The final quarter of 2025 opens with the U.S. dollar still under pressure. The Fed has already trimmed rates twice this year and is expected to cut again before December is out. On paper, that should be negative for the greenback. But the real story is what these moves signal.

Watch for these signals in Q4:

- If the Fed holds steady, the dollar could rebound.

- If the Fed cuts harder, markets may see trouble brewing and swing risk-off.

- If the Fed sticks to the current pace, majors can grind higher into year-end — though much of that may already be priced.

More importantly, the yen carry trade remains the story to watch. If USD/JPY pushes to ¥150, the BoJ has flagged intervention, and that could be the first screw to unwind.

DXY weekly chart Q4 2025 forecast

Federal Reserve | Current (Sept 2025) | Expected end-Q4 2025 |

Fed Funds Rate | 4.00–4.25% | 3.50–3.75% |

DXY is testing its 200-week EMA again. History shows that when a bullish divergence forms under this line, the index often recovers. That setup is alive now. A rebound would aim for 100 as the psychological line, while failure points to a deeper slide into the 97–98 support zone.

DXY fundamentals are in a weird balance — the dollar still gets that knee-jerk safe-haven pop when equities dump, but the strength is shaky because the yen carry unwind lurks underneath.

If the unwind accelerates, USD weakness vs. the yen drags on DXY (since JPY is part of the basket). Meanwhile, the Fed’s path is crucial: if rate cuts are slower or more limited than markets hope (because they fear capital flows reversal), DXY could hold up better than expected. But if growth in the U.S. cracks or external flows reverse aggressively, DXY is vulnerable to a slide.

USD/JPY weekly chart Q4 2025 forecast

Fed vs BoJ | Current | Expected end-Q4 2025 |

Federal Reserve | 4.00–4.25% | 3.50–3.75% |

Bank of Japan | 0.50% | 0.75% |

The pair has been grinding higher inside its 2025 channel but capped by a descending trendline from 2024. Bulls are pushing, but momentum isn’t decisive.

- ¥150 is the intervention line; Tokyo has made that clear.

- If DXY firms, ¥155 is the next ceiling.

- On the downside, ¥140 is firm weekly support.

For USD/JPY, the picture is way more direct: higher Japanese yields and rising hedging costs force traders to repatriate, meaning they buy back yen and sell dollars.

BoJ is slowly but surely moving away from negative rates, while Fed cuts are on the table — that’s a narrowing yield gap. If US equities wobble into year-end and Japanese yields creep up, the carry unwind setup is live: first you’d see DXY hold up on safe-haven demand, then USD/JPY may decline once repatriation flows kick in.

