🌅 Morning Market Update | 13 October 2025 ☕

📈 U.S. index futures are rebounding during the Asian session on hopes of easing tensions between the United States and China. Despite the partial weekend de-escalation, geopolitical uncertainty continues to support safe-haven assets.

🇺🇸 On Monday, October 13, U.S. stock markets will trade as usual, while the bond market will remain closed due to Columbus Day.

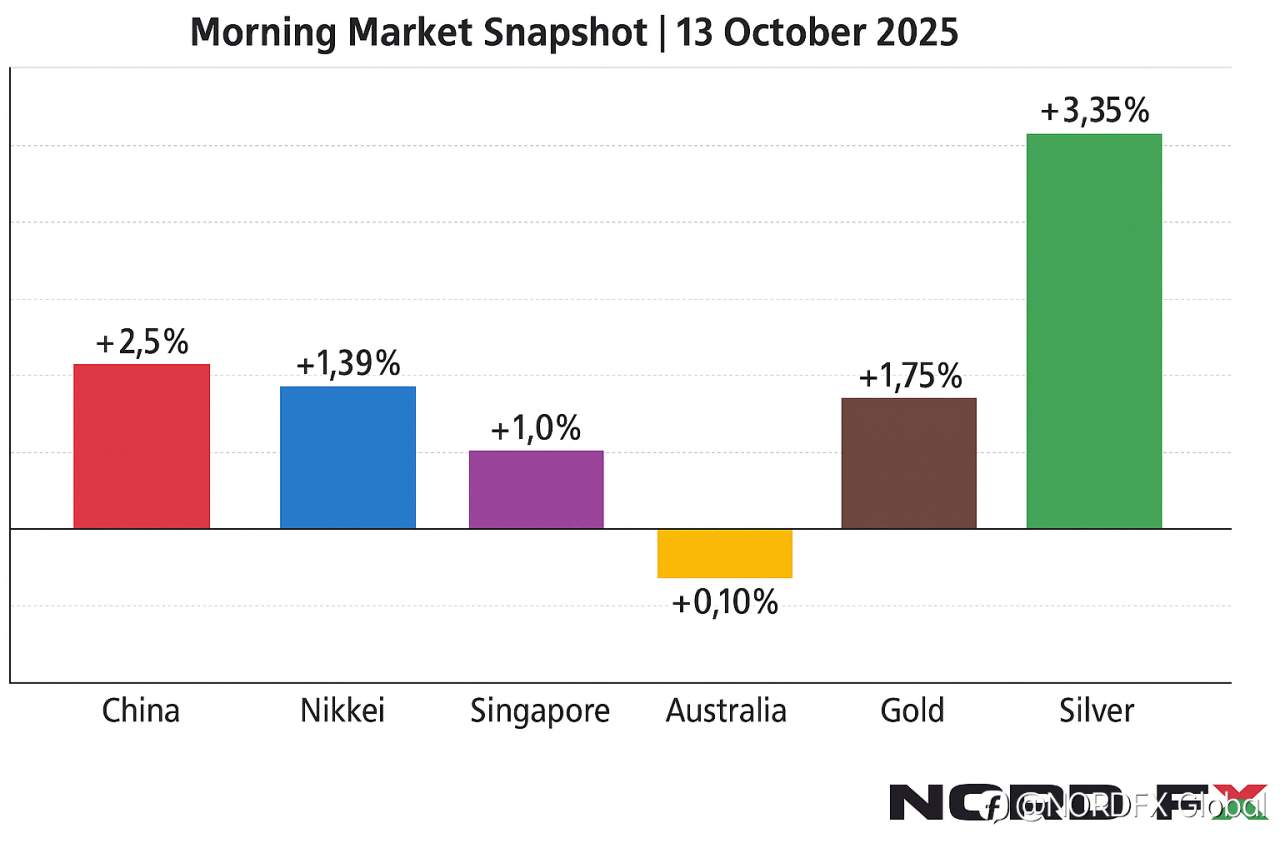

🌏 Asia-Pacific markets are trading firmly higher:

🇨🇳 China +2.5–3.0%

🇯🇵 Japan’s Nikkei +1.39%

🇸🇬 Singapore +1.0%

🇦🇺 Australia +0.10%

🥇 Gold climbs +1.75% to $4,075/oz, while silver surges +3.35% to $51.65/oz.

🗣️ After threatening 100% tariffs on all Chinese imports last Friday, Donald Trump softened his tone over the weekend — part of broader negotiation efforts. According to Goldman Sachs, markets are now expecting a “managed confrontation” rather than a full-scale escalation.

📊 China’s trade data show strength:

• Exports +8.3% YoY (best in 6 months)

• Imports +7.4% YoY (best in 17 months)

• Trade surplus: $90.5B (slightly below forecast)

At the same time, rare-earth exports fell 31% m/m to their lowest since February, while the U.S. plans to buy up to $1 billion of critical minerals to reduce reliance on China.

💡 Markets are waking up in a cautiously optimistic mood — with traders watching whether calm will last through the week.

📊 Stay tuned with NordFX for daily updates and fresh trading insights! 🚀

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()