🌅 Morning Update – 29.09.2025

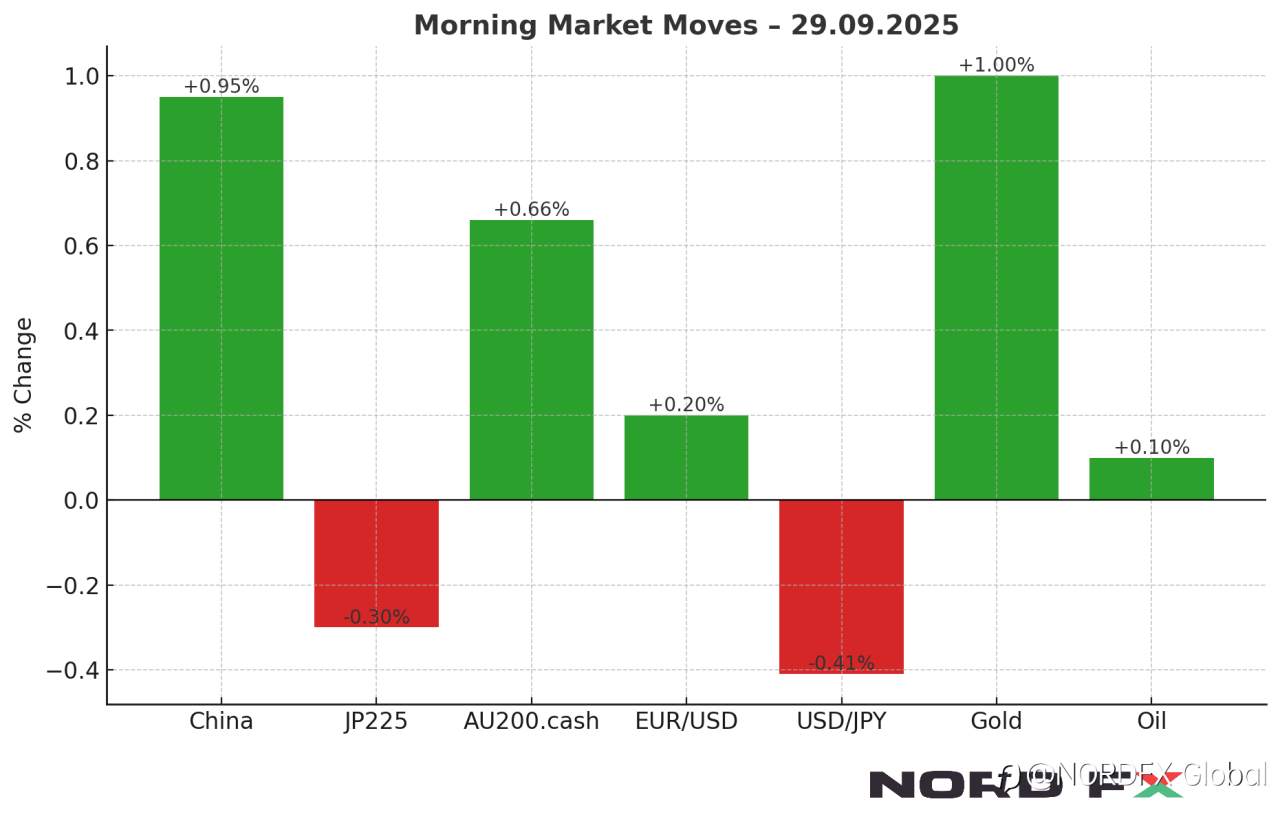

📈 Asia-Pacific markets opened mixed:

🇨🇳 China +0.80–1.10%

🇯🇵 JP225 −0.30%

🇦🇺 AU200.cash +0.66%

💵 Dollar weakness:

USIDX −0.20–0.30%

💶 EUR/USD +0.20%

💴 USD/JPY −0.41%

🥇 Gold surged above $3,800 (+1% daily, +10% monthly), heading for its strongest month since July 2020. Safe-haven demand fuels the rally.

🛢️ Oil dipped at the open but recovered after reports that OPEC+ may raise quotas by ~137 kb/d. Iraq restarted Kirkuk–Ceyhan flows (~180–190 kb/d). Markets stay cautious ahead of the OPEC+ meeting.

🏦 Shutdown risk in the U.S. remains elevated but eased compared to the weekend. BofA sees a 0.1 pp GDP drag per week if it happens.

📉 UBS puts the probability of a U.S. recession in 2025 at 93%, but describes the economy as “weak, not collapsing.”

🚗 Tesla is set to release Q3 sales, with consensus at 448–456k deliveries (vs. 463k last year), boosted by end-of-quarter U.S. tax credits.

🌍 Geopolitics: Xi is said to be pressing Trump on Taiwan in exchange for progress on a trade deal.

⚡ Stay tuned with NordFX for the latest updates and opportunities in global markets!

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()