Outside the box

The RBNZ went way outside the box, choosing Anna Breman, a Swede, to take over as Governor on December 1, 2025. This is reminiscent of Mark Carney’s appointment to the Bank of England and is the first non-Kiwi to run the RBNZ since the first governor of the Bank, Brit Leslie Lefaux

It’s worth noting that 60bps of cuts are priced in for the next two meetings (October 8 and November 26) and then there is a huge gap between get togethers and Breman’s first meeting will not be until February 18, 2026. The entire world could look different by then and thus there are no monetary policy implications here.

The thrust of the appointment is to draw a line under the unfortunate and controversy-plagued Orr era. As is the case with other central banks, Breman promises to refocus the RBNZ on monetary policy, inflation, and employment, and drop the drift towards unrelated issues like Māori equality, climate change, and social well-being. Breman is more of a technical, academic type and will definitely be less fun and offer fewer cartoons than Orr.

Currencies

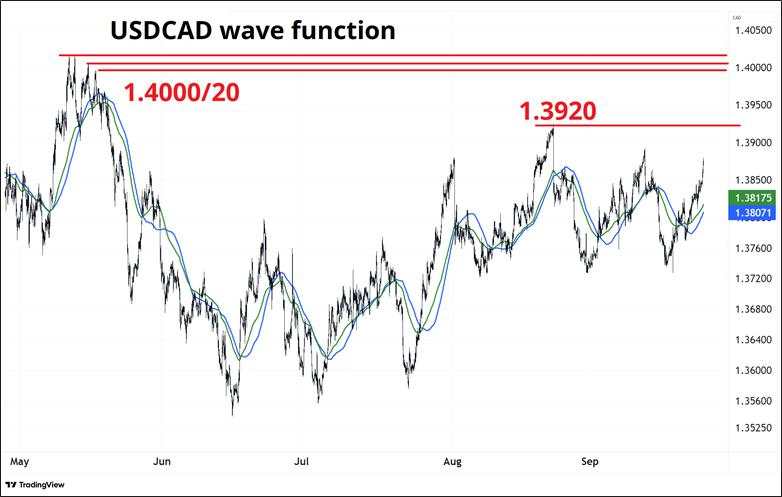

The dollar demand is showing up on schedule as we near the end of the month. Corporates (USD buyers) tend to be time-sensitive and price-insensitive while central banks and hedgers (USD sellers) are currently patient and level-dependent. This has led to a very short-term mismatch of supply and demand. USDCAD is back towards the top of the mind-numbing range that took hold in late July. Chop chop. My dream is that we make a run up through 1.3920 and retest that quadruple top at 1.4000 from early May. This might be a lot to ask from a currency trading on a 4-handle in one-month vol.

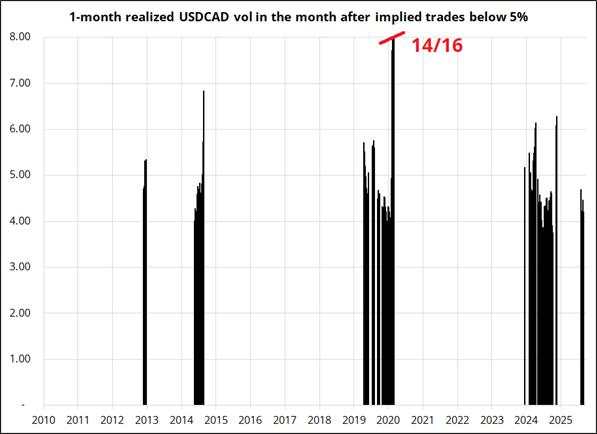

Directional bets can find great leverage in vol environments like this, but there is no promise that low implied vols will actually realize. I took a look at all the times that USDCAD implied vol was trading below 5% and then checked the actual (realized) vol in the month that followed. Output at right.

I chopped the y-axis at 8% to make things easier to see, but note that you could have bought 1-month USDCAD sub-5% in late February 2020, before it realized 14%/16% due to COVID. It’s crazy to think that mid-February 2020 was marked by near-generational lows in FX vol and an Economist cover touting the bull market in stocks. Funny. Amazingly if you look at all the times 1-month USDCAD vol was below 5%, the average is 4.58% and the average realized in the month after that is 4.51%. EMH.

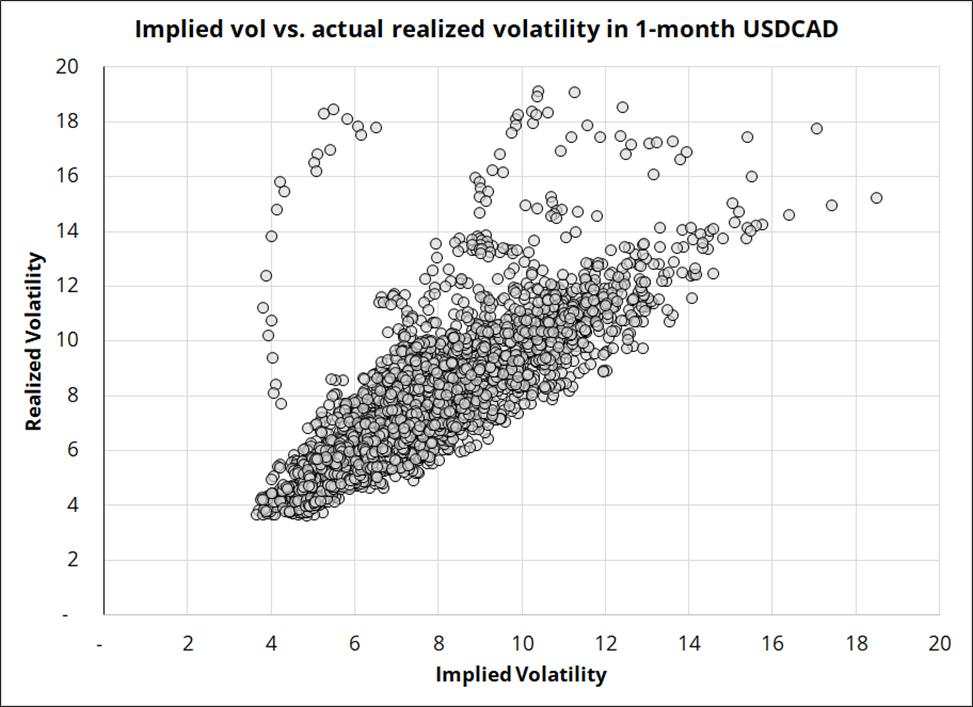

This made me curious about how well implied vol predicts the subsequent 1-month realized vol. Obviously the fit should be pretty good! But how good? Here’s what it looks like, 2010 to now.

The solar flare on the left is COVID. I tried bucketing implied vols to see if there is a sweet spot where you want to buy or sell, but it’s way too sensitive to shocks and regime changes. That is, obviously if you bought USDCAD vol at 4.3 on February 20, 2020, you did well, etc. Vol clusters, until it doesn’t. Buying low vols before a regime change is obviously a good strategy, but you can also use low vols to put on leveraged directional bets and make money even if the vol itself does not perform.

作者:Brent Donnelly,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()