July's macro data bolsters the case for the National Bank of Poland to continue its monetary easing path. Growth in industry remains slow, construction is still stagnant, wage increases have eased, and the employment decline has deepened. We expect a 25bp cut in early September, with the policy rate falling to 4.25% at the end of 2025 from the current 5.00%.

Industrial output growth still unimpressive

While Poland's industrial production expanded by 2.9% year-on-year in July – beating both our expectations and those of the market at 2.1% YoY and 1.6% YoY, respectively – June's reading was revised to -0.6% YoY from -0.1% reported previously. There are some optimistic signs in manufacturing, and preliminary manufacturing PMIs from the euro area are encouraging. Still, the overall condition of the industrial sector remains weak, and growth is unlikely to post a strong performance in the months ahead.

In the face of weak external demand and turbulence introduced by changes in US tariffs, the rebound for both Polish and European manufacturing may be negligible. Producers’ prices went down by 1.2% YoY in July, extending the period of deflation to two years.

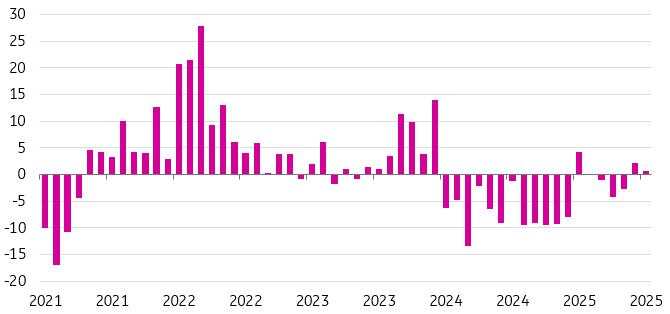

Recovery in industrial output proves enigmatic

Industrial production, 2021=100, SA.

Source: GUS.

Construction remains stagnant

Construction output increased by a mere 0.6% YoY in July. Stagnant trends continued as dwelling construction contracted further amid ongoing price corrections in the housing market, civil engineering fell again due to a slow absorption of EU funds, and activity growth in specialised works eased. Data from the construction sector does not suggest that the long-awaited acceleration of investment growth is materialising, which may be needed in the second half of this year for the economy to remain on track to achieve the 3.5% GDP growth we expect.

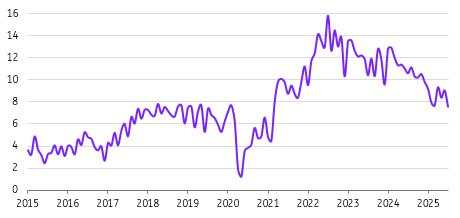

Construction activity subdued

Construction ouput, %YoY, NSA.

Source: GUS.

Labour market tensions are easing

Wages in companies went up by 7.6% YoY in July, surprising to the downside. At the same time, the decline in employment deepened to 0.9% YoY from 0.8% YoY in June (analysts expected -0.8%YoY).

In recent months, policymakers have been pointing to elevated wage growth as one of the key arguments for a cautious approach to rate cuts and maintaining relatively restrictive monetary policy. July’s lower reading suggests a positive outlook for a continued moderation in wage growth, weakening the strength of this argument.Business surveys have also revealed that wage pressure is easing, and the proposed increase in the minimum wage and compensation in the public sector in 2026 (3.0% in both cases) should further cool wage growth moving forward.

Wages growth slowed down

Average wage and salary in enterprises, %YoY.

Source: GUS.

Policymakers have room for monetary easing as inflation risks fade

With CPI inflation falling within the band of acceptable deviations from the target in June (3.1%YoY), coupled with slowing wage growth and an even sharper decline in employment, we believe the Monetary Policy Council is likely to cut National Bank of Poland (NBP) rates by 25bp at the next policy meeting in early September.

Upside risks to inflation stressed by policymakers recently are fading, and there is still sizeable room to reduce the restrictiveness of monetary policy in Poland. We foresee further policy easing in the fourth quarter of 2025 and expect the main policy rate to decline to 4.25% by the end of the year from the current 5.00%.

Read the original analysis: Polish rates likely to be lowered in September as inflation risks ease

作者:ING Global Economics Team,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()