- USD/JPY retreats as yield spreads narrow, tilting flows back toward the yen.

- Shifts in policy tone fuel selling pressure, with upside attempts capped at 148.50.

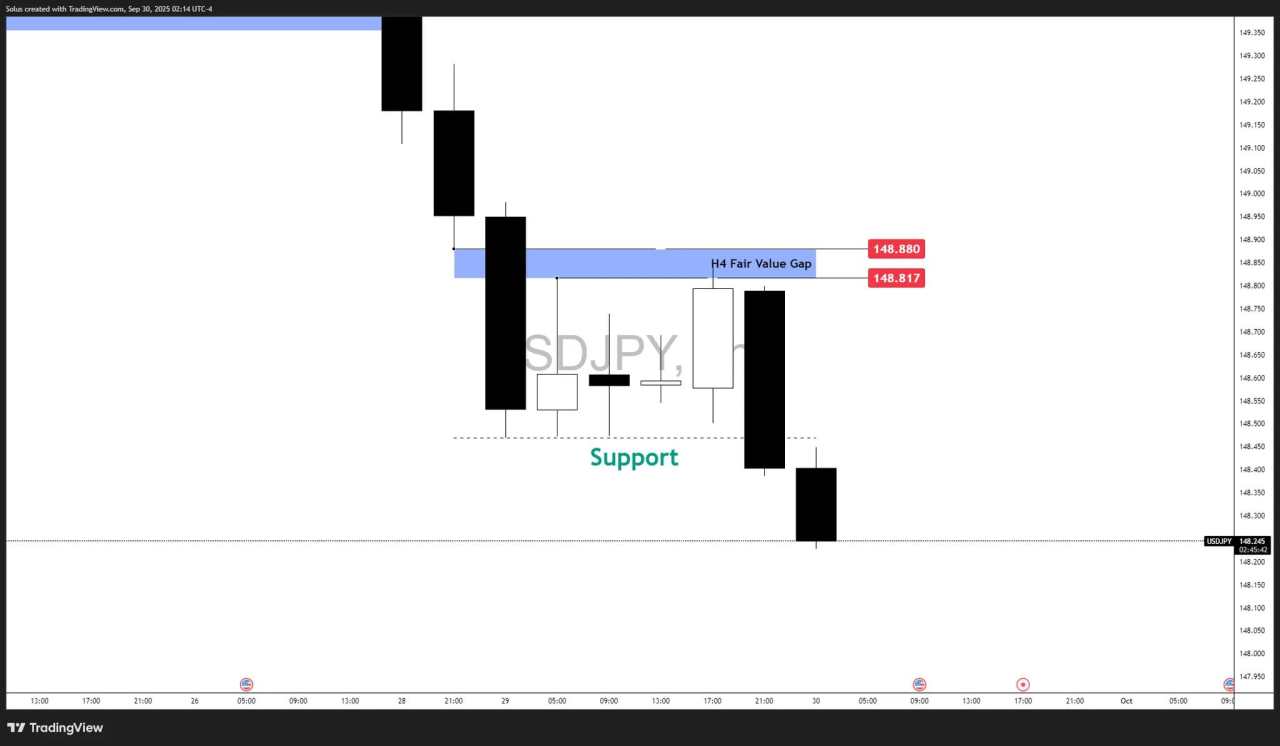

- Support at 148.20 gives way, confirming a breakdown toward deeper liquidity.

USD/JPY breakdown: From resistance to reversal

USD/JPY has shifted tone in recent sessions, with momentum flipping from attempted breakouts to downside continuation. The dollar’s strength stalled just as the yen found renewed demand, resulting in a sharp pullback.

