Summary

The large widening in the trade balance can mostly be traced to just two import categories: nonmonetary gold and computers. While this may again partially reflect businesses pulling forward demand ahead of hiked tariff rates, it also reflects monthly volatility as well as a budding transition to a high-tech future. Trade flows remain a far cry from normal, and will remain in flux until trade policy finds a bottom.

There's Gold in them thar imports

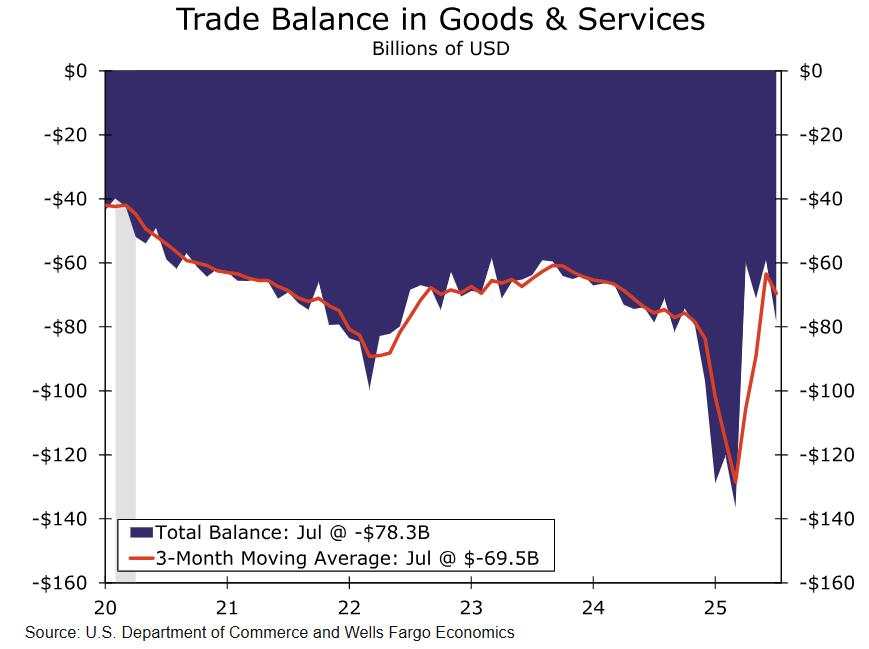

Another pop in imports caused the U.S. international trade balance to widen to $78.3 billion in July (chart). The $18.4 billion gain in goods imports was due to a renewed jump in industrial supplies, which rose 26% after five-consecutive monthly declines following an initial pull-forward at the start of the year.

It is tempting to look at this development and conclude that the businesses are returning to some semblance of normal after tariff disruptions earlier this year. That explanation is made all the more compelling when seeing an import surge alongside the sharp rebound in durable goods orders in July. Yet when we look at the details of what is really driving trade it becomes obvious that things are anything but normal.

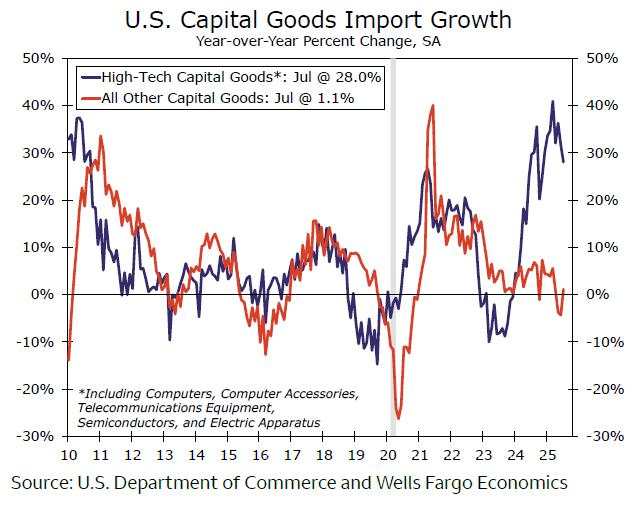

We have been on the record that the import trade over the past year is best understood when viewed through the lens of high-tech imports. Consider the nearby chart that plots the annual change in goods imports for a just five high-tech items (blue line) vs. literally all other capital goods (red line). When it comes to imports, it is tech's world.

While the trend still favors a massive import surge in tech-related components, July's import surge was also driven by one other category that technically is considered an industrial supply, but might be considered in a different light in the context of rising uncertainty: non-monetary gold. Of the overall $18.4 billion increase in goods imports, $9.5 billion was increased imports of gold. Combine gold with imports of computers (+$1.5B) and you have accounted for about 60% off the import surge with just two import categories. This is not in any way a return to normal for trade.

Download The Full Economic Indicator

作者:Wells Fargo Research Team,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()