The U.S. dollar faces a critical test as Fed cut bets collide with GDP and Core PCE data. With 83% odds of easing priced in, DXY’s fate hinges on whether resistance at 98.80 breaks or a rejection sends it back toward 97.50.

- Fed cut bets weigh on USD, with markets pricing an 83% chance of easing at the September meeting.

- GDP and Core PCE data on deck could redefine the Fed narrative and trigger sharp repositioning.

- Technical inflection at 98.80, where a breakout targets 100, while rejection risks a slide toward 96.50.

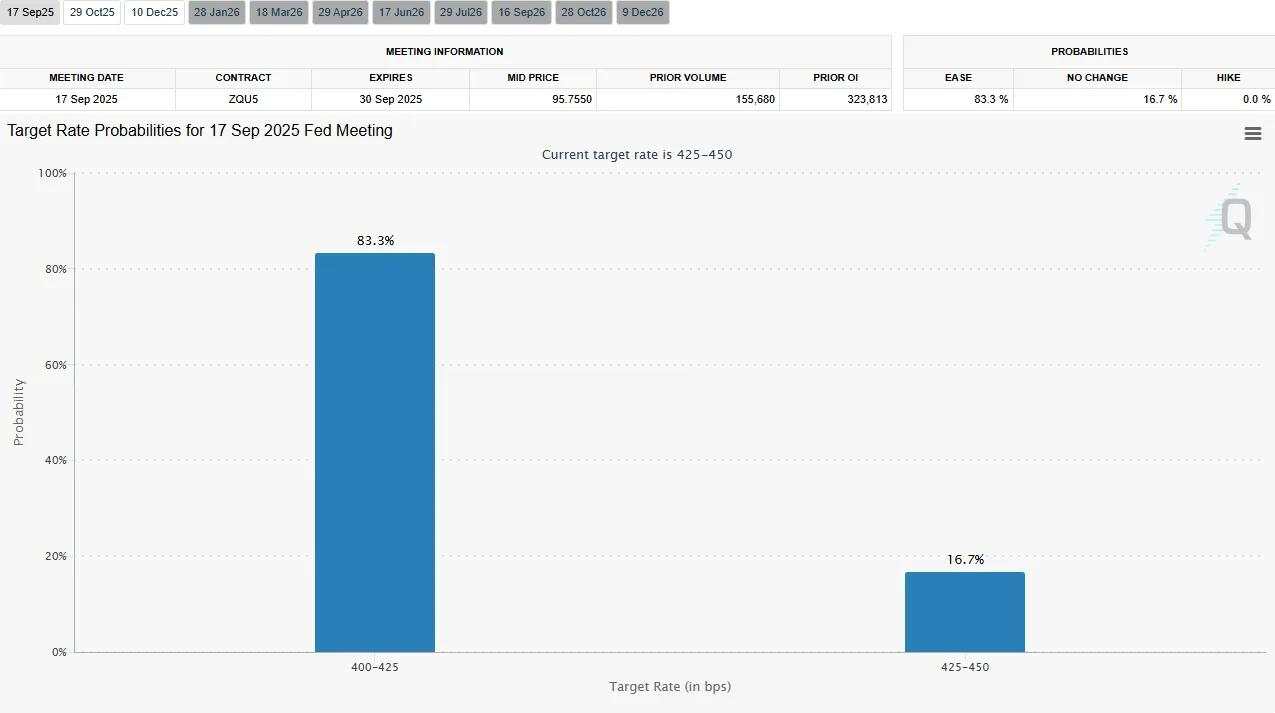

Fed cut probabilities: Macro anchor for USD

Markets remain firmly convinced that the Federal Reserve will deliver a 25bps rate cut on September 17. According to CME FedWatch, there is an 83.3% probability of easing, compared to just 16.7% odds of no change and 0% probability of a hike.

This dovish expectation has been the primary weight on the U.S. dollar, keeping investors defensive on the greenback as capital rotates toward higher-yielding emerging markets and alternative assets.

However, with such a high probability of cuts already priced in, the risk for the dollar is now skewed asymmetrically: if the Fed delivers less-dovish guidance or data surprises to the upside (jobs, GDP, PCE), the dollar could stage a sharper rebound.

