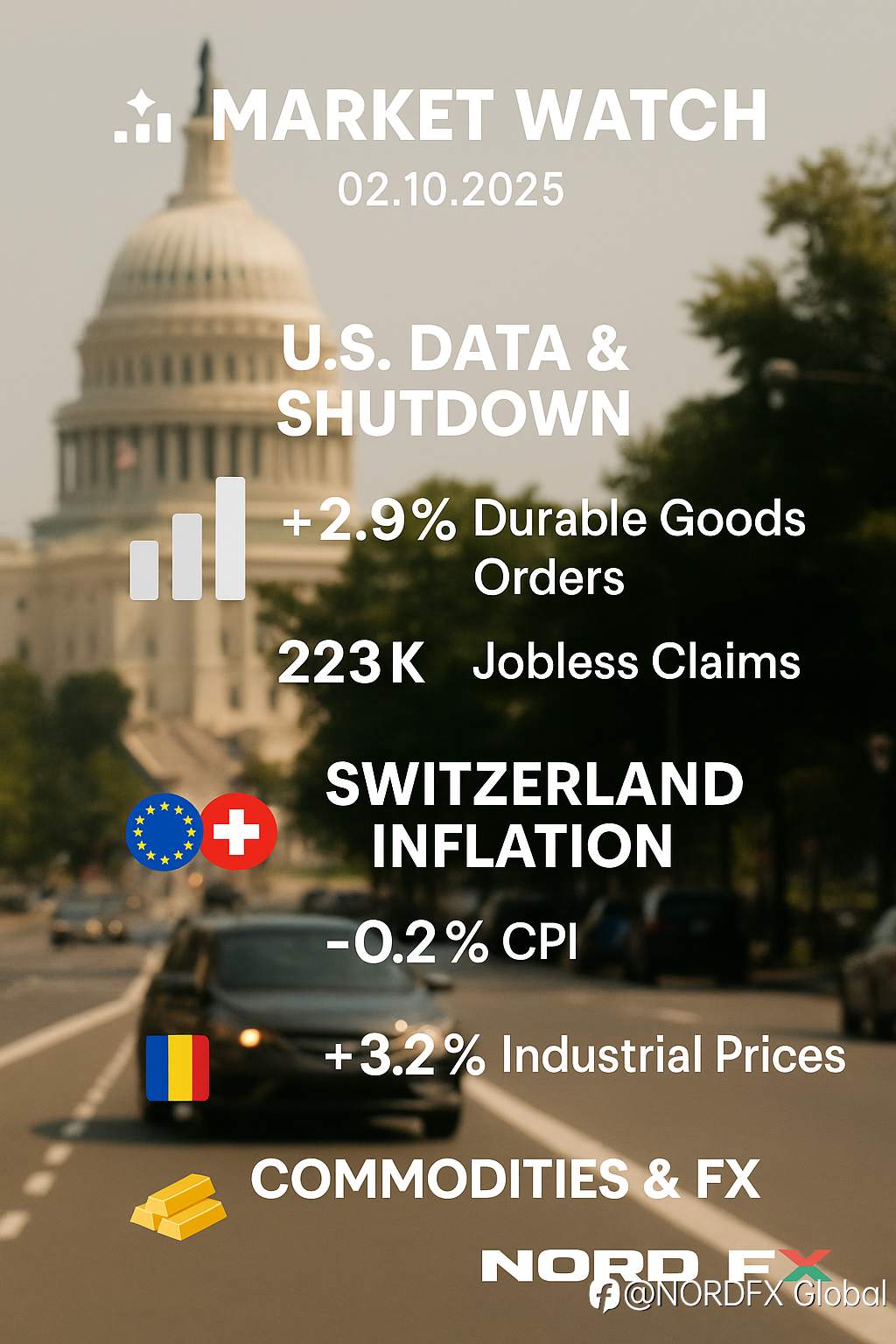

📊✨ Market Watch – 02.10.2025 ✨📊

🇺🇸 U.S. Data & Shutdown

The government shutdown continues, but some key private and pre-released data reached markets:

• Durable Goods Orders (Aug) rebounded +2.9% m/m (vs –2.7% prev.), suggesting resilience.

• Ex-transport orders rose +0.4% m/m (below +1.0% prev.).

• Weekly Jobless Claims climbed to 223K (prev. 218K), pointing to a softer labour trend.

🇨🇭 Switzerland Inflation

CPI came in at –0.2% m/m and 0.2% y/y, undershooting the 0.3% forecast. Weak price growth reinforces a dovish SNB backdrop.

🇷🇴 Romania Prices

Industrial Production Prices rose +3.2% y/y in September (prev. 2.7%), signalling sticky cost pressures.

🥇 Commodities & FX

• Gold stays near record highs as safe-haven demand continues.

• Oil trades choppy ahead of OPEC+ follow-up signals.

• The dollar index is pressured by weaker labour sentiment.

🕒 Key Data & Events (BST)

• 01:00 🇺🇸 Durable Goods Orders (Aug) +2.9% m/m

• 01:00 🇺🇸 Jobless Claims 223K

• 09:30 🇨🇭 CPI (Sept) 0.2% y/y

• 09:00 🇷🇴 Industrial Prices (Sept) 3.2% y/y

💡 Takeaway

Durable goods offered relief, but rising jobless claims keep labour concerns alive. Swiss inflation undershot forecasts, while Romania’s prices surprised to the upside. Traders will stay focused on shutdown developments and central bank rhetoric.

👉 Start trading with NordFX today:

https://account.nordfx.com/acc...

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()