% in April after seasonal adjustment, marking the second consecutive month of decline. And the slowdown is widespread, with annual growth falling to 2.7%, its slowest pace since spring 2023, according to S&P Global.

This slowdown is particularly noticeable in the major metropolises where house prices soared during the pandemic. Tampa (-2.2%) and Dallas (-0.2%) are already recording year-on-year declines, while New York (+7.9%), Chicago (+6.0%) and Detroit (+5.5%) are now leading the rise, proof that the geography of the market is being redrawn.

Housing affordability: The heart of the matter

The Mortgage Bankers Association's (MBA) Purchase Applications Payment Index (PAPI), which measures the burden of mortgage payments relative to income, rose again in May.

The median payment for a borrower now stands at $2,211 per month, notes MBA, even as incomes have risen. Clearly, even though prices are slowing down, rising rates are still weighing heavily on budgets.

At 6.81%, the average 30-year mortgage rate, according to the NAR, remains close to 7%, a level that many buyers, especially first-time buyers, are struggling to bear. As a result, the share of first-time buyers has fallen back to 30% of transactions, well below historical levels.

A market dependent on interest rates

"If interest rates fall in the second half of the year, we can expect a rebound in sales," reiterates Lawrence Yun, chief economist at the NAR.

But this scenario remains uncertain as the Fed faces geopolitical tensions (conflict in the Middle East, trade war) fuelling uncertainties about inflation, inciting a wait-and-see attitude on the one hand, and political pressure from US President Donald Trump to lower interest rates on the other.

The leading indicator of pending home sales rebounded by an encouraging 1.8% in May. But caution is still the order of the day. Buyers are sensitive to the slightest fluctuations in interest rates, and even a slight rise could further delay their decisions.

A slow transition, not yet a recovery

The US real estate market seems to be slowly emerging from its torpor, but it is proceeding cautiously along a path strewn with obstacles. The increase in inventory and the slowdown in prices are signs of rebalancing. But, as long as interest rates remain high, housing affordability will remain a challenge for millions of Americans.

The next few months will be crucial. A rate cut could revive the momentum, but if it is delayed, the market could well remain stuck in this fragile in-between state, neither in crisis nor in recovery.

作者:Ghiles Guezout,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()