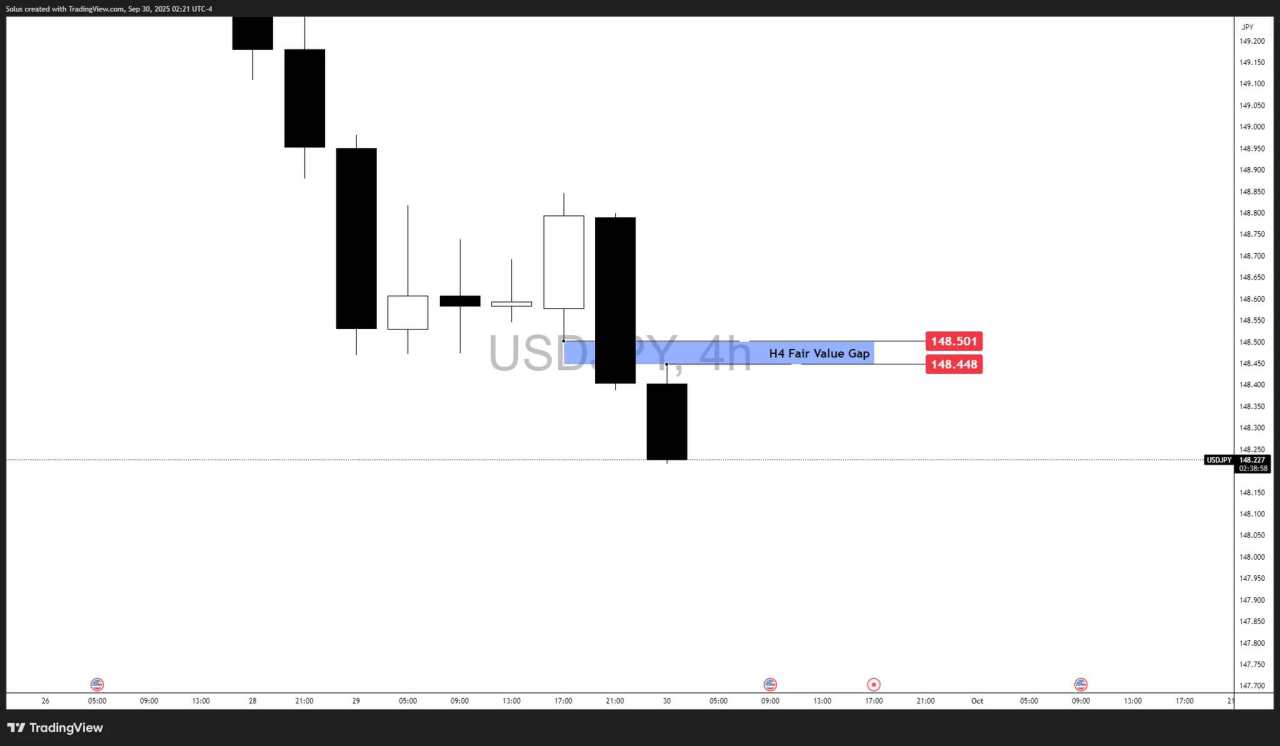

The turning point came at the 148.448–148.501 H4 Fair Value Gap (FVG), where price was rejected on retests of higher ground. This imbalance acted as resistance, fueling supply-driven momentum and accelerating the decline. Now trading below 148.20, the pair has confirmed a support break, leaving sellers firmly in control in the short term.

BoJ stance adds weight to the Yen

The Bank of Japan’s evolving stance has provided a supportive backdrop for yen appreciation. While the central bank has kept its benchmark rate at 0.50%, policymakers are no longer purely dovish:

- Internal dissent on the BOJ board has already raised the possibility of lifting rates to 0.75% in the near term.

- The BOJ has begun reducing its massive ETF and J-REIT holdings — a clear step away from years of aggressive stimulus.

- Policymakers such as Noguchi now stress that the “need for rate hikes is rising more than ever,” underscoring a cautious hawkish tilt.

This shift contrasts with the Fed’s cautious easing path and has amplified yen strength, making the recent USD/JPY breakdown more pronounced.

Why USD/JPY now faces headwinds

The current decline reflects a combination of structural and technical pressures:

- Yield spreads have narrowed, softening dollar advantage.

