- USD follows forecasted bearish path, rejecting 99.00 and sliding into the 97.80 handle.

- CME FedWatch shows 89.7% probability of a September Fed rate cut, anchoring a dovish USD bias.

- NFP jobs data on Friday is the decisive catalyst, with risks skewed toward further downside if labor softness persists.

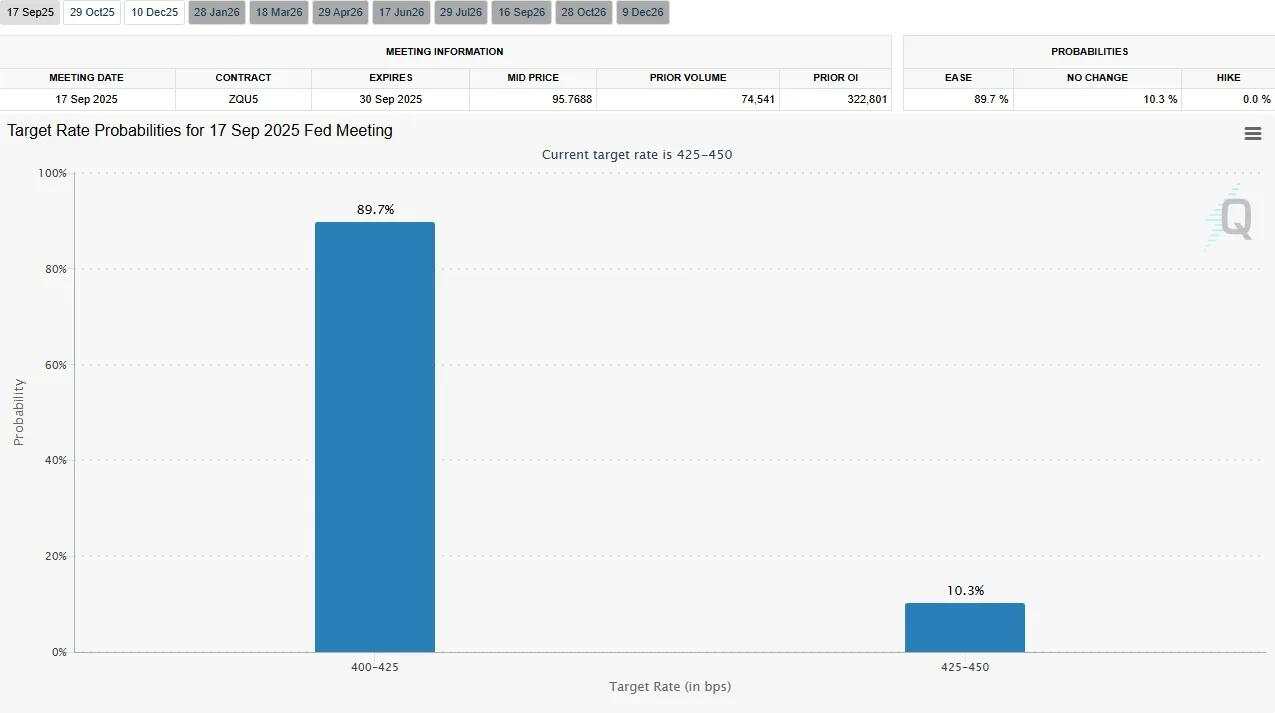

Fed cut expectations dominate

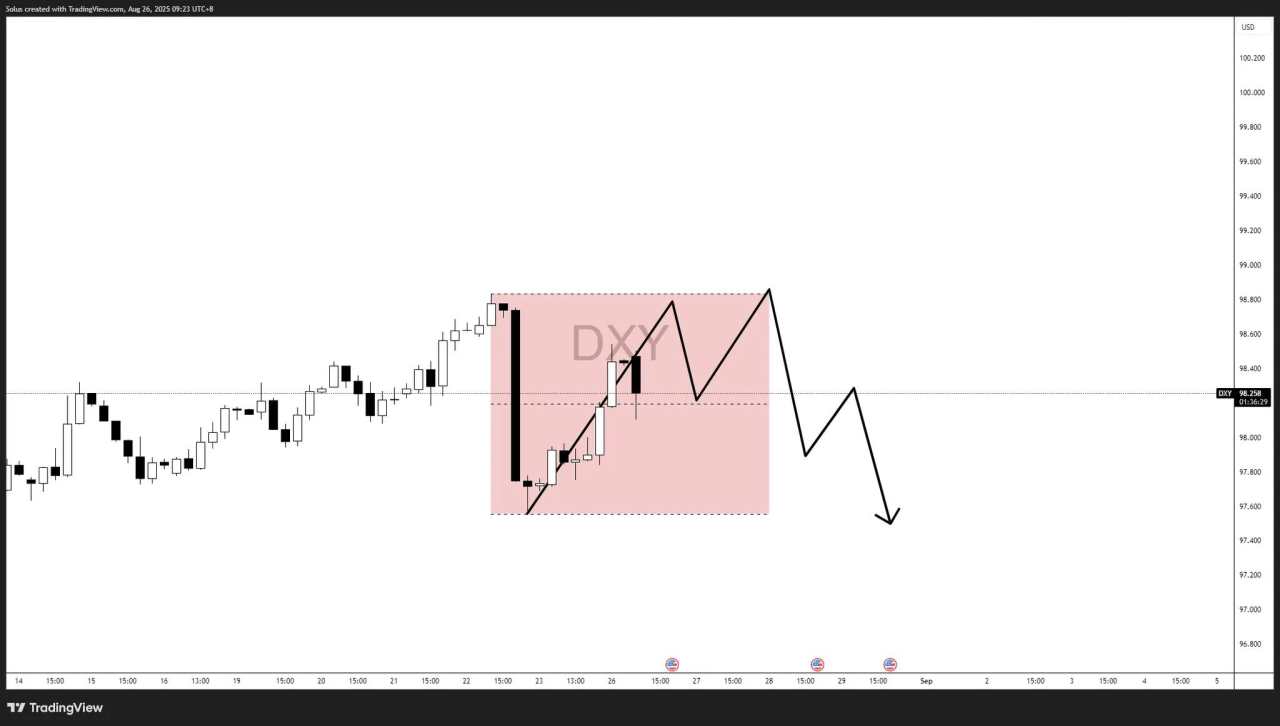

The U.S. Dollar’s trajectory remains anchored in monetary policy expectations. As outlined in our August 26 forecast, DXY faced rejection at 99.00, with a path toward 97.50–97.20.

That projection has now played out, as price action shows a clear distribution structure, capped by sellers unwilling to let DXY extend higher.

The CME FedWatch tool confirms the macro backdrop:

- 89.7% probability of a 25bps rate cut on September 17

- 10.3% probability of no change

- 0% probability of a hike

With nearly all risk priced toward easing, the USD remains under pressure.

How the forecast played out: Bearish path confirmed

On August 26, we mapped a scenario where DXY would reject the 98.40–99.00 supply zone, form distribution, and then rotate lower into the 97.80 handle.

The market validated that projection almost step-for-step. DXY rolled into a distribution phase, rejected late buyers, and broke lower into consolidation around 97.80. This confirms that sellers are in control, aligning both technical structures and dovish Fed expectations.

The focus now shifts to whether Friday’s Non-Farm Payrolls (NFP) release will extend this bearish continuation into 97.20–96.80, or provide a short-lived relief bounce.

High-impact news this week: NFP in focus

This week is packed with red-folder U.S. data, but labor market prints carry the most weight:

- Sept 2 – ISM Manufacturing PMI (Aug): Expected at 49, still below 50, signaling contraction.

- Sept 3 – JOLTs Job Openings (Jul): Forecast 7.4M vs. 7.437M, hinting at cooling labor demand.

- Sept 4 – ISM Services PMI (Aug): Forecast 51 vs. 50.1, a key resilience check.

