#XOM

Exxon Mobil Corporation

136.48

1.64

(1.22%)

Prices By FOLLOWME , in USD

数据

LOW

HIGH

134.48

136.65

1 W

+1.00%

1 MO

+13.87%

3 MO

+18.99%

6 MO

+22.23%

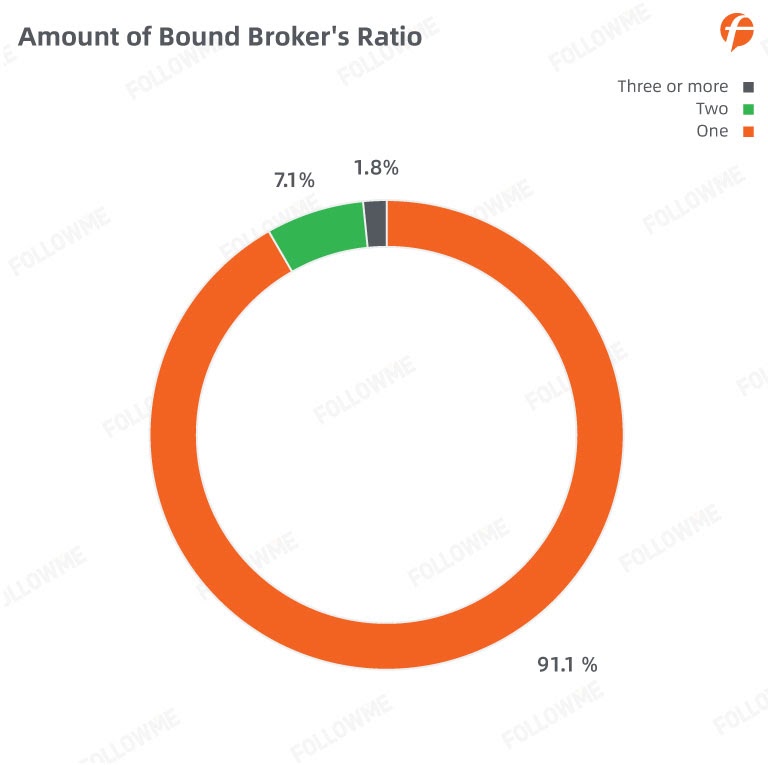

FOLLOWME Community Trading Report the third quarter of 2020

Introduction: Since the beginning of the year, the global outbreak of COVID-19 has prompted countries and major economies around the world to adopt a series of large-scale economic stimuli to ease policies. Central banks, led by the Federal Reserve, have adjusted their monetary policies to inject li

- LittleRabbit :wow very informative! thanks a lot!

- Tony Stark :wow cool😎

- elleefx :Thanks for the info

Stock Markets Dive Further, But Others Steady

#OPINIONLEADER##OPINIONLEADER# Markets are staying in risk aversion today with heavy selling in stocks. Expectations on the negotiation between Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin are low. Meanwhile, other markets are relatively

- AbuSalaam :hi

- 钉子侠 :💪

Here’s the signal for investors from the deep pessimism of Bill Ackman and George Soros

Stocks are bouncing around on the 100th day of trading this year, with the Dow and S&P 500 headed for the worst annual start since 1970 and the Nasdaq its worst ever. This choppy market can’t help itself, because “there are too many unknowns,” Stephanie Link, chief investment strategist and port

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, etc. BUT first, to start off your day with a bang, here's a recap of the important news we think you should r

Crude oil rallies ahead of OPEC+ meeting and inventory data

The Canadian dollar moved sideways after the latest interest rate decision by the Bank of Canada. The bank decided to hike interest rates by 0.50%. Pushing the overnight rate to 1.50%. In addition, Tiff Macklem warned that more rate hikes were necessary to curb the soaring inflation. This was more h

- Mr ROGERS :@Mrjack708

- imeji2 :Trading with an expert is the best strategy for newbies and busy investor send a private message to Magdalena J Gabriel for good tips @Fb📚

Week Ahead – Big Tech Earnings Eyed

#OPINIONLEADER# Writer: Muhammad Laraib Nasir Experienced trader and freelance writer. US Wall Street will pay close attention to the first look at third-quarter GDP. After two consecutive quarters of negative readings, growth is expected to bounce back into expansion territory with a