- Rejection at the 148.448–148.501 FVG highlighted supply dominance.

- Support at 148.20 failed, leaving price exposed to deeper downside liquidity.

This does not necessarily mark a full reversal of the long-term trend, but it highlights how corrective legs can extend when key supply zones hold.

Technical outlook: USD/JPY

USD/JPY continues to consolidate beneath 148.30, with the 148.448–148.501 FVG now the critical pivot zone. How price reacts to this imbalance will dictate the next leg.

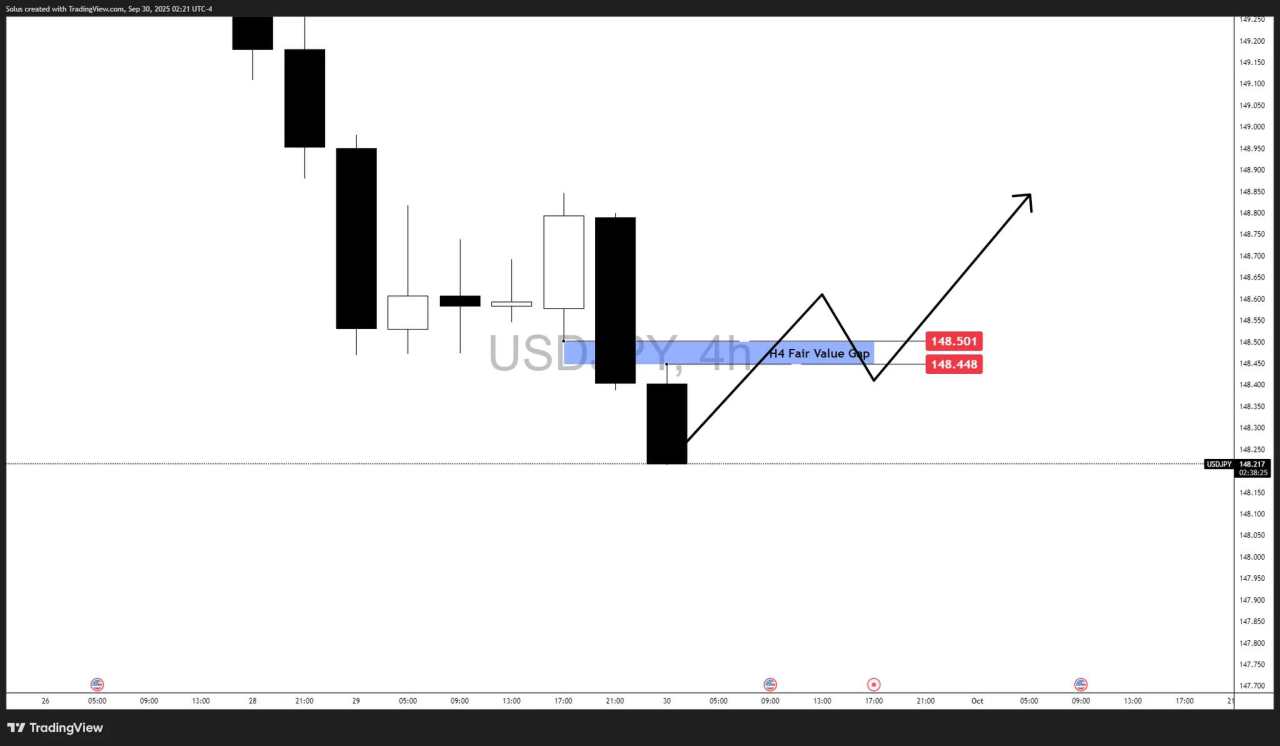

Bullish scenario: Reclaim of FVG aone

If buyers reclaim the 148.448–148.501 imbalance, it would signal absorption of supply and a potential shift in momentum. A clean close above flips the FVG into demand.

- Upside targets: 148.70–148.90, with scope to retest 149.20–149.50.

- Confirmation requires higher-timeframe closes holding above 148.50.

- This recovery setup suggests base-building for a rebound after the breakdown.