- Sept 5 – Labor Market Double Header

- Unemployment Rate (Aug): Forecast 4.3% vs. 4.2% prior.

- Non-Farm Payrolls (Aug): Forecast 75K vs. 73K prior.

Why NFP matters most

If payroll growth undershoots forecasts - or if the unemployment rate ticks higher - the market will cement expectations of a September cut, driving DXY toward 96.80. A surprise upside beat, however, could trigger a temporary relief rally, though it would be unlikely to derail the broader bearish USD narrative.

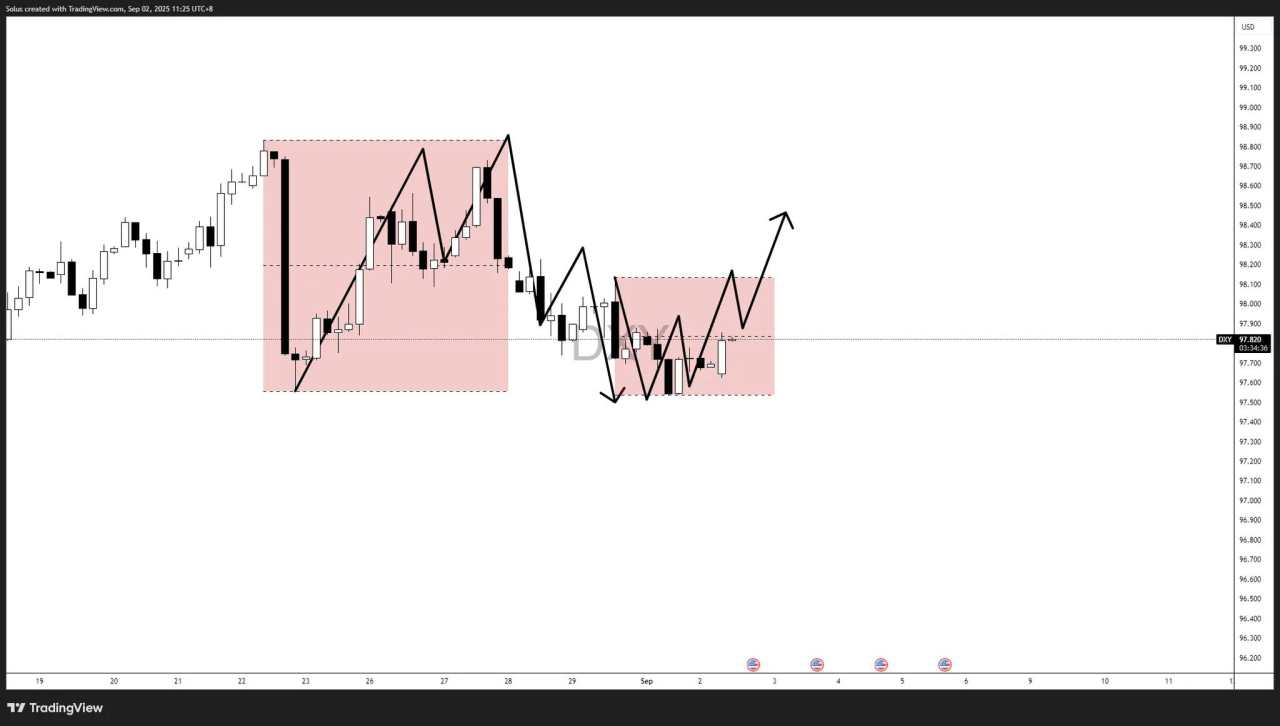

Technical outlook: Bearish bias with key inflection

The U.S. Dollar Index has transitioned from distribution at 99.00 into a consolidation near 97.80. This pause reflects market indecision ahead of NFP, where the data release is likely to dictate whether DXY continues its downward trajectory or attempts a corrective rally.

Bullish scenario: Relief rally if NFP surprises to the upside

If NFP beats strongly (job creation above 100K and stable unemployment), DXY could bounce from current levels. This would likely unwind excessive bearish positioning and allow a climb back into the upper supply zone.

