Purpose

Change in price of goods and services purchased by consumers.

Key highlights

- The US CPI expected to rise further in July due to the impact of tariff driven price hikes.

- Core CPI MoM is estimated to rise to 0.3% in July while CPI YoY is anticipated to print 2.80%.

- June’s CPI hit 2.7%, it’s highest in four months, driven by tariffs and rising prices. July is expected to similar increase — around 0.2% for the month and 2.8% annually — as tariffs boost costs while falling gas prices and weak demand limit service price growth.

- July’s CPI will reveal ongoing tariff-driven inflation quietly eroding consumers’ buying power — a slow decline, not a crash.

- Rising CPI distances further from the Federal Reserve's 2% long-term target.

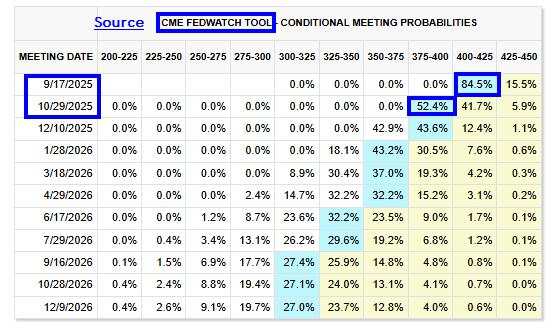

US interest rate probabilities

- CME Fed watch is pointing at 84.5% and 52.4% probability of a rate cut in September and October, respectively.

US 10Y yields technical view

- US 10Y yields formed a double top formation between April 2024 and January 2025 by failing to break 4.74% and 4.81%.

- 10Y yields are facing a robust obstacle around 4.35 – 4.40%.

- Below this resistance a dip to 4.2 -4.10% is likely.

Technical analysis perspective

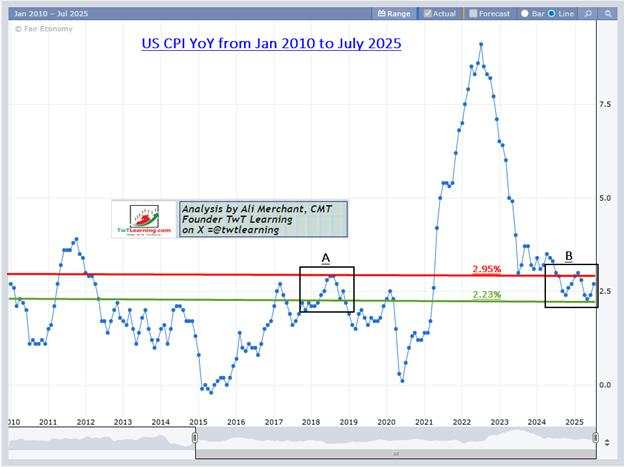

US CPI YoY

- US Core CPI Year-over-Year stayed below 2.2% from November 2012 to January 2017.

- Inflation rose to 2.7% by March 2017, then dropped to 1.6% in July 2017.

- Technically, past strong resistance, once broken upward, often becomes a solid support level in the future.

- YoY CPI has remained above 2.3% since October 2024.

- Inflation rebounded twice, from 2.4% in October 2024 to 2.3% in May 2025, forming a double bottom-like pattern.

- This formation suggests inflation could rise from 2.8% to 2.9% in the coming months.

- A similar pattern occurred between January and August 2018 (see rectangle A), which can be compared to the October 2024 - May 2025 pattern (rectangle B).

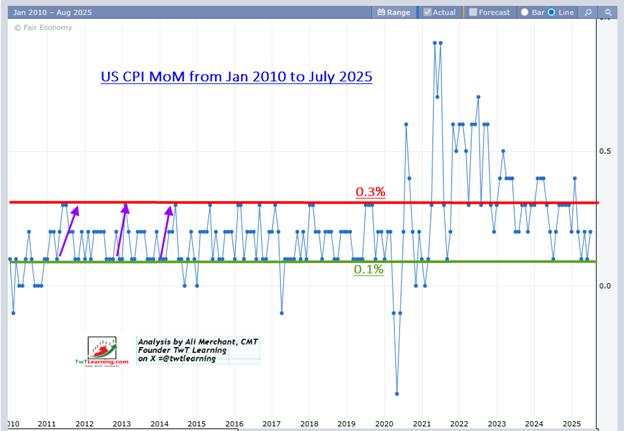

US Core CPI MoM:

Core CPI rises to 0.3% if it remains above 0.1% for a couple of months since April 2011 except on a few occasions where it cooled down.

作者:Ali Merchant, CMT,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

喜欢的话,赞赏支持一下

加载失败()