- Special_Loyalty6000 :Freelancer are needed for the following project.. *Typing *Writing *Translation *logo design Payment: $2000 Kindly inbox me if you'er interested

Mixed earnings, hawkish Fed, growing pressure on Truss and USD/JPY

Equities give back early-week gains on hawkish Fed talk, and mixed earnings. Netflix soared 13% yesterday, but Tesla lost more than 6% after the bell, after announcing a slight revenue miss in Q3. The UK’s political turmoil gets worse by the day, and the dollar-yen tests the 150 level amid mounting

If S&P 500 breaks out over 4550 is it likely to go to the .786 retracement level at 4668

1. A. 3/24 AC – Geo Saturn Contra-Parallel Uranus. Major change in trend Cattle, Coffee, COPPER, & Cotton. B. 3/28 PM – Uranus 60 US Sun. Moderate change in trend US Stocks, T-Bonds, US Dollar. C. 3/29 AC – Jupiter 90 US Mars. Major change in trend US Stocks, T-Bonds, US Dollar. D. 3/31 AC – New

- Fernandez Morgan :Invest $100 and earn $8500 weekly with Henriella Geoffrey fxtrade @Instagrám and recover your funds as well

Fried chicken was cheap comfort food for South Koreans. Now a meal can cost $22

Hong Kong/Seoul (CNN Business)Clark Park, a 35-year-old YouTuber, is one of many people in South Korea fed up with high food prices. That's why he grabbed his camera and joined a huge throng of shoppers clamoring for cheap fried chicken one August morning at Homeplus, a hypermarket chain that had ju

President Biden says America will get inflation under control. But it won't be easy

Minneapolis (CNN Business)President Joe Biden expressed optimism about the direction of the US economy Sunday, saying America will be able to rein in historically high inflation and that he's hoping the Federal Reserve will achieve a "soft landing" by slowing economic growth without going into reces

Oil plunges below $80 to eight-month low as recession fears mount

New York (CNN)Recession fears are slamming the oil market, with crude tumbling on Friday below $80 a barrel for the first time since January. The good news is the selloff should drive prices at the gas pump down, easing crushing inflation that has been harming consumers. The bad news is the sharp dr

UK Court Closes Down Genesis11, Says Online Broker Is Unregulated

At least seven investors lost £263,000.The Official Receiver of the Public Interest Unit has been appointed as the liquidator. The United Kingdom announced on Monday that the High Court of Justice, Business and Property Courts in England and Wales has shut down online broker Scothop Limited, popular

End of day trading review 18 03 2022

#OPINIONLEADER# FMG buy trade FMG long from 18.03 from yesterday out at 18.53 with the high 18.60's not giving in and wanted to wait for the IO open. Although price was starting to roll over and I didn't want to get back into a situation of getting stuck in a deep pull back if strong

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, etc. BUT first, to start off your day with a bang, here's a recap of the important news we think you should r

These Green Cryptocurrencies Should Be On Your Radar In 2022

West Virginia Senator Joe Manchin recently dealt a blow to the Biden administration with regard to its environmental, aka green agenda, when the Senator said he would vote no on the President's $1.9 trillion Build Back Better initiative. The legislation included items that would shift the US from fo

- Fernandez Morgan :I started my investment with $100 and I made $1450 in just 3days of trading with Henriella Geoffrey fxtrade on Instagrám

- Ahmad Mohammad :sᴛᴀʀᴛ ᴇᴀʀɴɪɴɢ ᴍᴀssɪᴠᴇʟʏ ᴡɪᴛʜ ᴛʜᴇ sᴋɪʟʟs ᴀɴᴅ ᴘʀᴏᴘᴇʀ sᴛʀᴀᴛᴇɢɪᴇs ᴛʜᴀᴛ ᴄᴀɴ ʜᴇʟᴘ ʏᴏᴜ ᴀᴄʜɪᴇᴠᴇ sᴜᴄᴄᴇss ᴡɪᴛʜ Mʀs Kᴀᴛᴀʀɪɴᴀ_ᴊ_...

- Brooklyn Lincoln :This woman offers fast reliable/profitableb trading just get in touch with Kathy L Baldwin on ₣₴₵Ɇ฿ØØ₭ and directly on What'spp +17069447542

正在加载中...