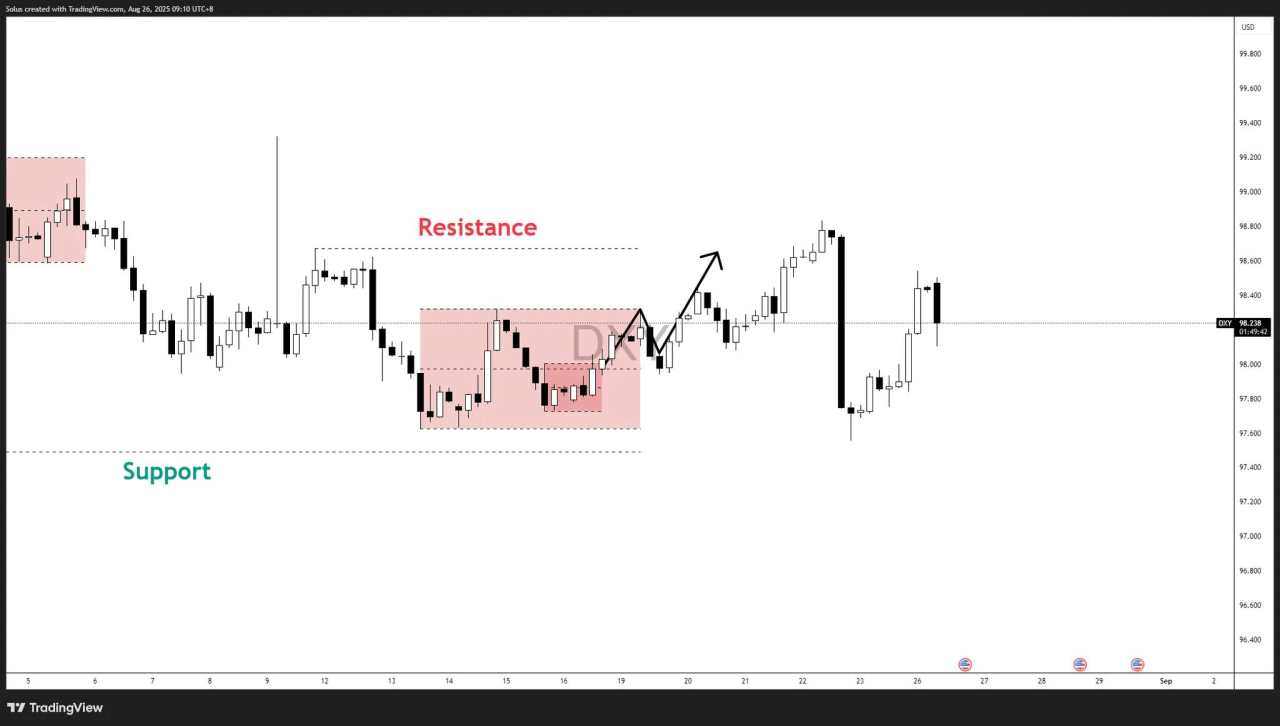

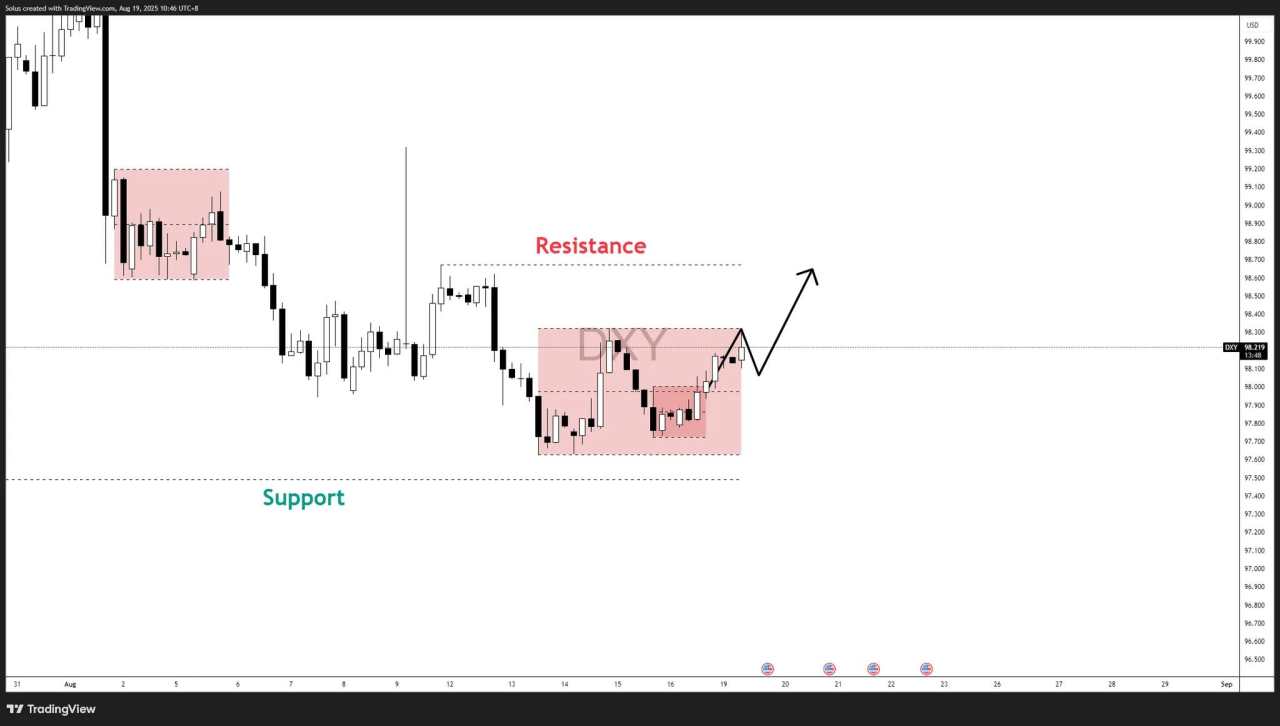

Technical narrative: Range breakout and retest

The DXY spent much of mid-August trapped in a 97.50–98.80 range, consolidating as markets digested Powell’s Jackson Hole speech.

- Support: 97.50 remains the key floor. A break below could expose 96.25–96.55.

- Resistance: 98.80 is the critical ceiling. A confirmed breakout above here invites momentum toward 99.00–99.50.

Recent sessions show the dollar attempting to materialize the bullish scenario, with a breakout attempt beyond resistance supported by stronger momentum candles. This technical development contrasts the macro dovish bias, setting up a tug of war between fundamentals and price action.

Bullish scenario materializing: From August 19 to today

In our August 19 blog (USD Forecast: Dollar stalls in 97.60–98.30 range as bearish risks build), we highlighted that while the bias was tilted bearish, a bullish recovery would materialize if the DXY could defend support and reclaim resistance.

That path is now unfolding:

- The dollar defended 97.50 support.

- Price is now testing the 98.50 breakout zone.

- Upside targets stand at 99.00–99.50, with scope to challenge 100.25 if momentum persists.

