📉 Morning Market Update (05.11.2025)

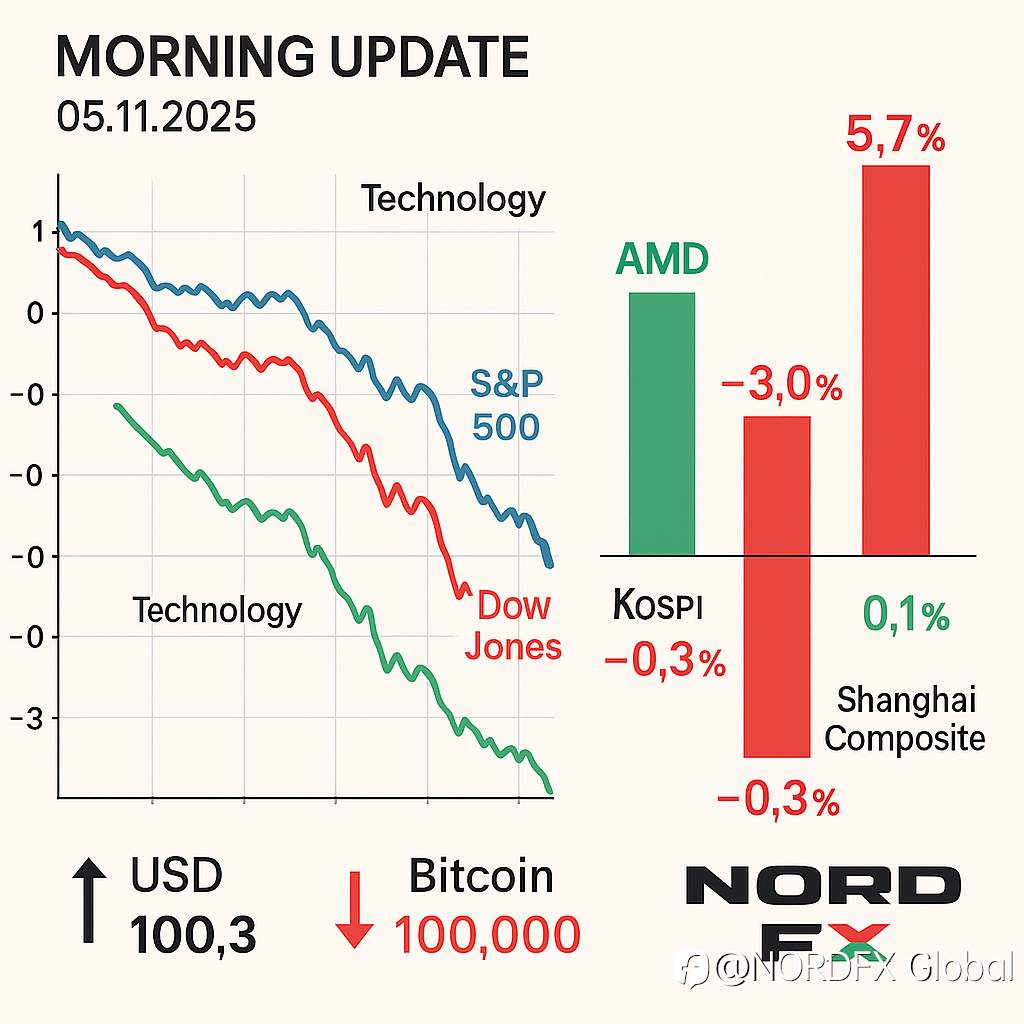

Wall Street closed deep in the red on Tuesday. The NASDAQ tumbled around 2%, the S&P 500 lost 1.17%, and the Dow Jones dropped slightly over 0.5%. Tech and consumer stocks were under the heaviest pressure, with semiconductor giants sliding up to 3.7% amid profit-taking and correction fears after a long rally.

💻 AMD beat expectations in Q3 2025, reporting record revenue of $9.25 bn from its Client and Gaming segments. The company raised Q4 guidance to $9.3–9.9 bn and continues to boost R&D and secure major AI orders, confirming that its growth strategy is paying off despite a mild margin miss.

🌏 Asia-Pacific followed Wall Street lower.

🇯🇵 Japan’s Nikkei 225 plunged 3%, and Topix had its worst day in over six months, led by a 10% fall in SoftBank and sharp selling in chipmakers.

🇰🇷 South Korea’s KOSPI slid 4.8%, with Samsung and SK Hynix triggering a brief futures-trading halt.

🇭🇰 Hong Kong’s Hang Seng lost 0.28%, while 🇨🇳 Shanghai Composite stayed barely positive (+0.05%) after Beijing suspended 24% tariffs on U.S. goods for one year.

🇦🇺 Australia’s ASX 200 slipped 0.24% amid global risk-off sentiment.

⚖️ Chinese Premier Li Qiang warned that protectionism is disrupting global trade, calling for cooperation. The services PMI fell to 52.6, the lowest in three months, while the PBOC set a stronger-than-expected yuan fix at 7.0901 per USD.

💵 The U.S. dollar index (DXY) broke above 100.00, reaching 100.26 – its highest since August – gaining 4.2% since mid-September. The greenback strengthened against most majors, including +1% vs NZD and +0.9% vs GBP.

⚙️ Copper extended its losing streak to a fifth day, signalling cooling industrial demand.

💰 Canada raised deficit forecasts and cut growth outlooks, while BoJ minutes confirmed a cautious stance on policy normalisation.

🪙

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

加载失败()