Global stock market rally powers on

- China data disappoints and points to a broad economic slowdown.

- France downgrade could weigh on the bond market and the euro.

- How low will Fed rates go?

- BOE: QT in focus as rates set to remain unchanged.

It was another good week for risk, with indices across the globe posting gains last week. The increases were led by Japan, the Nikkei rose by 4%, and the Hang Seng was higher by 3.8%. The S&P 500 made multiple fresh record highs, although it closed down a touch on Friday, and the Nasdaq rose by 2% after a stunning 25% rally for Oracle. Tesla rose by 12% even though Elon Musk was awarded $1 trillion in stock, the largest ever corporate award, which has not put off investors. Perhaps this is because Elon Musk will have to achieve the impossible to see any of it.

Other notable stock market winners last week included Anglo American in the UK, which rose by 12% after announcing a deal to buy Teck Resources to make a mega sized copper mining company. BAE Systems, Babcock and Rolls Royce were also higher, as defense stocks surged on the back of news that Russian drones entered Polish air space. News over the weekend included reports that Russian drones also entered Romanian air space, another Nato member, which could ensure that defense stocks remain in demand for the coming week.

Weak China data unlikely to deter risk appetite

The appetite for risk remains strong and is defying global fears like political turmoil for France and Japan, geopolitical risks, and a slowdown in the world’s second largest economy. There are signs of a broad economic slowdown in China. Retail sales data for August were weaker than expected, industrial production data also grew at a slower rate than expected, the jobless rate ticked up and property sales also fell last month. This data is unlikely to deter another leg higher for stocks, since it could spur the Chinese government on to add more stimulus to prop up the economy, which is risk positive.

French sovereign rating downgrade to weigh on the euro

The big news on Friday was the downgrade of French sovereign debt by Fitch, the credit ratings agency. Fitch downgraded France by one notch to A+, assigning a stable outlook, even though France is yet to secure a budget and has had its third prime minister in a year. Bond yields in France are rising sharply, and the French 10-year sovereign bond was the worst performer in Europe and in the US last week. French bond market under performance has been a feature of the last 3 months, and we expect this to continue, even though Fitch assigned France a stable outlook. On Monday, French bond market futures are drifting lower, suggesting that yields will rise later, the euro has also opened lower at the start of this week, and is the third weakest currency in the G10 FX space.

France now has a lower credit rating than Apple, which has an AA+ rating, and LVMH, which has a rating of AA-, and is on par with the likes of Barclays. The problem for France is that it needs to attract buyers of its debt to fund its massive, and growing, fiscal deficit. However, there are more attractive options out there, including corporate credit. This means that French sovereign bonds could see their yields continue to rise, until the country has a credible plan in place to shrink the deficit.

This week is extremely busy for event risk. The Fed meeting on Wednesday is swiftly followed by the Bank of England and the Norges Bank on Thursday. The outcome of these meetings, especially the Fed meeting, will be crucial for determining the next move for markets. President Trump is also on a state visit to the UK and will bring tech bosses including Nvidia’s Jensen Huang with him. Whether promises of investment in the UK’s tech sector will lift the gloom of the UK’s economic prospects and upcoming budget fears, we will have to see.

As we lead up to a key week for event risk, there are signs that cracks could be appearing in the euro, it was one of the weakest performers in the G10 FX space last week, while the US dollar and the pound were in the middle of the pack. Below, we look at two key events that are worth watching out for.

1, The Federal Reserve: how low will rates go?