- Key reclaim levels: 98.20–98.40.

- Break above 98.60 strengthens upside momentum.

- Target zone: 99.00–99.20, where sellers are likely to cap gains.

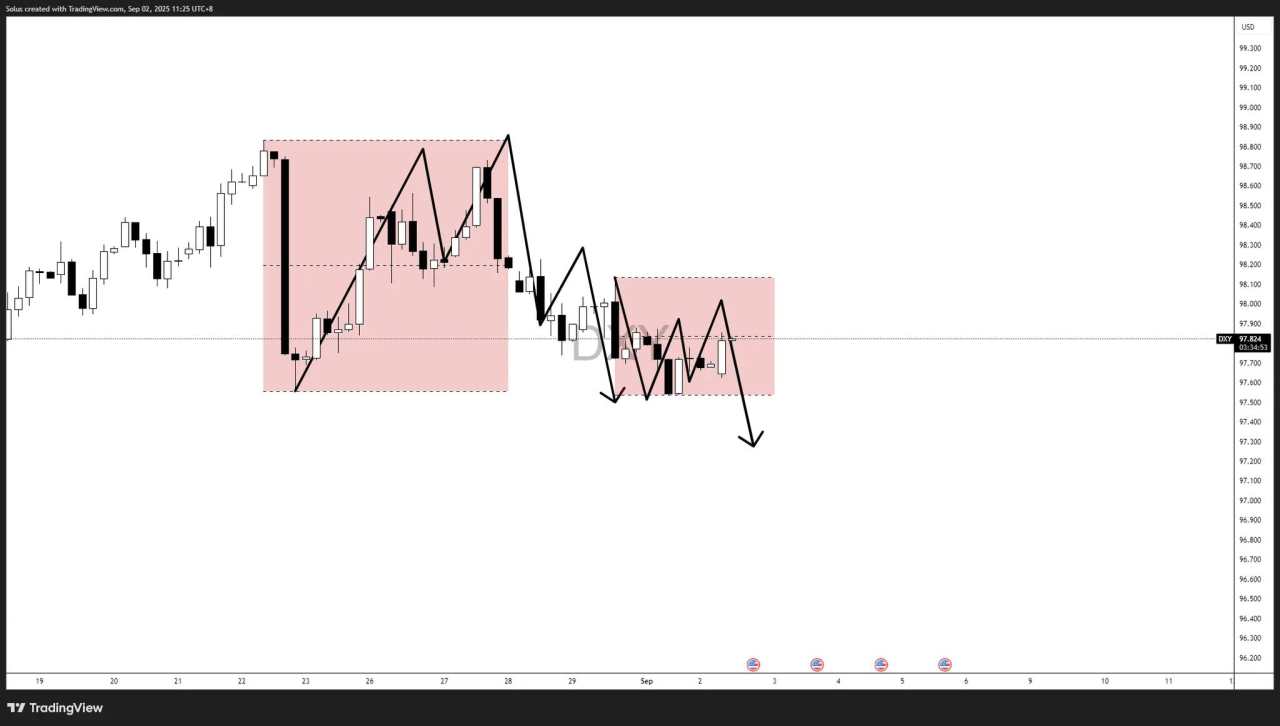

Bearish scenario: Breakdown if NFP misses expectations

If NFP falls short (job creation below 75K or higher unemployment), bearish continuation becomes the dominant path. In this case, the current 97.80 consolidation will resolve lower, driving DXY into fresh liquidity zones.

- Breakdown trigger: Failure to hold 97.60.

- First target: 97.20.

- Extension target: 96.80, aligning with Fed’s dovish bias.

Conclusion

The U.S. Dollar’s bearish trajectory has played out as forecast, with rejection at 99.00 leading to downside into the 97.80 handle. With the Fed expected to cut rates in September and NFP looming, the market now faces a decisive inflection point.

If labor data disappoints, DXY could accelerate toward 96.80. If it surprises to the upside, a relief rally back toward 99.00 is possible - but still capped by dovish fundamentals.

作者:Jasper Osita,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()