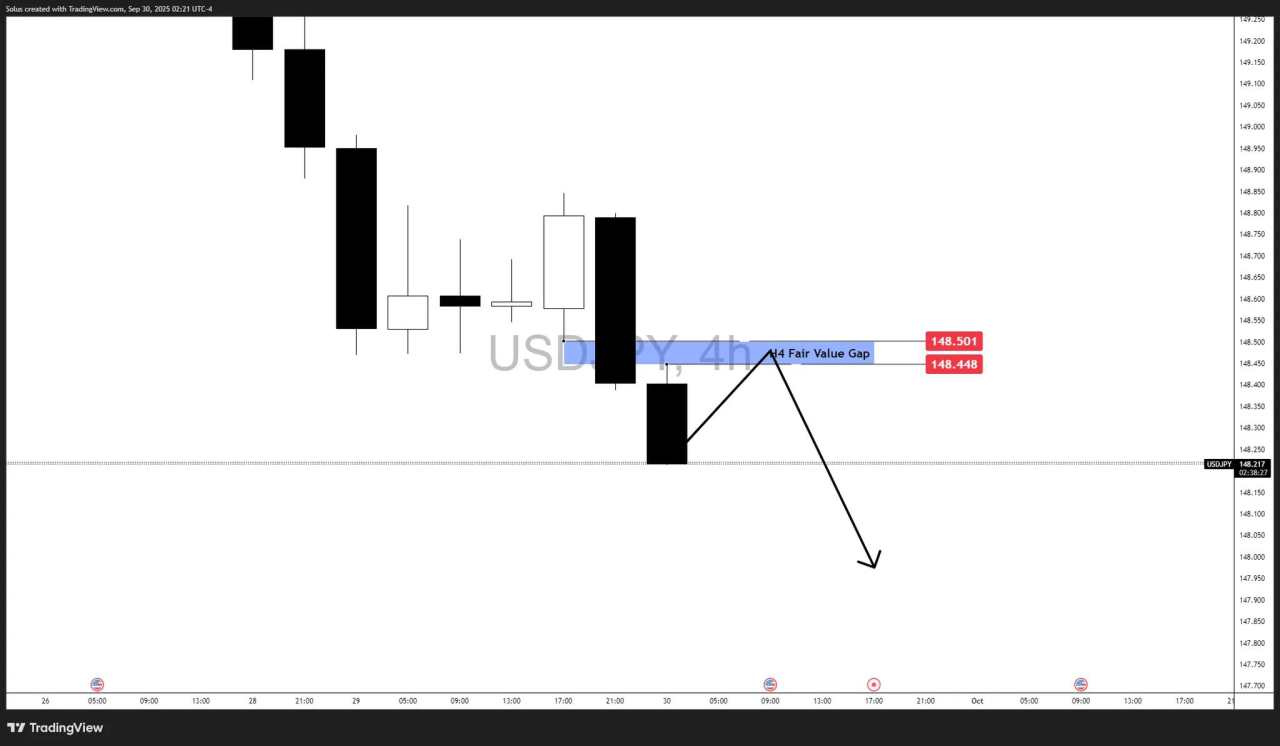

Bearish scenario: Rejection at FVG, continuation lower

If price retests the 148.448–148.501 H4 FVG and sellers defend it, the imbalance acts as supply. This rejection would confirm continuation of the bearish sequence.

- Downside targets: 148.00, followed by deeper liquidity at 147.70–147.50.

- As long as price is capped beneath the FVG, momentum remains bearish.

- Rallies are likely to be corrective within a broader downside leg.

Conclusion

USD/JPY has lost traction as the dollar weakens against the yen, with the 148.448–148.501 H4 FVG acting as a decisive resistance zone. The breakdown below 148.20 confirms sellers’ grip, with focus shifting toward 147.50 if supply holds. Only a reclaim of the imbalance can neutralize the bearish outlook and open recovery back toward 149.00+.

作者:Jasper Osita,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()