-

ECB-Fed rate path divergence boosts euro/dollar.

-

Counter risks threaten sustainability of gains.

-

Stronger euro could trigger ECB “contingency cut”.

-

US inflation risks reduce Fed’s easing scope.

-

Euro/dollar rally is losing momentum.

ECB-Fed rate path divergence widens

Following the latest monetary policy decisions of the European Central Bank and the Federal Reserve, the divergence between rate-path expectations for the two Banks has widened further, acting as a supportive force for the euro/dollar currency pair. Will this theme continue to fuel the pair, or are the bulls headed towards a hidden trap?

A thorough examination of each central bank’s policy and the impact on the respective currencies may help clarify the outlook and assess the risks surrounding this pair. So, let’s dive right in.

Fed appears less dovish than expected, but investors don’t buy it

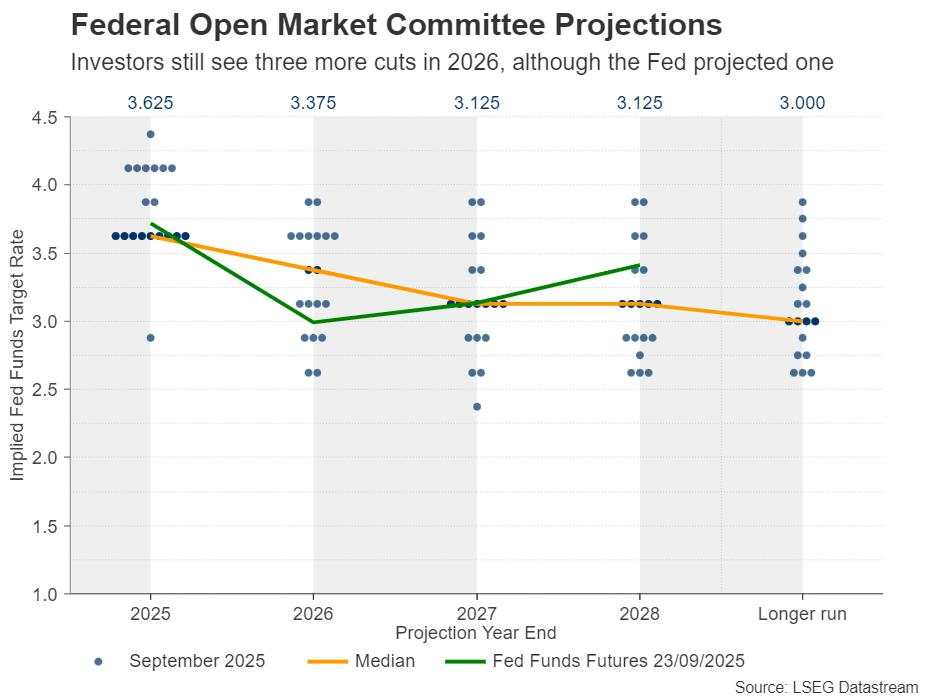

Last week, the Federal Reserve cut interest rates by 25bps as expected and agreed with the market that two more same-size reductions could be warranted by year-end. However, they projected only one more rate cut in 2026, and Fed Chair Powell avoided pre-committing to aggressive reductions, noting that this was a “risk-management cut” and that the Committee is not on a preset path.

Yet, the market remained unconvinced, betting on three more cuts next year. Although the market’s dovish stance could continue weighing on the dollar for some time, upside risks to the implied rate path – and thereby the greenback – appear to be rising.

