Gold may have taken a breather after its surging to $3500 earlier this year, but the macro backdrop remains squarely in its favor. The recent pause isn't a reversal—it's digestion. Positioning has normalized somewhat, but the bigger drivers are still intact, and arguably strengthening.

We’re still in a world of rising geopolitical tension, unanchored fiscal policy, and growing skepticism over the long-term integrity of the global dollar system. These aren’t short-term narratives—they’re structural. And gold is one of the few assets with a proven track record of outperforming when confidence in fiat regimes starts to wobble.

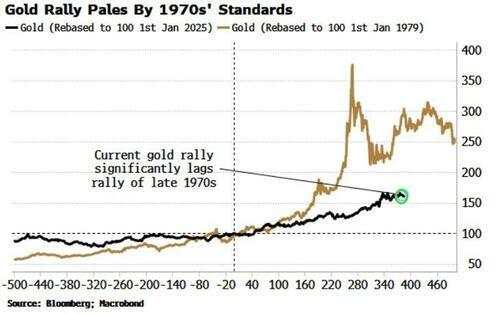

If anything, the parallels with the 1970s are becoming more pronounced. Back then, a credibility gap at the Fed and rising inflation lit the fuse. Today, it’s not just inflation risk, but broader questions around debt sustainability, reserve diversification, and the weaponization of the dollar.

For investors thinking in quarters and years—not days—this sets up well for a renewed leg higher. Don’t let the recent sideways action distract from the larger trend. Gold isn’t rolling over—it’s coiling.

Such moves serve as a sharp reminder of what happens when the macro tide turns and the currents of capital start searching for something sturdier than paper promises. Precious metals don’t just drift higher on sentiment—they surge when trust falters. Silver’s moonshot in the 1970s didn’t need headlines; it needed only a loss of faith in the system.

That’s worth remembering now, as the foundations of the international monetary system begin to creak. The global order is more brittle than it has been in decades—fractured by wars, tariffs, and the politicization of money itself.

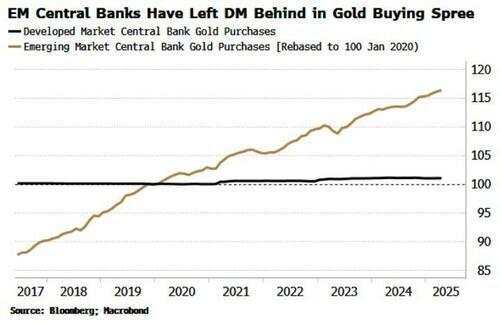

You don’t need a chart to see what’s happening—just follow the balance sheets. Since the U.S. froze Russia’s reserves after the Ukraine invasion, central banks have been speaking loud and clear. They’re not just shifting allocations—they’re redrawing the map. Gold buying has surged. Dollar hoarding has stalled. This isn’t portfolio fine-tuning—it’s monetary self-defense.

In a world where fiat can be frozen with the stroke of a pen, gold offers no counterparty risk, no signature required. That’s not ideology—it’s strategy. And for many, it’s becoming the cornerstone of a new playbook.

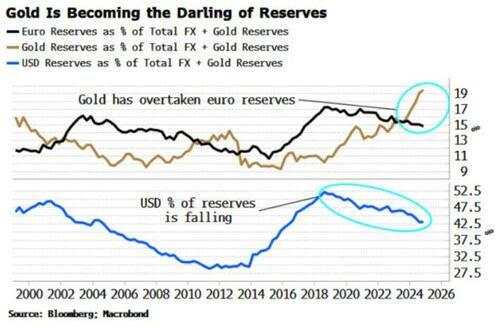

Central banks aren’t just watching from the sidelines—they’re quietly rewriting the playbook. Gold reserves now exceed euro holdings by the widest margin on record. And this isn’t just a valuation quirk driven by price—this is real volume. Over 36,000 tons now sit in vaults globally, the most since the mid-1970s.

That’s not a coincidence. It’s a signal.

When the institutions tasked with guarding monetary stability are reallocating out of paper and into metal, it’s not about yield—it's about trust. Gold doesn’t offer interest, but in a world where politics and policy collide with capital flows, it offers something far more valuable: autonomy.

This isn’t a hedge. It’s a pivot. And it’s happening in real time.

At the same time, the dollar’s share of global reserves is slipping like sand through a clenched fist—now down to just 43%. This isn’t a panic-driven selloff, but a slow, deliberate diversification—more like a tide pulling back than a wave crashing ashore. And Washington or Frankfurt isn’t leading the shift, but by central banks across the emerging world, especially in Asia. These are the institutions that have learned, sometimes the hard way, that the dollar isn’t just a currency—it’s a lever of statecraft. When reserve assets can be frozen overnight, neutrality becomes a luxury and gold becomes policy.

That may change, however.

The current U.S. administration has made one thing clear: no country is beyond reach if it steps out of line—be it on trade, defense, tech, or capital flow. The dollar isn't just a reserve currency; it’s a compliance tool. And that realization is rippling through reserve managers. Should developed-market central banks eventually pivot and re-anchor into gold—a late-in-the-day reconversion—it would add fuel to an already tightening market and likely send prices into uncharted territory.

Retail buyers are starting to catch on, albeit belatedly. The early phase of this rally, driven largely by emerging-market central banks since 2022, saw little retail participation. U.S.-based gold ETF flows were flat through much of the move. Only in recent months have those holdings started to tick higher, suggesting that the broader investment community is finally beginning to connect the dots. Gold is no longer just an inflation hedge—it’s becoming a geopolitical hedge, a trust hedge, and, increasingly, a system hedge.

But retail flows in Asia—particularly from China and India—are a different kettle of fish. Unlike their Western counterparts, Asian investors took their cue from central banks early. As the chart above shows, China-domiciled ETF holdings have been climbing steadily for well over a year.

While the absolute size of Asian gold ETFs still trails those in Europe and the U.S., the rate of accumulation tells a different story. Since mid-2024, the increase in Asian ETF holdings has been nearly equal to the combined rise seen in Western funds. That’s not noise—it’s conviction. And it underscores the growing divergence in how East and West are interpreting the same macro signals.

With markets now treating tariff risk and Middle East tension as back-burner issues, some near-term consolidation in gold is likely—especially as equities make another charge at new highs. But don’t mistake calm for resolution.

作者:Stephen Innes,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()