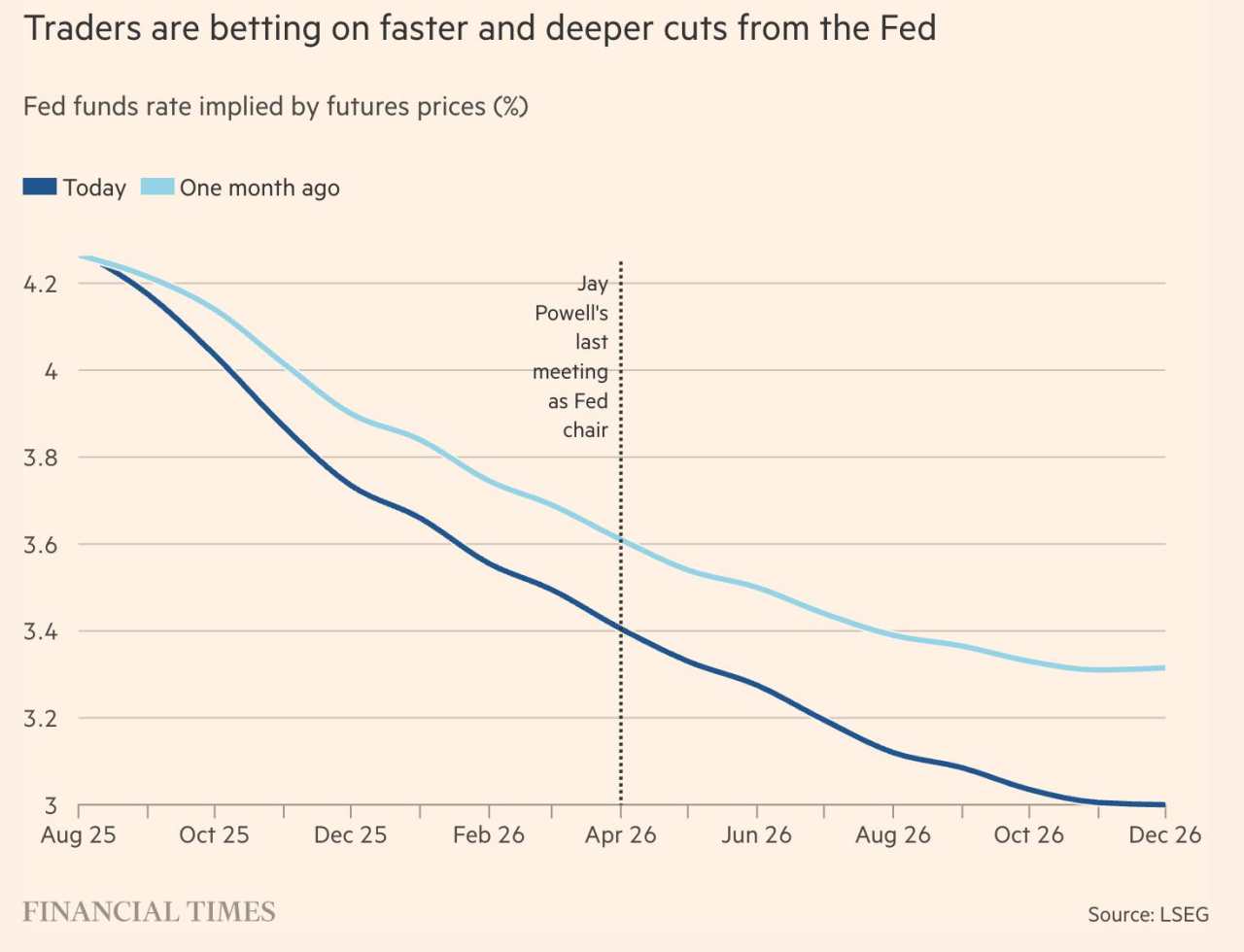

The market’s now front-running not just the Fed, but the next Fed. Futures are starting to price a post-Powell pivot party, with traders betting on at least five cuts by end-2026—up from four just a month ago. The catalyst? Less about inflation dynamics, more about the political pressure cooker Powell’s been shoved into.

Trump’s been turning up the heat, branding Powell “Mr. Too Late” like it’s his personal nickname for a slow waiter. The barrage is working—at least on market psychology. Traders are gaming out a scenario where Powell’s replacement is handpicked for maximum dovish pliability. Think “Operation Rate Relief” wrapped in a MAGA ribbon.

The real inflection isn’t even near-term—it’s mid-2026, where pricing now assumes a much more aggressive easing cycle once the new sheriff is sworn in. It’s less about data, more about regime change. When monetary policy starts pivoting on presidential social media heat, you know the playbook’s been thrown out the window.

Trump’s not even pretending anymore. Powell’s days are numbered, and the audition process for the next Fed chair is happening in broad daylight—part press release, part loyalty test. The short list? “Three or four people,” per Trump’s Truth Social post, though the real qualification seems to be how fast they’ll spin the dovish dial once Powell exits stage left.

