- Gold sustains momentum post-Jackson Hole, with XAU/USD holding firm near $3,386–$3,400 after a $50 breakout rally.

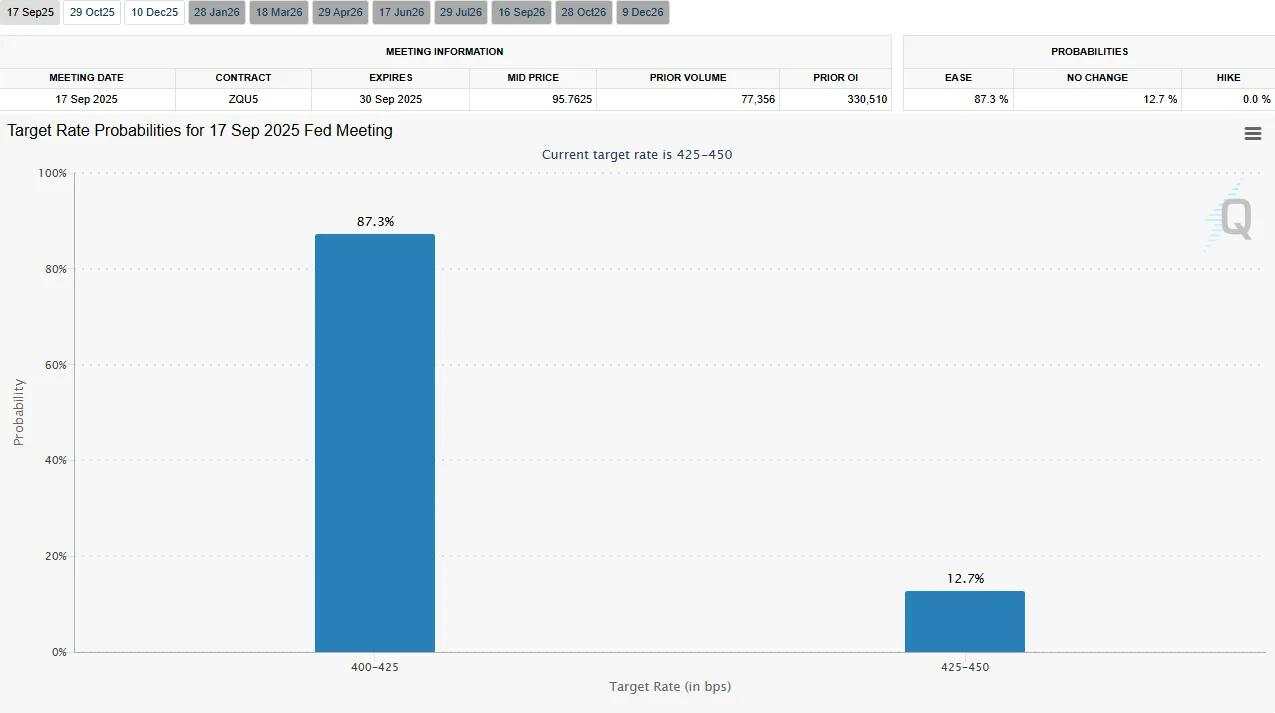

- Fed cut odds near 80–90% and political pressure on the Fed have weakened the dollar, reinforcing the bullish gold price forecast.