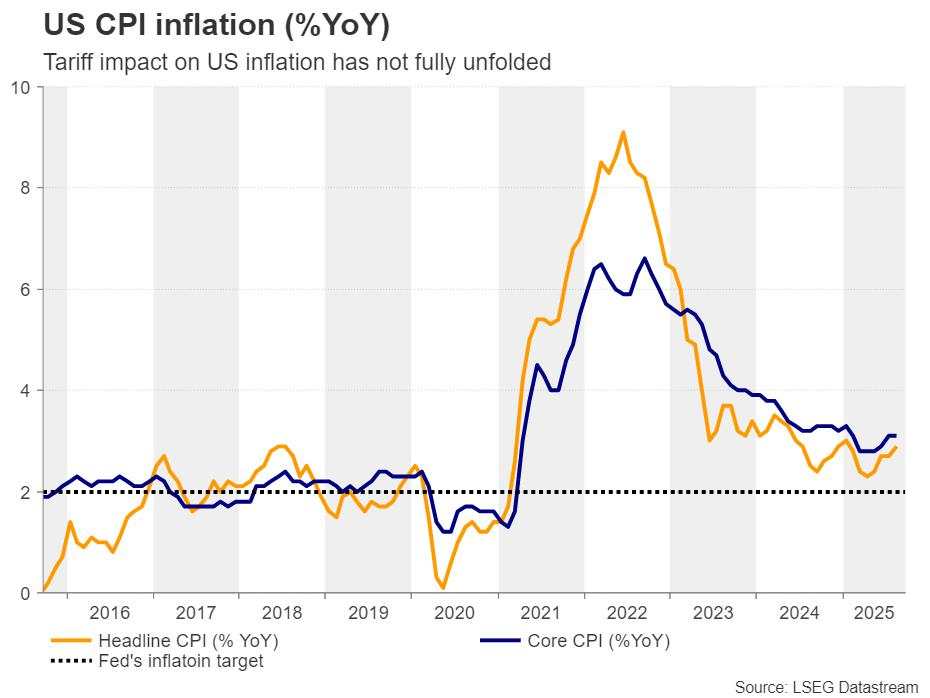

Despite the weakening labor market, the Fed’s own projections showed optimism for the forecast horizon, while economic activity remains solid, with the Atlanta Fed GDPNow model forecasting a 3.3% growth for Q3. Furthermore, although any tariff-induced inflation has not prominently appeared in consumer prices, this may be because companies are absorbing higher import costs to remain competitive.

Inflation risks could lift the US Dollar

But how long will US firms tolerate shrinking profit margins? The Organization for Economic Cooperation and Development (OECD) noted this week that the full impact of tariff hikes is still unfolding, meaning that the upside risks to inflation remain elevated.

Taking all this into account, five additional rate cuts by the end of 2026 may be excessive. If economic data continues to point to a resilient economy, or if inflation risks materialize, the market may need to scale back some of its rate-cut bets, something that could support the US dollar.

Is the ECB done cutting rates?

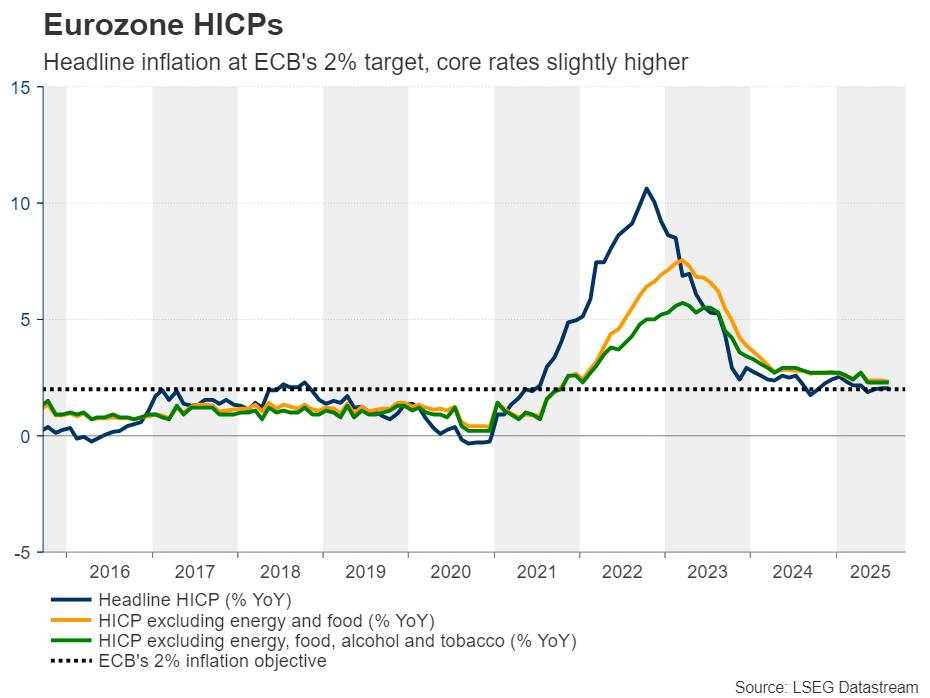

Turning to the Eurozone, the ECB kept interest rates unchanged at its latest meeting, maintaining a positive view on growth and inflation. At the press conference following the decision, President Lagarde noted that the Bank is in a “good place”, with inflation being where they wanted it to be and with global trade uncertainty easing after several nations, including the EU, reached common ground with the US.

Although policymakers saw inflation below their 2.0% objective, Lagarde said that “minimal deviations, if they remain minimal and not long-lasting, will not necessarily justify any particular movement.”