This scenario is particularly relevant as bearish macro positioning is crowded—creating room for sharp upside corrections if data or policy surprises counter market expectations.

Key data watch: Core PCE and GDP growth

The U.S. dollar faces two pivotal catalysts this week:

- Thursday, August 28 – Q2 GDP (Preliminary)

- Consensus: 3.1% (vs prior 3.0%).

- Implications: A stronger print reinforces U.S. growth resilience, challenging aggressive Fed cut bets. A downside miss would validate recessionary concerns and deepen dollar weakness..

- Friday, August 29 – Core PCE Price Index (July)

- MoM: Expected at 0.3%, steady from June.

- YoY: Expected at 2.9%, slightly higher than prior 2.8%.

- Implications: Any upside surprise above consensus would flag sticky inflation, forcing markets to temper expectations for aggressive easing. Conversely, a soft print bolsters the dovish case and risks pulling the dollar back into its 97.50 support zone.

Together, these releases will define the September 17 FOMC narrative. With Fed funds futures already pricing an 83.3% probability of a rate cut, the risk for the dollar lies in an asymmetric reaction:

- Stronger GDP + Sticky PCE = Bullish USD breakout toward 99.00–100.25.

- Weak GDP + Soft PCE = Bearish rejection at resistance, DXY sliding back toward 97.50–96.50.