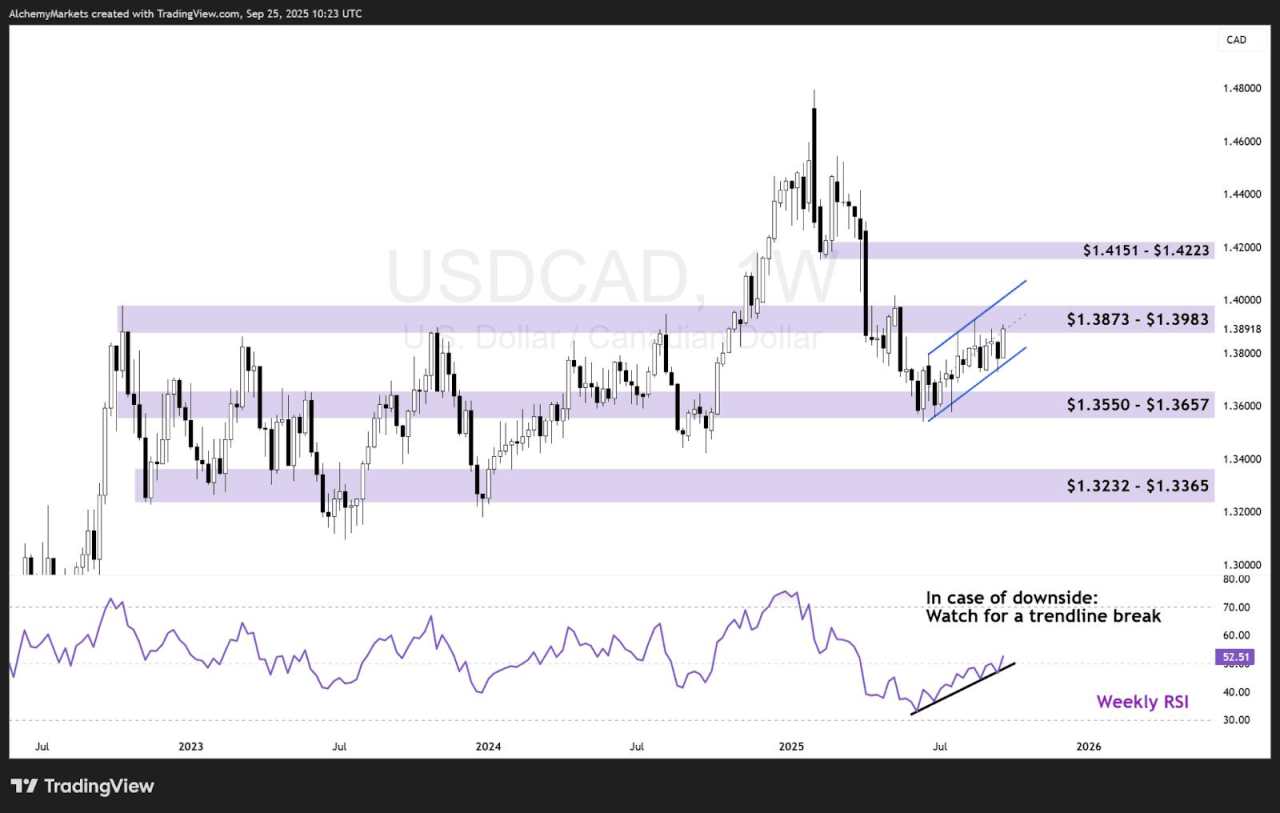

USD/CAD weekly chart Q4 2025 forecast

Fed vs BoC | Current | Expected end-Q4 2025 |

Federal Reserve | 4.00–4.25% | 3.50–3.75% |

Bank of Canada | 2.50% | 2.25–2.50% |

The loonie has pulled the pair back into its 2022–2024 range. The mid-zone around C$1.355 is the pivot. Price is pressing the top of the channel, rejection leans bearish, while a breakout would aim for C$1.415.

On the weekly timeframe, the RSI is also grinding up on an ascending trendline — a clear break below would signal weakness for the greenback versus the CAD.

USD/CAD fundamentals in Q4 come down to policy and oil. The Fed is set to cut rates again, which lowers dollar appeal. The Bank of Canada is easing less, so the gap between the two is not moving strongly in the USD’s favour. Oil adds another layer: if risk-off hits and crude slides, USD/CAD can spike higher. But if energy holds steady or rebounds, the loonie gets support and the pair tilts lower.

