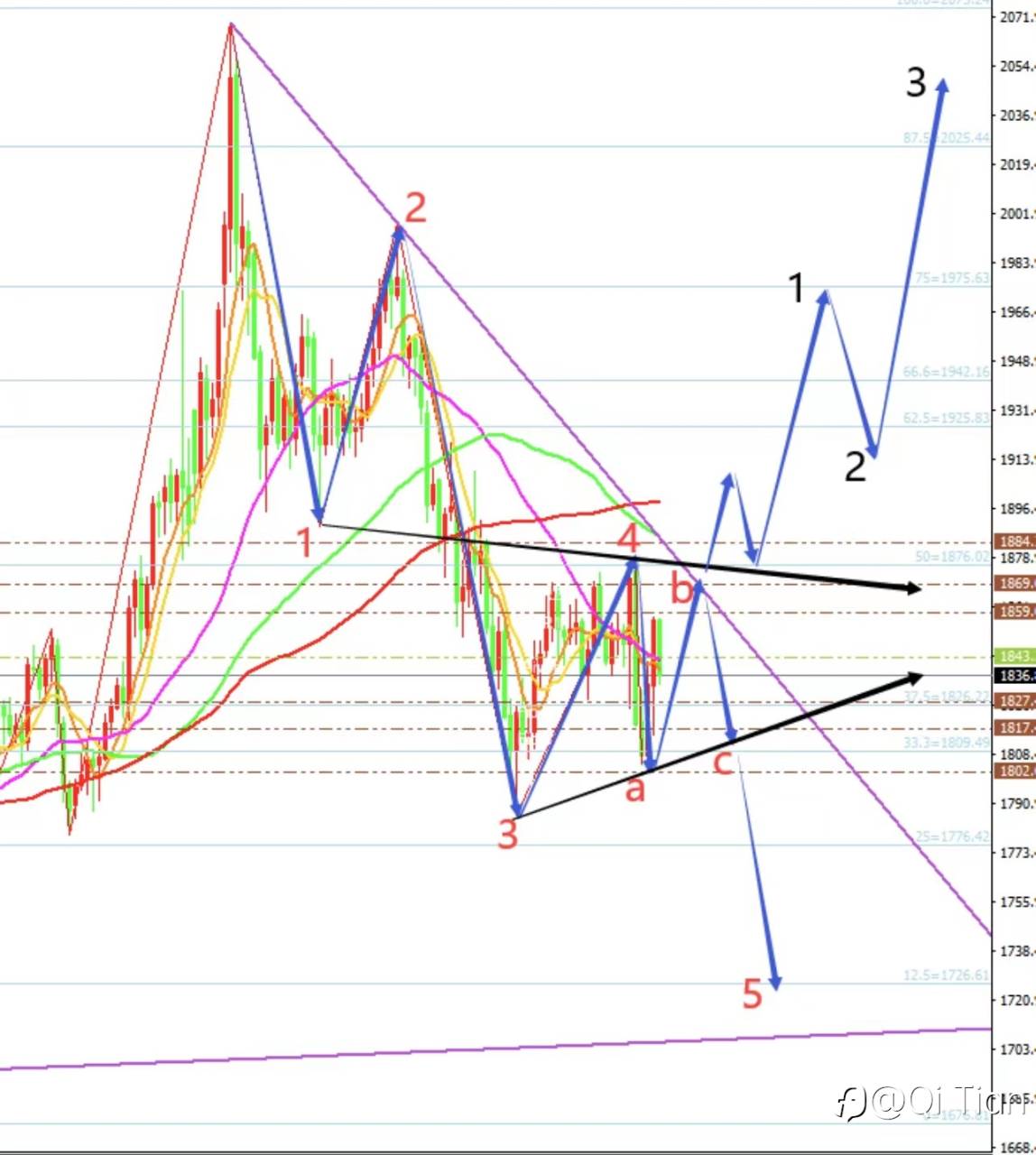

The price of gold showed a call back in pricing, ending with shocks around the 1842/1835 range, and the daily chart closed at positive chart. At present, the daily moving average system MA10/7 is flat, and the RSI indicator is still below the central axis. From the perspective of the daily line, the probability of continuing to fluctuate is high, and there is no clear direction and trend. The short-term four-hour chart and the hourly chart of the moving average re-condensed and glued together, and the RSI indicator returned to the central axis, making it clear that the price was in the upper line of the triangle finishing range to see 1845/48 for suppression, and the lower line of the triangle to see 1828/1825 for support.

Today’s trading protocol is to sell at high and buy at low, but still see wide fluctuations. The upper resistance is 1848/1856/1868/1878, and the lower support is 1832/1828/1820/1808.

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

-THE END-