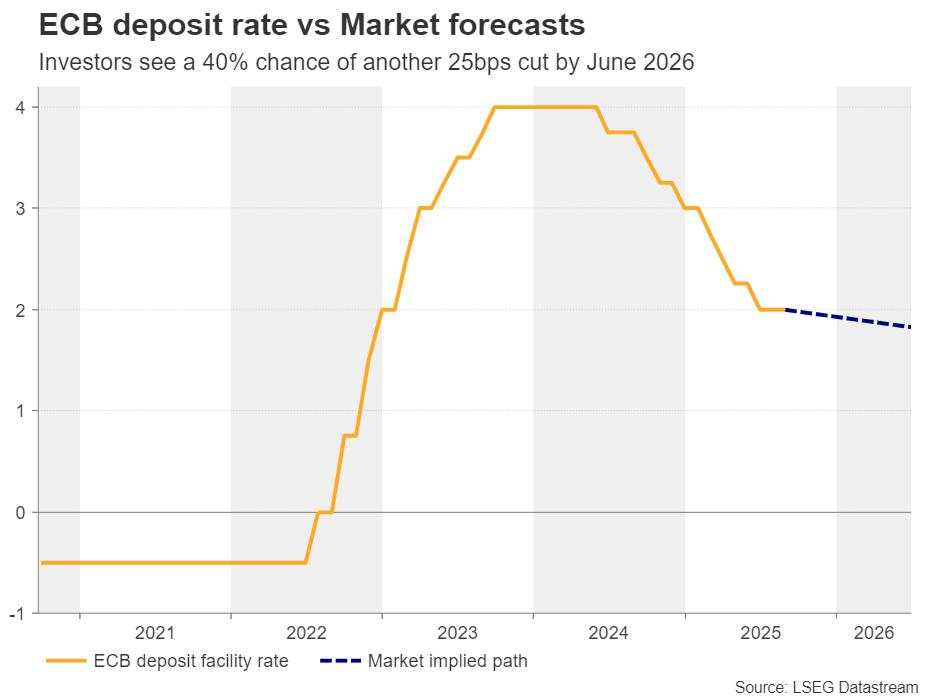

The decision led investors to scale back their rate cut expectations, baking into the cake only a 40% probability of another 25bps rate reduction by June 2026. In other words, most investors believe that the ECB has completed its rate-cut cycle.

This contrasts sharply expectations for the Fed’s future course of action and is likely to continue benefiting the euro against its US counterpart for the time being. However, just as the US dollar faces upside risks, downside risks to the euro may increase.

Stronger euro could prompt “contingency cut”

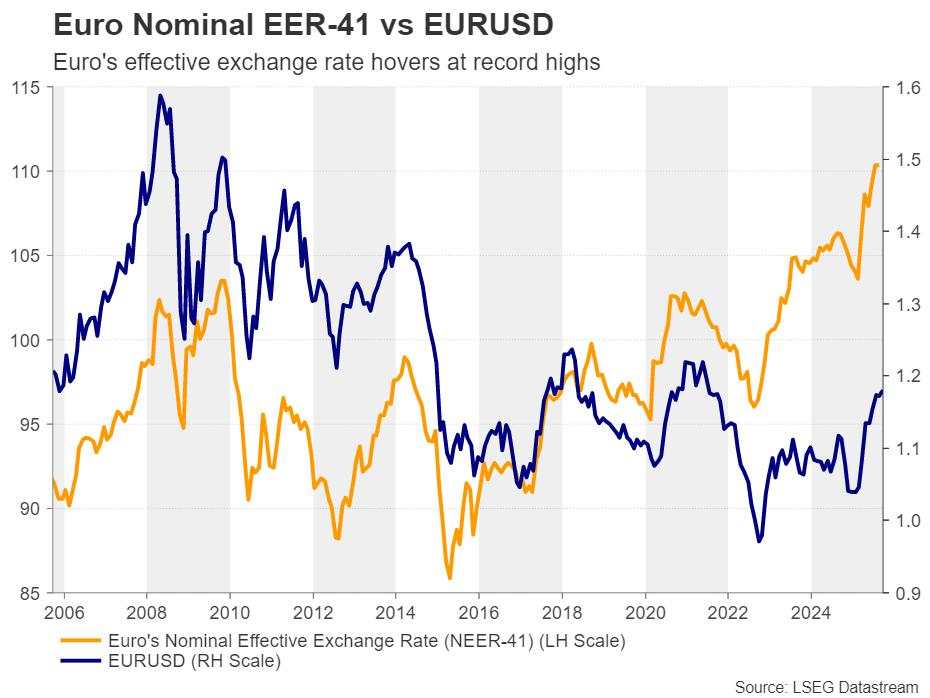

A strong acceleration in the euro could raise disinflationary risks. ECB Vice President de Guindos recently said that they are closely monitoring the euro’s nominal effective exchange rate rather than just its levels against the US dollar. That effective exchange rate, which compares the euro with 41 of Eurozone’s trading partners, is hovering at a record high, up 27% over the past decade. This means that a stronger euro will not only cause inflation to undershoot the ECB’s target but also harm trade and the Euro-area economy.

