The Federal Reserve finally delivered a 25 bps rate cut in September and signalled more easing into 2025. The dot plot now leans toward three cuts next year, with the CME FedWatch tool showing strong odds for additional moves in October and December.

Powell described the decision as a “risk-management cut”—a nod to a softening labour market, even as inflation remains sticky around 3.0–3.1% on the Fed’s preferred PCE gauge.

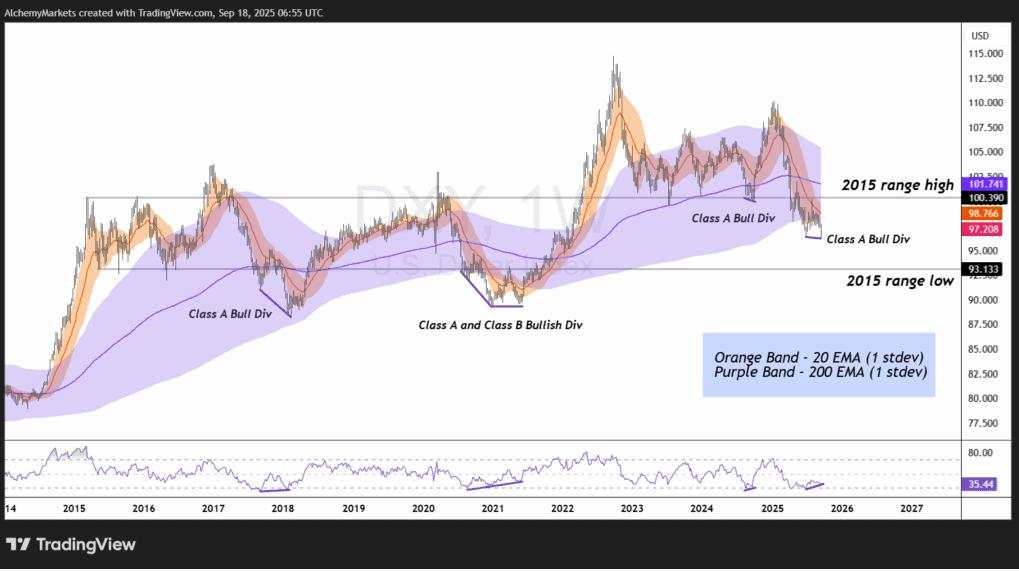

For the U.S. dollar, this creates an interesting setup. On the weekly chart, the RSI has carved out bullish divergence from oversold levels (<35), a signal that has historically preceded strong rallies. The caveat: the DXY remains suppressed under both its 20-EMA and 200-EMA bands (1 standard deviation).

History shows that when the 20 sits below the 200, a true recovery only follows once the 200-band is reclaimed. Right now, that level sits near 101.74, just above the 2015 range high at 100.39, which is already acting as resistance.

The playbook is clear: divergence suggests the dollar may be trying to base, but the Fed’s pivot has tilted conditions against it. Just as in 2008–2012, when the 200-EMA band capped every rebound until finally broken, the DXY could stay pinned beneath resistance unless it reclaims that dynamic barrier. Until then, the easing cycle and the weight of both EMA bands argue that dollar strength remains capped—even if short-term squeezes materialise.

Powell’s risk-management cut

- Fed frames the decision as cushioning a weakening labour market.

- SEP shows inflation still above target (3.0–3.1%) and unemployment drifting to 4.5%.

- Acknowledges trade-offs: inflation not at 2% until 2028.

Market reaction: A hawkish cut?

- CME FedWatch: odds of two more cuts this year jumped above 80%.

- Yields moved higher despite cuts → bond market heard a hawkish tone.

- Equities whipped around; small caps outperformed, S&P finished flat.

- Metals sold off on higher real yields.

Gold and metals under pressure

- Initial drop as yields climbed post-meeting.

- Gold bias still bullish long-term, but traders waiting for a pullback.

- Divergence signals suggest dips may be opportunities rather than trend breaks.

Equities: Melt-up risk vs seasonal weakness

- Historically, Fed cuts at all-time highs lead to higher markets one year later.

- Russell 2000 nearly broke out; Dow closed at fresh highs.

- September seasonality and reversal signals argue for short-term consolidation first.

FX crosses in play

- EUR/USD favoured if Fed cuts faster than ECB.

- AUD/USD attractive on dip buys around support.

- Dollar capped under EMA bands keeps majors supported near-term.

What to watch next

Traders will be watching weekly claims and payroll revisions to confirm labour softening, alongside inflation pass-through from tariffs—Powell called it “one-time,” but risks linger. October’s FOMC is next on the calendar, with the Fed’s credibility at stake if inflation stays sticky.

作者:Zorrays Junaid,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()