US Dollar Index

The dollar index takes a breather after nearly 1% drop on Friday, inspired by unexpectedly dovish Fed Chair Powell’s remarks in his speech in Jackson Hole symposium of central bankers.

The dollar has registered the biggest daily drop since Aug 1, deflated by signals that the Fed may start to ease its currently restrictive monetary policy, as chief Powell focused on strong weakening in the labor sector and described elevated inflation as short-lasting phenomenon.

Although Powell did not provide any details and did not commit any action by the central bank in the near future, the signal he sent was very negative for the dollar.

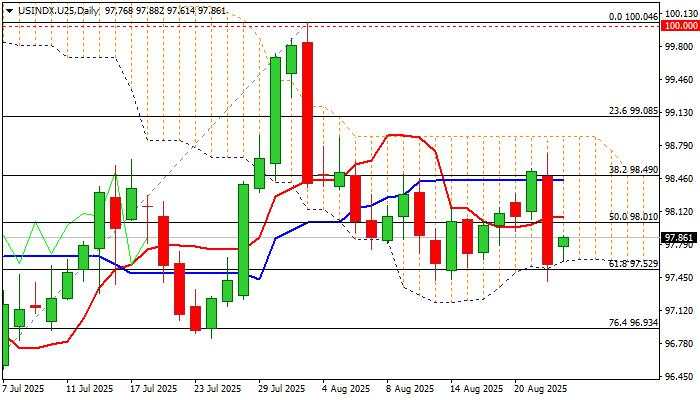

Sharp fall found firm ground at $97.53 (strong technical support provided by daily Ichimoku cloud base / Fibo 61.8% of $95.97/$100.04 upleg), with consolidation likely to be limited (ideally to be capped by barriers at 98.06/98.42 (daily Tenkan-sen / Fibo 38.2% retracement of $100.04/$97.41 descend) to keep bears in play.

Violation of triggers at $97.50/40 zone (cloud base / Fibo / higher base on daily chart) would signal bearish continuation and expose July 24 higher low at $96.82) which guards key support at $95.97 (2025 low).

Daily studies remain predominantly bearish, with a number of factors keeping the dollar under pressure and contributing to negative short-term outlook.

Res: 98.06; 98.42; 98.69; 98.88.

Sup: 97.53; 97.41; 96.82; 95.97.

作者:Slobodan Drvenica,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()