Given this, a “contingency cut” to protect the economy is not a sci-fi scenario. If ECB policymakers signal concerns, the euro is likely to change course. While some officials have stated that no further rate cuts are needed, others, including Vice-President de Guindos, have kept the door open should conditions deteriorate.

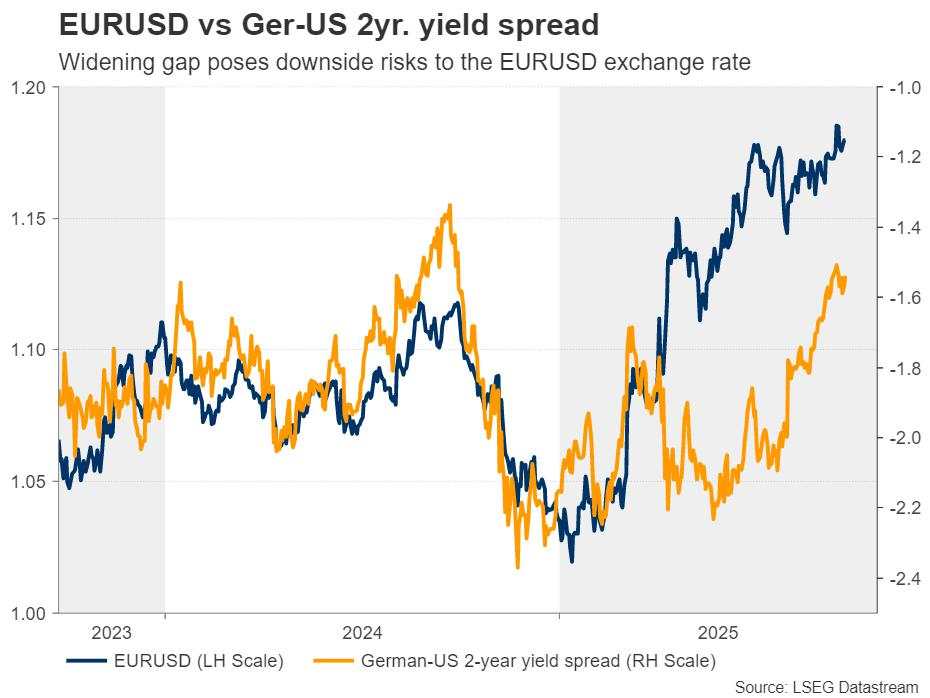

Euro/Dollar diverges from German-US yield spread

Downside risks to the euro/dollar pair are also evident when comparing the FX rate with the yield spread between the German and US short-term bond yields. Yields reflect investor expectations for interest rates, and thus, the widening gap between the pair and the yield spread suggests that euro/dollar may have gone too far.