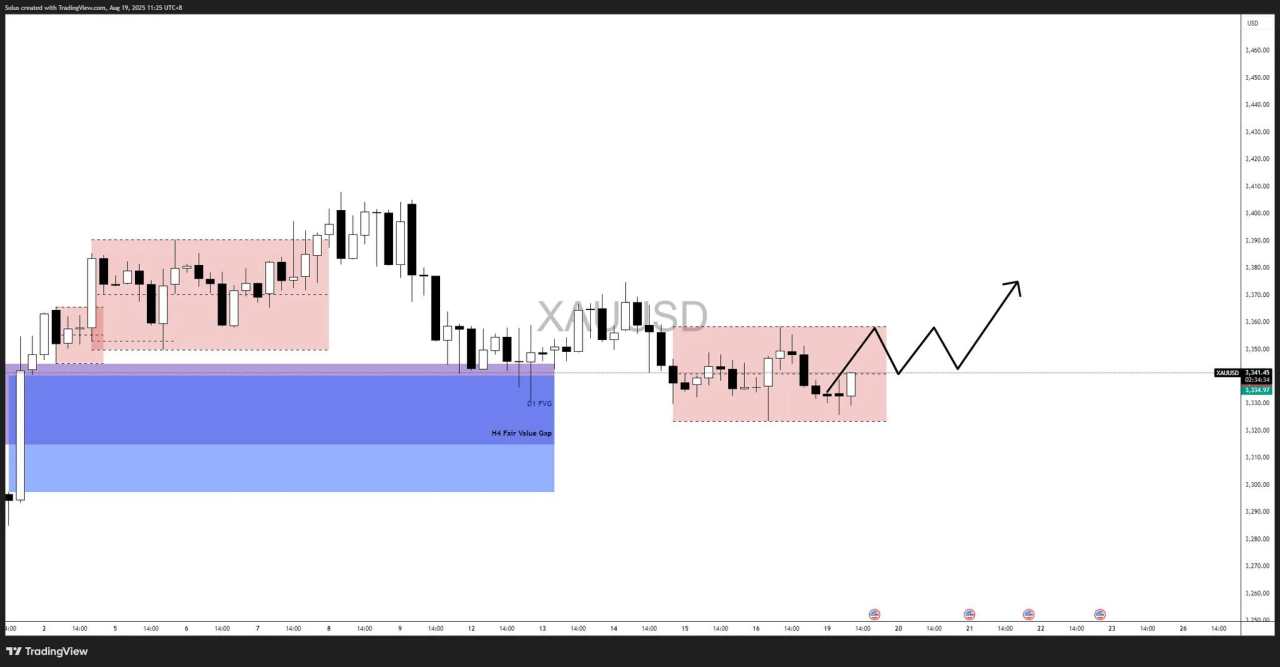

- Technical outlook shows $3,400 as the key decision point — a breakout targets $3,420–$3,480, while rejection risks a pullback into the H4 Fair Value Gap.

Gold sustains a post–Jackson Hole bid

Gold’s advance into the $3,380–$3,400 band was fueled by two intertwined forces: (1) markets reading Powell’s Jackson Hole remarks as incrementally dovish; and (2) an unusual Fed-independence shock—the U.S. President’s move against Fed Governor Lisa Cook—that pressured the dollar and nudged haven demand. By Tuesday, bullion held firm just under $3,400, with the prior ~$50 pop from Friday still visible in the tape.

Rate expectations tightened in gold’s favor. Across the week, CME FedWatch probabilities for a September cut swung into a high-confidence range (variously cited around ~83% and ~89% by major outlets), underscoring the market’s conviction that policy easing is near. That USD drift + lower real-rate impulse is the classic cocktail for bullion bids.

Narrative: From forecast to fulfillment

In last week’s analysis, Gold forecast: Will Jackson Hole spark a breakout or breakdown, we highlighted the two scenarios: a clean break above $3,335–$3,360 would open the path to higher liquidity pools, while failure would risk a deeper pullback.

Fast forward to this week — the bullish roadmap played out almost to the letter:

- Gold consolidated within a mid-August range (marked in red box on chart).

- A sweep of range lows was followed by a strong displacement higher — a textbook liquidity grab + breakout sequence.

- The breakout reclaimed structure above $3,335, triggering the momentum surge we forecasted.

- Price is now trading just below the previous day’s high (~$3,388), after respecting the reclaimed structure.

This shows how the technical thesis aligned with fundamentals: Powell’s Jackson Hole remarks softened rate expectations, and the Fed-independence scare added a haven premium, both reinforcing gold’s breakout trajectory.

What drove Gold this week (and why it matters)

- Powell at Jackson Hole → softer path implied: Markets interpreted the speech as removing hawkish tail risk, lifting bullion alongside lower yields/softer USD.

- Fed-independence scare adds a haven bid: The President’s attempt to fire Gov. Lisa Cook rattled confidence and weighed on the dollar; gold held near $3,400.

- Breakout risk into PCE: Kitco flagged Core PCE as a potential upside catalyst if it cools; gold is coiling just below a key ceiling.

- Institutional forecast support: BMI (Fitch Solutions) upped its 2025 target to $3,250, reinforcing dip-buying appetite.

Gold price forecast: XAU/USD stalls below $3,400 at key decision point

Gold’s breakout has materialized, with XAU/USD pushing from the $3,335 base into the $3,386 area, just below the key $3,400 level. The rally left behind a 4H Fair Value Gap (FVG) at $3,351–$3,366, which now acts as the main support zone for this bullish leg.

For the gold price forecast, the outlook is simple: a clean close above $3,400 confirms continuation, opening targets toward $3,420–$3,440 and potentially $3,480. If price slips back into the FVG, a retest of $3,335–$3,320 becomes likely before bulls can attempt another run.

With the Core PCE inflation print due Friday, the market is coiled at a decision point: continue higher into fresh liquidity, or fade back toward the Fair Value Gap.

Bullish scenario: Breakout above $3,400

If bulls defend the $3,351–$3,366 H4 Fair Value Gap, structure remains bullish.

- Trigger: Clean break and daily close above $3,400.

- Targets:

- $3,420 → minor liquidity

- $3,440–$3,450 → supply zone

- $3,480 → extension toward ATH territory

- Fundamental catalyst: A softer-than-expected Core PCE or weaker growth data would boost Fed cut odds further (currently ~80%+), likely triggering safe-haven flows and USD weakness that supports XAU/USD.

Bearish Scenario: Failure to hold $3,386 → Re-entry into FVG

Rejection at $3,386–$3,400 and breakdown into the H4 FVG.

- Trigger: A move below $3,351 opens the door for deeper retracement.

- Targets:

- $3,335 → breakout base

- $3,320–$3,300 → corrective pullback zone

- Fundamental catalyst: A hotter-than-expected Core PCE or upside surprise in U.S. GDP would push real yields higher, strengthening the dollar and capping gold.

Final thoughts on Gold

This week’s gold technical analysis confirms how the Jackson Hole breakout forecast materialized. Now, with XAU/USD trading just shy of the $3,400 psychological barrier, the market is in balance mode. Whether it extends toward $3,480 or rotates back into the FVG will likely depend on Friday’s Core PCE release, which traders see as the decisive input for September’s Fed meeting.

作者:Jasper Osita,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()