EUR/USD weekly chart Q4 2025 forecast

Fed vs ECB | Current | Expected end-Q4 2025 |

Federal Reserve | 4.00–4.25% | 3.50–3.75% |

ECB Deposit Rate | 2.00% | 2.00% |

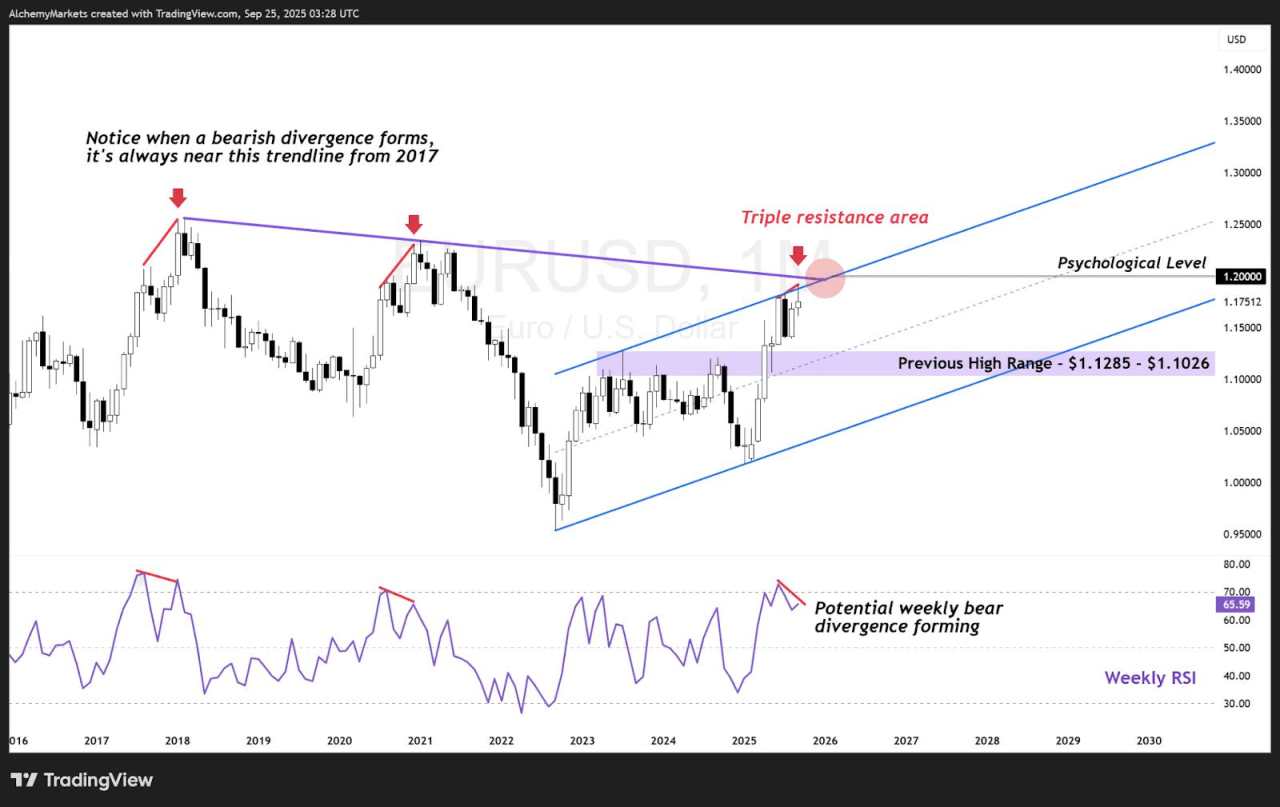

The euro is pressing into a heavy cluster of resistance: the $1.20 handle, a long-term trendline from 2017, and the top of the 2022 channel, with a bearish RSI divergence adding to the pressure. That makes this area a tough ceiling.

EUR/USD in Q4 hinges on the Fed’s cuts versus Europe’s weak growth. With the Fed easing toward 3.50–3.75% and the ECB holding at 2.00%, the policy gap narrows in the euro’s favour.

Still, $1.20 is a heavy ceiling with an eight-year trendline, the 2022 channel top, and bearish RSI all in play. Resistances like this require a catalyst for a breakout; like a USD/JPY unwind hitting the dollar. Otherwise, soft euro data or risk-off could keep the pair stuck below resistance.

GBP/USD weekly chart Q4 2025 forecast

Fed vs BoE | Current | Expected end-Q4 2025 |

Federal Reserve | 4.00–4.25% | 3.50–3.75% |

Bank of England | 4.00% | 4.00% |

Sterling is drawing a similar pattern to the Euro. It’s been climbing inside its broad channel since 2022 and currently under a 8 year trendline.

The $1.40 zone lines up with a fib extension and the trendline since 2017, making it a natural resistance zone. The channel, while not obvious, is valid due to its midline acting as support all year.