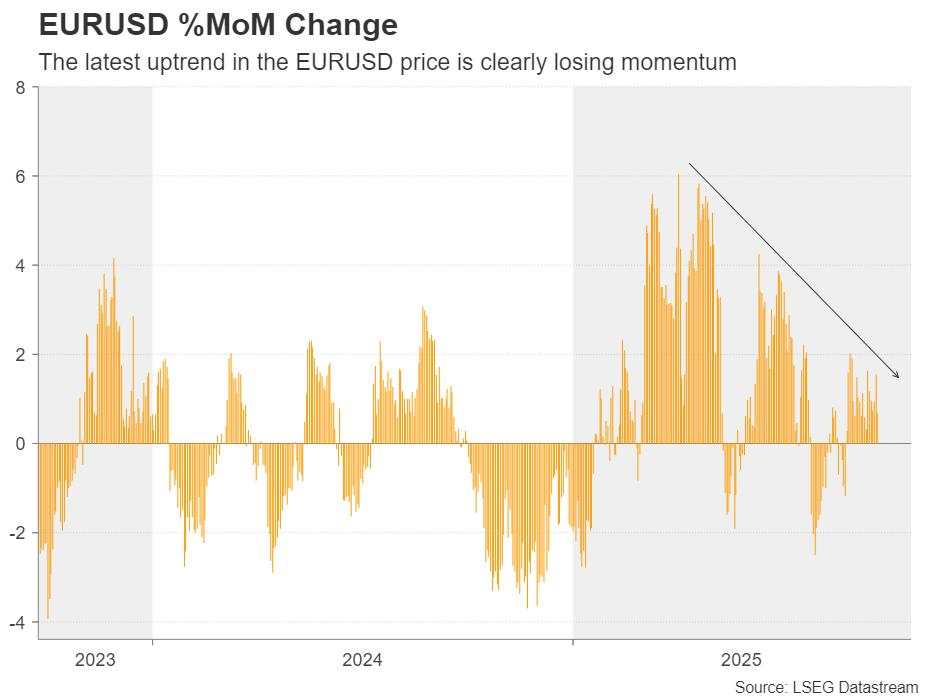

What’s more, the euro/dollar uptrend that began at the start of the year has been losing momentum in recent months.

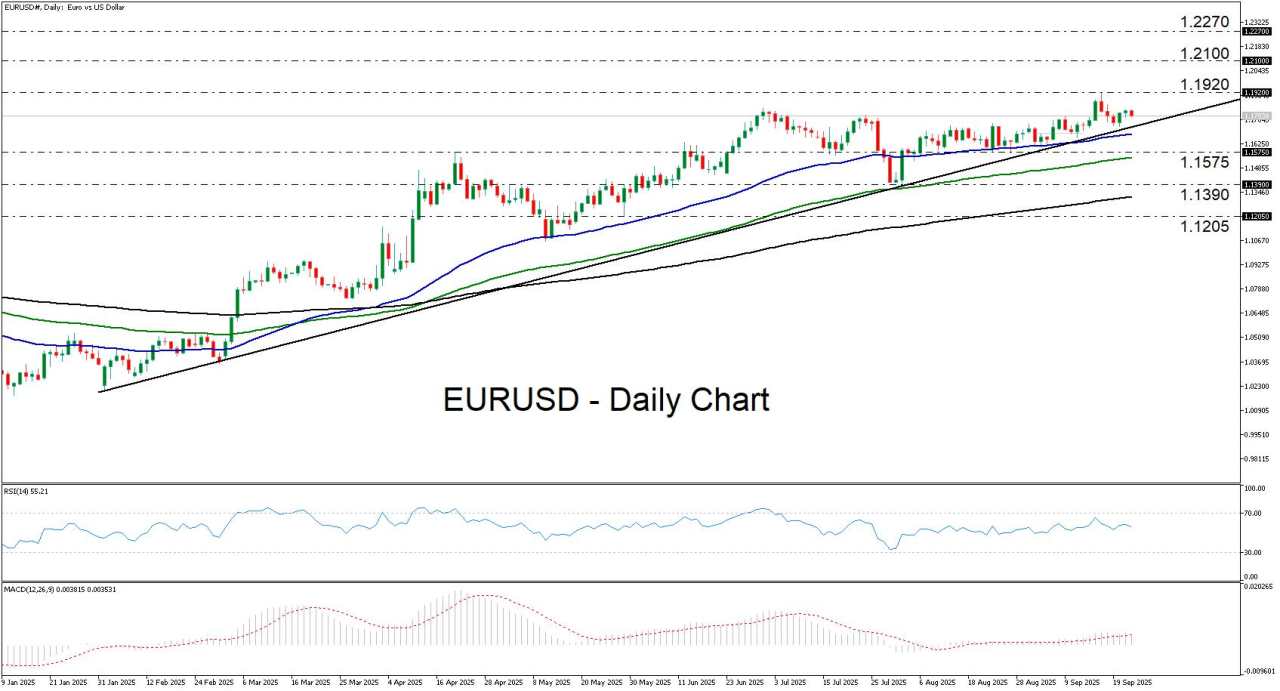

Euro/dollar still in uptrend, but losing momentum

From a purely technical standpoint, the euro/dollar pair remains above the uptrend line drawn from the February 3 low, even though there are clear signs that the uptrend is weakening. The bulls reached a four-year high of 1.1920 on September 17, but they didn’t hold for long and allowed a pullback back below the peak of July 1, hovering near the trendline.

For the uptrend to regain its splendor, a clear break above 1.1920 may be needed. Such a move could pave the way to the 1.2100 zone, and a breach there could allow extensions towards the peak of May 25, 2021, at around 1.2270.

On the downside, a decisive dip below 1.1575 could confirm that downside risks are materializing. The pair would be already well below the uptrend line and the bears may feel confident to target the 1.1390 zone, marked as support by the low of August 1. If they don’t stop there, they may extend their march towards the June 29 low of 1.1205.

作者:Charalampos Pissouros,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()