S&P 500 with Nasdaq almost retested Wednesday‘s lows – unlike Russell 2000, which refused to correct meaningfully Friday premarket. That was but one of the signs of what to expect – and all clients were ready as to what I expected to unfold, and what was the game plan – charts and thinking revealed in the weekend video.

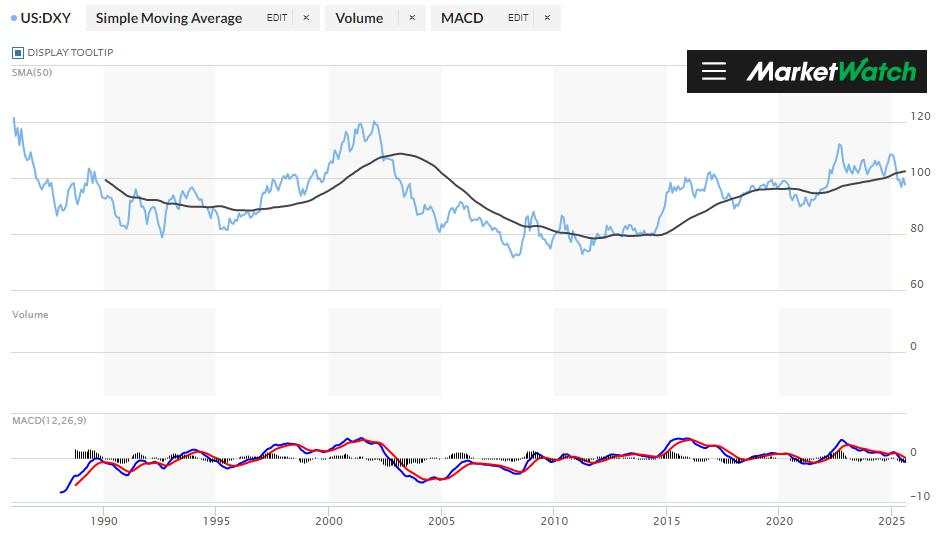

Powell did this time exactly what the markets wished for – no playing up tariffs inflation impact, but two cuts in 2025 prospects solidified. He even surprised in delivering less (tuned down in ambition) inflation focus for the Fed as such, giving more priority to the job market vs. relaxed inflation target. Exactly what stocks (all indices as predicted) were looking for, and so did gold, silver and Bitcoin too. Yields down, dollar down, and flirting with a longtime rising trendline starting in 2011 break. Should the weakness continue, that would further spur risk assets, knowing full well the huge Treasury debt issuance slated for these last two quarters of 2025.

First, I‘ll reveal the chart with scenarios for Friday‘s Jackson Hole, shared with all clients before the opening bell, and the accompanying opening sentence from premium daily analytics, „the greatest momentary risk is off-the-cuff Powell remarks, but I consider it likely stocks would see through these, and led by IWM, would turn up“. Sunday, I called for shallow pullback on Monday...

作者:Monica Kingsley,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()