Names being floated—Scott Bessent, Kevin Warsh, Chris Waller—aren’t new to the game, but the context has flipped. Warsh was once a poster child for hawkish orthodoxy, but under Trump 2.0, even the former hawks are starting to coo. Rate cuts are now the political litmus test, and everyone on that shortlist knows the audition is about optics and obedience, not economic purity.

Waller’s already nudging toward a July cut, and Bowman is echoing the same. That’s not policy consensus—it’s a subtle shift in posture, a signal flare to 1600 Pennsylvania. The market’s picking it up: front-end yields are melting like gelato in a heatwave, with 2s and 5s at two-month lows. Futures traders are pricing in not just cuts, but a structural tilt toward looser policy once Powell’s desk nameplate gets swapped out.

Powell, for his part, is trying to stay above the fray—no July cut, inflation still sticky, watching tariffs. He’s doing his best impersonation of the last adult in the room. But the market’s already looking past him. A “shadow chair” may not be official, but it’s priced. Traders aren’t waiting for a nomination—they’re front-running the regime shift.

In this setup, historical policy stances mean nothing. Even Warsh, the hawk of 2008, could turn dove if it gets him the nod. The rulebook is gone. The new game is about playing nice with fiscal dominance, tariffs-as-policy, and the increasingly blurred line between the West Wing and the Eccles Building.

Bottom line? The Fed isn’t just on pause. It’s in a political vise. And when the chair gets replaced, so too might the guardrails. Buckle up.

Independence, Interrupted: Are Central Banks Still Calling the Shots?

One of the great fictions in modern finance is that central banks operate independently—data-driven technocrats floating serenely above the political fray, laser-focused on inflation and growth. But scratch beneath the surface, and that illusion looks increasingly fragile.

As the world’s monetary elite gather in Sintra this week—Powell, Lagarde, Ueda, Bailey, and Rhee all nodding politely over sparkling water—there’s a more uncomfortable question looming: are central banks still independent, or are they quietly becoming instruments of government policy?

Take the Fed. Jay Powell, legally independent and insulated by statute, is now more a protagonist in Trump’s “America First “ narrative than a central banker. Markets are already front-running the end of his term, pricing in not just rate cuts but a more dovish policy regime under whoever replaces him. Trump calls him “Mr. Too Late” and openly muses about his successor. It’s no longer about CPI or core PCE—it’s about political alignment. The Fed isn’t getting direct orders, but it’s definitely not flying above the noise either.

Over in Europe, Lagarde is riding a rare moment of calm, quietly pitching the euro as a stable alternative to a wobbly dollar. A decade ago the euro was on life support—now it’s the least dysfunctional option on the table. But even the ECB, arguably the most structurally independent of the bunch, has a track record of falling in line when the bond market screams. “Whatever it takes” wasn’t just monetary policy—it was a firewall to hold the eurozone together. That’s not obedience, but it’s not exactly free agency either. Will we see a repeat when the defence and infrastructure “Bazooka Bonds” hit the market?

Then there’s the Bank of Japan, which hasn’t met a fiscal directive it didn’t like. After years of running QE, YCC, and buying up equity ETFs like a macro hedge fund, it’s hard to argue the BoJ is independent in anything but legal form. It’s practically become the Ministry of Finance’s liquidity arm, executing soft stimulus while pretending not to blink.

The Bank of England, meanwhile, is stuck in its own bind. It still waves the independence flag, but it’s been whipsawed between runaway wage inflation, political noise, and a government that wouldn’t mind a bit of monetary slack. Split votes on the MPC aren’t signs of healthy debate—they’re a reflection of political crosscurrents the BoE is trying to manage without admitting it.

China doesn’t even pretend. The PBoC is state-directed, full stop. It operates with precision, but only within the parameters handed down by the Party. Monetary policy there is just one lever in a vast control room. Obedience isn’t a problem—it’s the point.

Other central banks like those in Australia, Canada, and South Korea sit somewhere on the spectrum—nominally independent but politically sensitive. Australia’s RBA just got a dual-mandate makeover after government review. The Bank of Korea is trying to slow a property market pop without wrecking consumer confidence. They don’t take direct orders, but they’re not blind to their fiscal counterparts either.

What’s really happening is a slow, steady drift toward fiscal dominance. Central banks aren’t being told what to do—but they’re increasingly cornered into accommodating bloated fiscal policy, populist pressure, and geopolitical headaches. Independence isn’t disappearing overnight. It’s eroding—press conference by press conference, appointment by appointment—until monetary policy becomes a support act for the main show: government spending.

So while Sintra offers a stage for polite policy discourse and academic chin-stroking, the real story is playing out underneath. Central banks still wear the uniform of independence, but the markets are starting to see the strings. And if they can’t—or won’t—say no when the heat’s on, then maybe it’s time we stop pretending this game is still about the data.

作者:Stephen Innes,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()