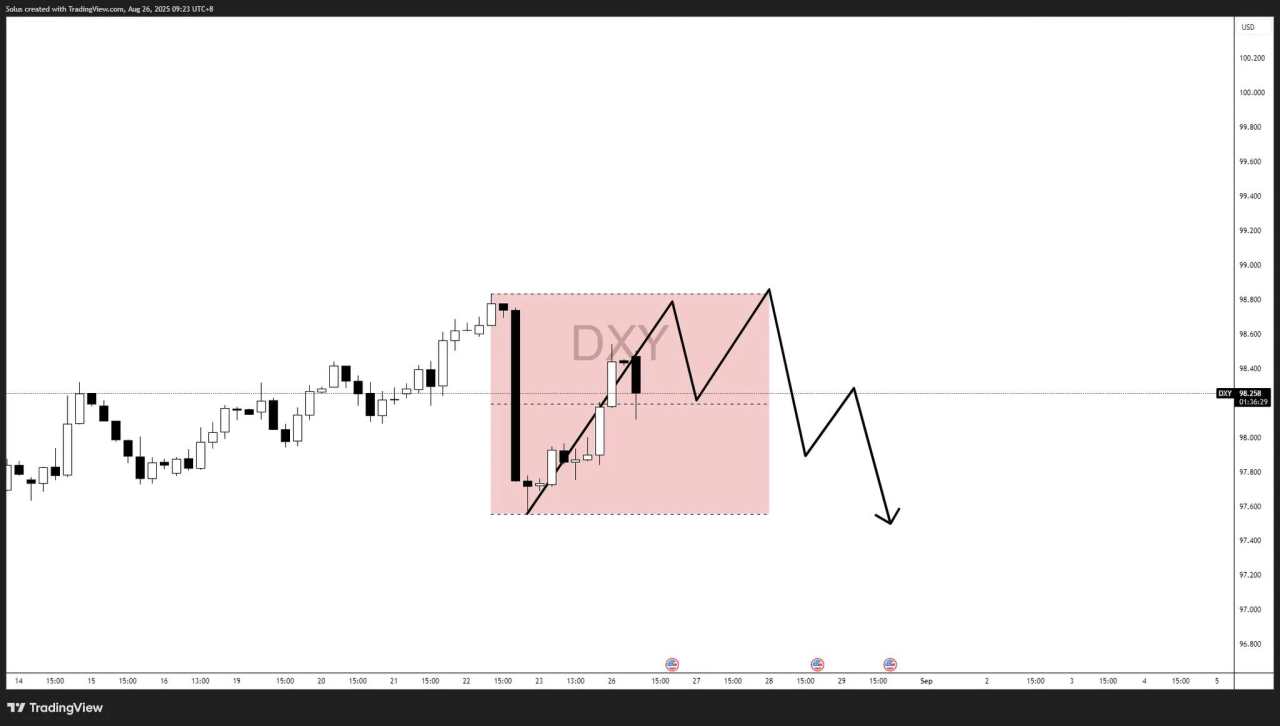

Technical scenarios for the US Dollar

Bullish scenario: Breakout confirmation and extension

The bullish case for the U.S. dollar rests on the DXY holding above its consolidation range and breaking past 98.80 resistance with conviction. A stronger-than-expected GDP (Aug 28) and sticky Core PCE inflation (Aug 29) could be the catalysts that flip sentiment.

If growth and inflation data come in hotter, the Fed may be forced to adopt a less aggressive easing stance, sparking a repricing across futures markets. With 83% of a rate cut already priced in, even a modest shift in expectations could drive short covering and fuel a rally.

In this scenario, the dollar would not just hold its current levels but accelerate toward 99.80 and 100, confirming the bullish scenario outlined in the August 19 forecast.

Bullish pathway:

- A sustained break above 98.50 resistance confirms upside momentum.

- Initial target sits at 99.00–99.50.

- Extension toward 100 possible if data delivers upside surprises.

- Market narrative: Fed less dovish than priced in, risk of over-positioned shorts unwinding.

Bearish scenario: Data-driven rejection and breakdown

The bearish case builds on the current dovish Fed bias and high cut probabilities. If Q2 GDP disappoints or Core PCE inflation comes in soft, markets will double down on expectations for September easing and possibly more cuts ahead.

In that event, the dollar’s recent rebound may prove a false breakout—failing to sustain above 98.80 and instead reversing back into the range. A rejection at resistance, followed by renewed selling pressure, would expose the 97.50 support zone. If this floor breaks, the DXY could slide further toward 96.25–96.55, in line with the macro dovish outlook.

This path would reinforce the view that the dollar’s upside is limited without policy support, keeping global flows tilted toward risk assets and emerging markets.

Bearish pathway:

- Rejection at 98.80 resistance, failure to sustain breakout.

- Retest of 97.50 support as immediate downside target.

- Break below 97.50 accelerates losses toward 96.25–96.55.

- Market narrative: Fed cut bets validated by weak data, risk-on sentiment strengthens against USD.

With GDP and Core PCE data on deck, the U.S. dollar is at an inflection point. Both bullish and bearish scenarios remain open, and the 98.50 level will be decisive in determining which path materializes.

作者:Jasper Osita,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()