🌅 Morning Market Update | 9 October 2025 ☕

📈 U.S. index futures are trading flat today, while the dollar (USDIDX) slips 0.1%.

🇪🇺 Key events ahead include the ECB minutes (11:30 GMT), Jerome Powell’s speech (12:30 GMT), and U.S. wholesale trade data (16:00 GMT).

🧾 Before Wall Street opens (around 09:00 GMT), PepsiCo will report its Q3 earnings, kicking off the U.S. large-cap earnings season!

📊 The September FOMC minutes revealed a cautiously optimistic Fed: officials revised upward GDP growth forecasts for 2025–2028, signalling confidence that the economy can maintain momentum as monetary policy gradually eases.

💬 Almost all members supported a 25 bp rate cut in September, while a few preferred no change — and one argued for a deeper 50 bp cut. This highlights the Fed’s intent to balance growth support and inflation control.

💡 Inflation vigilance remains key: participants still see persistent price risks, but also growing downside risks to employment. The Fed may rely on tools like the standing repo facility to stabilise markets during quantitative tightening.

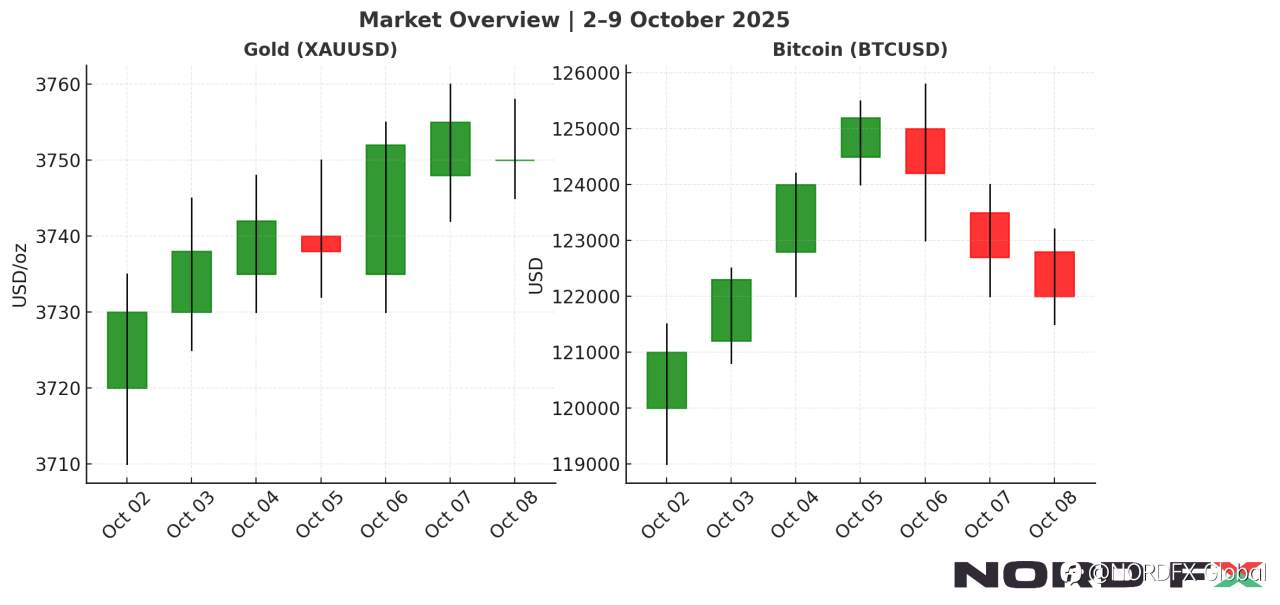

🥇 Precious metals stay near recent highs: gold -0.1%, silver +0.5%.

💻 Crypto faces pressure — Bitcoin hovers near $122,000, down from $125,000, while Ethereum slides nearly 2%.

🔥 Natural gas futures -1% ahead of the EIA storage report (14:30 GMT) — expectations point to a sharp jump from 53 bcf to 77 bcf.

🏛️ Meanwhile, Donald Trump said not all federal employees will receive back pay for the shutdown period, and the IRS confirmed 46% of staff will be furloughed during the closure.

🚀 Stay alert — today’s ECB and Fed remarks could set the tone for global markets!

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()