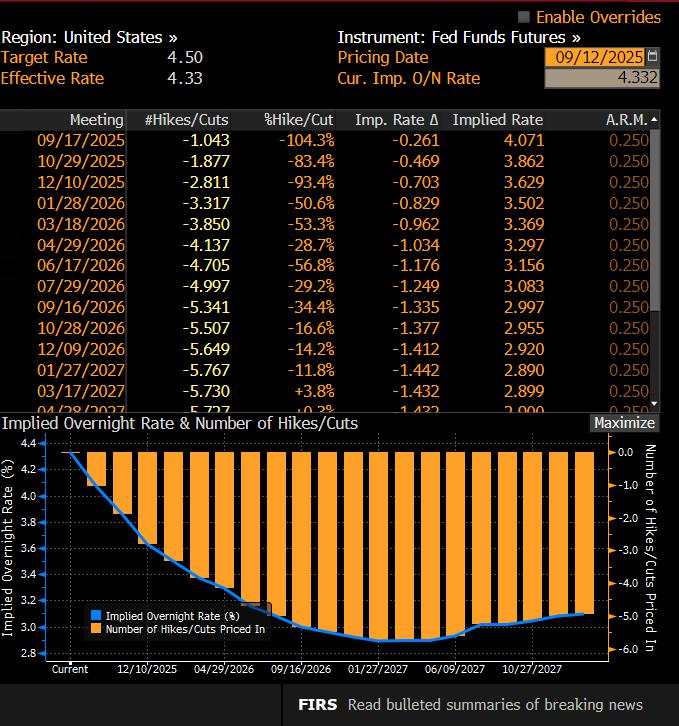

The Federal Reserve will announce their latest policy decision on Wednesday 17th September, followed by a press conference from Jerome Powell. A 25bp rate cut is fully priced in by the Federal Funds Futures market, but there is a small chance of a 50bp rate cut, currently this stands at 4%. We expect a 25bp rate cut at this meeting, however, the market will be looking for signs about what the Fed does next. There are currently just under six rate cuts priced between now and January 2027. In recent months there has been a massive recalibration in Fed rate cut expectations due to a softening in the labour market and massive pressure from the White House to cut rates. The question now is, has the market got too far ahead of itself, and will the Fed push back on the rate-cutting narrative due to stubbornly high inflation, which remains well above the Fed’s target rate.

This week’s meeting sees the release of the latest Fed staff forecasts for GDP, CPI and the unemployment rate, the Fed’s ‘Dot Plot’ will also be released. The Dot Plot will be scrutinized to see if the Fed is happy with the market’s assumptions, or if they plan a more cautious approach to easing.

Stocks could get volatile over Fed meeting

The Nasdaq closed at a record high last week, and the S&P 500 also posted healthy gains, as investors’ enthusiasm for risky assets has surged with the bumper rate cut expectations. This has sent Treasury prices soaring, the 2-year Treasury yield is down nearly 40bps in the last 3 months and bond yields move inversely to prices. It has also had a major impact on stocks, and US stocks are now outpacing YTD gains for some European indices including the Eurostoxx and Cac indices.

Uncertainty surrounding the future path for Fed policy means that some traders are now bracing for volatility around Wednesday’s Fed decision, with options markets pricing in a 1% swing in either direction, which would be one of the biggest daily moves in weeks.

The risk is that after such a strong rally, the S&P 500 is higher by 10% in the past 3 months, the market sells the news of the Fed meeting. If more rate cuts are signaled for early next year, then investors could buy the dip, but if the outlook is less clear, then we could see a longer sell off in risky assets. A less dovish Fed could boost the dollar, which is the worst performing currency in the G10 FX space so far this year. Overall, there is a lot resting on this meeting, the market expects the Fed to acquiesce to Donald Trump’s requests and over-ease monetary policy. However, if the Feds pushes back on this and asserts its independence, then it could be viewed as a hawkish move with big consequences for financial markets.

Chart 1: Fed rate cut expectations, devised from the Federal Funds Futures market

Source: XTB and Bloomberg

2, The Bank of England: QT pause on the cards

The BOE is not expected to cut interest rates at this week’s meeting, and we will have to wait until November to get the latest growth and inflation forecasts from the Bank of England, which will come 3 weeks before the dreaded UK budget. However, the focus is unlikely to be on what the BOE is doing now and there could be two things to watch in this week’s BOE meeting.

Firstly, there are some concerns that stubbornly high inflation, caused in part by public sector wage rises, will crimp the BOE’s ability to cut rates further and that 4% could be the UK’s new neutral interest rate. This week’s meeting could go some way to confirming if this view is correct. Secondly, there are calls for the BOE to slow the pace of quantitative tightening, whereby it sells the bonds on its balance sheet, as this is putting more upward pressure on UK bond yields and causing government borrowing costs to surge.

We talk about direct political pressure on the US’s Federal Reserve to cut interest rates, however this could be political pressure by stealth. The UK’s long term borrowing costs are at their highest level for nearly 30 years, and even the Bank has said that its QT program is adding to this pressure. Several former MPC officials have urged the BOE to slow or reduce its bond sales, according to the Guardian.

The BOE could announce that its QT program will be scaled back to £70bn for the year ahead. This is lower than previously expected, but it would still require a hefty amount of bond selling, which could keep upward pressure on yields. Thus, a sharper reduction, or a halting of active bond sales would have the biggest ameliorating effect on UK long-term yields, in our view.

However, holding onto the bonds could also be problematic for the BOE. They will earn less interest on their Gilt portfolio than they give to banks that hold their reserves at the BOE. This is because the bonds that the BOE owns often have low yields, since most of them were accumulated when interest rates were very low between 2009 and 2021. This could open the question of whether Rachel Reeves could tax bank earnings at this year’s Budget, something she is reportedly inclined to do. Thus, bank stocks could be in focus in the aftermath of this week’s meeting.

This week is busy for the UK, with a State visit for President Trump and the release of labour market data and the latest CPI report. Payrolled employees could slip again for August, while inflation data is expected to remain elevated. Headline CPI is expected to rise by 0.3%, driven by energy price increases, while the core rate is expected to fall a notch to 3.7% from 3.8%, and service price inflation is expected to decline slightly to 4.8% from 5% in July. This is still way too high for rate cuts for most of the MPC. Thus, the UK’s economic data is unlikely to play ball for those looking for rate cuts.

作者:Kathleen Brooks,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()