Gold (XAUUSD) has retreated from recent peaks, yet strong safe-haven demand continues to support the outlook. Political risks from a potential U.S. government shutdown, steady inflation data, and expectations for Fed rate cuts remain key drivers. At the same time, markets are now closely watching upcoming Fed remarks and political developments in Washington, both of which could impact the direction of gold. Even with the pullback, the overall trend remains bullish, supported by firm technical foundations that signal lasting strength.

Gold retreats with Fed guidance, inflation and political risks in focus

Gold recently pulled back after reaching record highs above $3,800, yet it remains firmly positioned as the leading safe-haven asset. The earlier surge was fueled by concerns over a looming U.S. government shutdown, which lifted demand for gold and pressured the Dollar. Even with the retreat, fiscal uncertainty and expectations for Fed rate cuts continue to provide strong underlying support for the metal.

Meanwhile, U.S. inflation data aligned with market expectations. Specifically, the PCE Price Index rose 2.7% year-on-year in August, while core PCE increased 2.9%. Both figures matched analyst forecasts, confirming inflation stability and keeping the Fed on track for policy easing. Markets now price in an 88% chance of a rate cut in October and a 65% possibility in December. Lower rates reduce the cost of holding non-yielding assets, such as gold, thereby reinforcing its upward momentum.

Looking ahead, the focus now shifts to upcoming remarks from Federal Reserve officials, including Christopher Waller, Beth Hammack, Alberto Musalem, John Williams, and Raphael Bostic. In particular, their guidance could influence the U.S. Dollar and gold. Hawkish tones are likely to support the dollar, while dovish tones would favour the metal. At the same time, President Donald Trump’s meeting with congressional leaders underscores the urgency of securing a funding deal. If no agreement is reached, parts of the government will close on Wednesday, further fueling demand for gold as a safe haven.

Gold maintains uptrend with recurring consolidation and breakout patterns

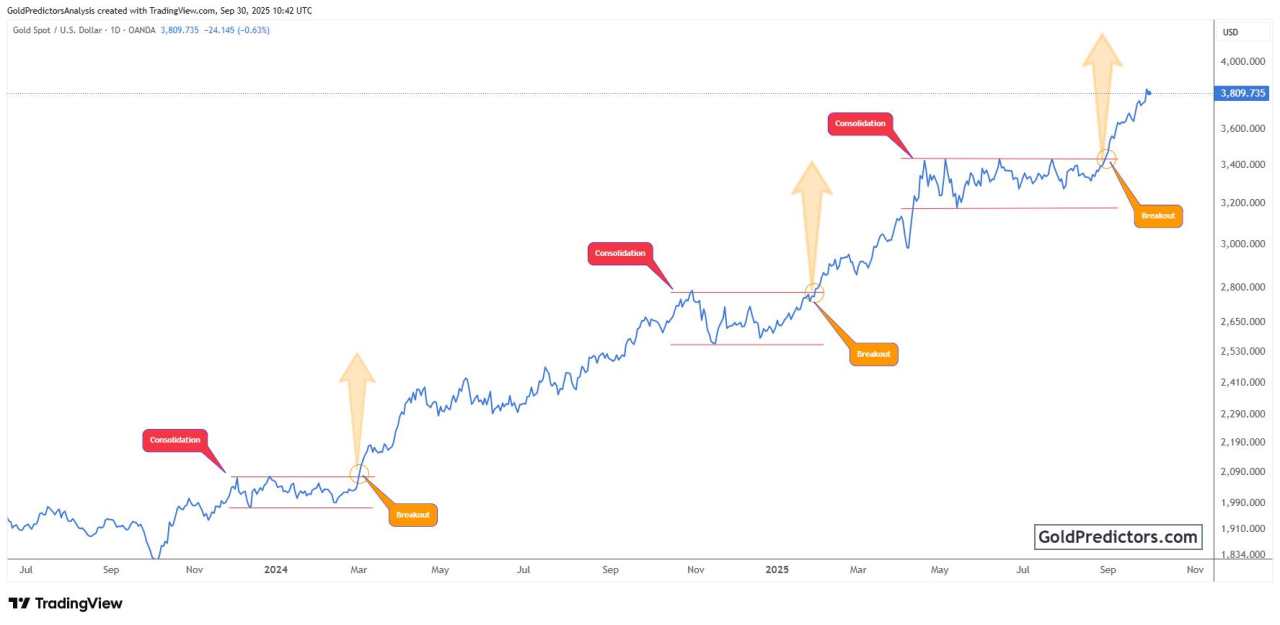

The gold chart below shows a series of consolidation phases followed by decisive breakouts. Each breakout has triggered a strong upward move, establishing higher support levels. Furthermore, the chart highlights three distinct cycles. In each case, price action consolidated within a horizontal band, and once resistance was cleared, momentum surged. Overall, this pattern indicates a steady increase in demand that fuels each breakout.

In early 2024, gold triggered a breakout from a base near $2,050, sparking a sustained rally that drove prices above $2,600. Subsequently, another consolidation zone formed later in 2024 and resolved with a breakout in early 2025, driving gold toward $3,200. Most recently, gold consolidated between $3,000 and $3,400 for several months before breaking resistance and pushing higher. Ultimately, the breakout signalled renewed strength and carried the metal beyond $3,800.

Consequently, this recurring cycle of consolidation and breakout underscores strong bullish momentum. Moreover, buyers consistently step in during pauses, absorbing supply and keeping prices on the rise. The reliability of this pattern strengthens confidence in further upside. Now, after retreating from record levels, market participants will watch whether the move establishes another base or accelerates into a sharper rally. Overall, the broader trend remains upward, with technical momentum indicating continued strength.

Gold outlook: Pullback meets strong support from Fed expectations and political uncertainty

Gold has recently pulled back from record levels above $3,800, yet it remains firmly supported by safe-haven demand. Political risks, stable inflation data, and expectations for Fed rate cuts continue to strengthen its appeal. Technical patterns still indicate sustained momentum, with each breakout establishing stronger support. Market participants are watching whether gold consolidates further or resumes its climb.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

作者:Muhammad Umair, PhD,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()