🌅 Morning Update | 29.10.2025

📈 Wall Street futures extend their rise ahead of key Big Tech earnings (Microsoft, Alphabet, Meta) and the Federal Reserve’s decision, where markets expect a 25 bp rate cut.

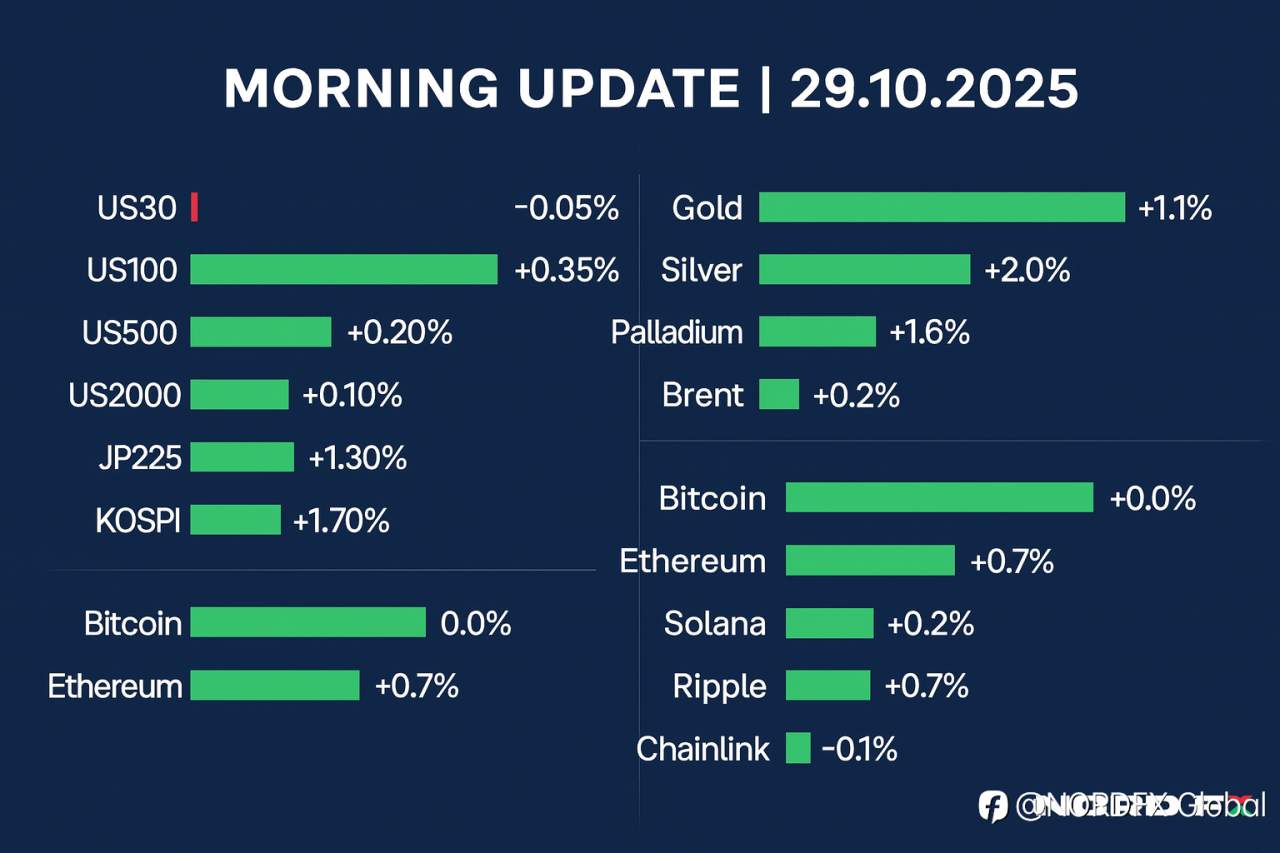

🟢 US100 is up for the sixth day (+0.35%), US500 gains +0.2%, and US2000 adds +0.1%, while US30 and EU50 hover slightly below the line.

💬 U.S. Treasury Secretary S. Bessent said that “leaving room for the Bank of Japan will be key to anchoring inflation expectations,” following PM Takaichi’s calls for closer BOJ–government coordination.

🌏 In Asia, sentiment is mixed. Australia’s AU200 fell nearly 1% after a hotter-than-expected CPI, while Japan (JP225 +1.3%) and Korea (KOSPI +1.7%) rallied on AI-driven tech optimism, supported by record profits from SK Hynix ($7.9 billion operating profit).

🇦🇺 Australia’s inflation surprised to the upside in Q3:

📊 CPI +1.3% q/q (vs 1.1%) and +3.2% y/y (vs 3.0%), led by housing, recreation, and transport.

Electricity prices soared 9% after tariff reviews and delayed rebates.

💵 The AUD strengthens across G10 (AUDUSD +0.4%), while the GBP weakens for a second session (GBPUSD –0.2%) after disappointing retail data. EURUSD trades at 1.163 (–0.2%).

🥇 Gold rebounds +1.1% to $3,980, silver +2% to $47.84, while platinum +1% and palladium +1.6% also edge higher.

🛢 Brent +0.2%, WTI +0.3%, and natural gas +0.6% recover modestly after recent declines.

💹 Crypto market is calm: Bitcoin flat ≈ $ 4,030, Ethereum +0.7%, Solana +0.2%, Ripple +0.7%, Chainlink –0.1%.

✨ Markets await today’s U.S. data and the Fed’s statement — stay tuned with NordFX for instant updates!

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()