On the fundamentals, Q4 is a story of the Fed cutting rates toward 3.50–3.75% while the Bank of England holds steady at 4.00%. That narrows the policy gap against the dollar and gives sterling some tailwind. Still, the effect may be limited if growth data in the UK continues to underwhelm.

For a clean break above $1.40, cable would likely need an added driver such as broad dollar weakness from a USD/JPY unwind. Without that, softer UK data or risk-off sentiment could stall the move and keep GBP/USD capped under long-term resistance.

AUD/USD weekly chart Q4 2025 forecast

Fed vs RBA | Current | Expected end-Q4 2025 |

Federal Reserve | 4.00–4.25% | 3.50–3.75% |

RBA Cash Rate | 3.60% | 3.35% or hold at 3.60% |

The Aussie tapped a multi-year trendline from 2021 and remains inside its channel. A breakdown targets $0.6338, while a grind higher puts $0.68 back in play; a clear “risk-on” signal if reached.

The RBA is expected to hold at 3.60% or trim slightly to 3.35%. That shift narrows the rate gap against the dollar, which lends some support to the Aussie. Still, much of this policy path is likely anticipated, so the pair’s direction will lean heavily on how global risk appetite plays out.

If equities and commodities remain steady, AUD has room to grind higher toward $0.68, signalling risk-on momentum. But if growth jitters flare and markets swing risk-off, the Aussie could falter back toward its ascending trendline support, or horizontal support at $0.6338 waiting to be tested.

NZD/USD weekly chart Q4 2025 forecast

Fed vs RBNZ | Current | Expected end-Q4 2025 |

Federal Reserve | 4.00–4.25% | 3.50–3.75% |

RBNZ OCR | 3.00% | 2.50% |

Unlike the other FX majors on this list, the Kiwi sits in a bull flag and has slowly consolidated to the downside. Currently, it sits right on support with bullish divergence on weekly RSI. If it holds, $0.6062 and $0.6277 are the upside levels. A break lower would target the base of the formation.

NZD/USD in Q4 trades on Fed easing versus the RBNZ’s dovish tilt. Both central banks are expected to cut by 50bps by year-end, but with the dollar carrying more weight across FX, the Kiwi is more likely to be the benefactor.

If risk appetite holds and the dollar softens broadly, NZD/USD has room to rebound toward $0.6062 and $0.6277 (top of its triangle formation). But if global conditions sour and risk-off takes hold, the Kiwi could break lower instead, testing the base of its broader triangle structure.

USD/CHF weekly chart Q4 2025 forecast

Fed vs SNB | Current | Expected end-Q4 2025 |

Federal Reserve | 4.00–4.25% | 3.50–3.75% |

Swiss National Bank | 1.25% | 1.25% |

USD/CHF has been range bound since 2011 and is now testing the lower end near 0.7722–0.7908 CHF, backed by the 78.6% retracement. An anchored volume profile shows a thin profile just right under, making this the last bastion of support for USD/CHF.

However, the asset has technically reached its range lows, and has a monthly bullish RSI divergence backing its potential reversal. This could mean USD-Franc sees $0.8359 in Q4, as long as 0.77 holds.

Unlike EUR/USD and GBP/USD, the yen carry isn’t the main driver here yet, since USD/JPY has not reached the ¥150 intervention zone and DXY itself is flashing a potential reversal setup. That gives USD/CHF more scope to respond to its own technical base, with a rebound plausible if dollar stabilises.

Final word

The dollar’s weakness is real, but the easy trade may already be behind us.

- If the Fed pauses, the dollar squeezes higher.

- If the Fed cuts harder, risk-off flows follow.

- If the Fed sticks to the current path, majors like EUR, GBP, and AUD can continue to edge higher.

Q4 is less about the rate move itself, and more about the markets looking to react to the news. Will they sell the rumor, then buy the news later? It’s certainly looking like a possibility.

With EUR/USD and GBP/USD stuck at 8-Year resistances, it’s prudent to only expect a breakout when we have a large catalyst to drive prices higher.

作者:Zorrays Junaid,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()