🌅 Morning Update (19.11.2025)

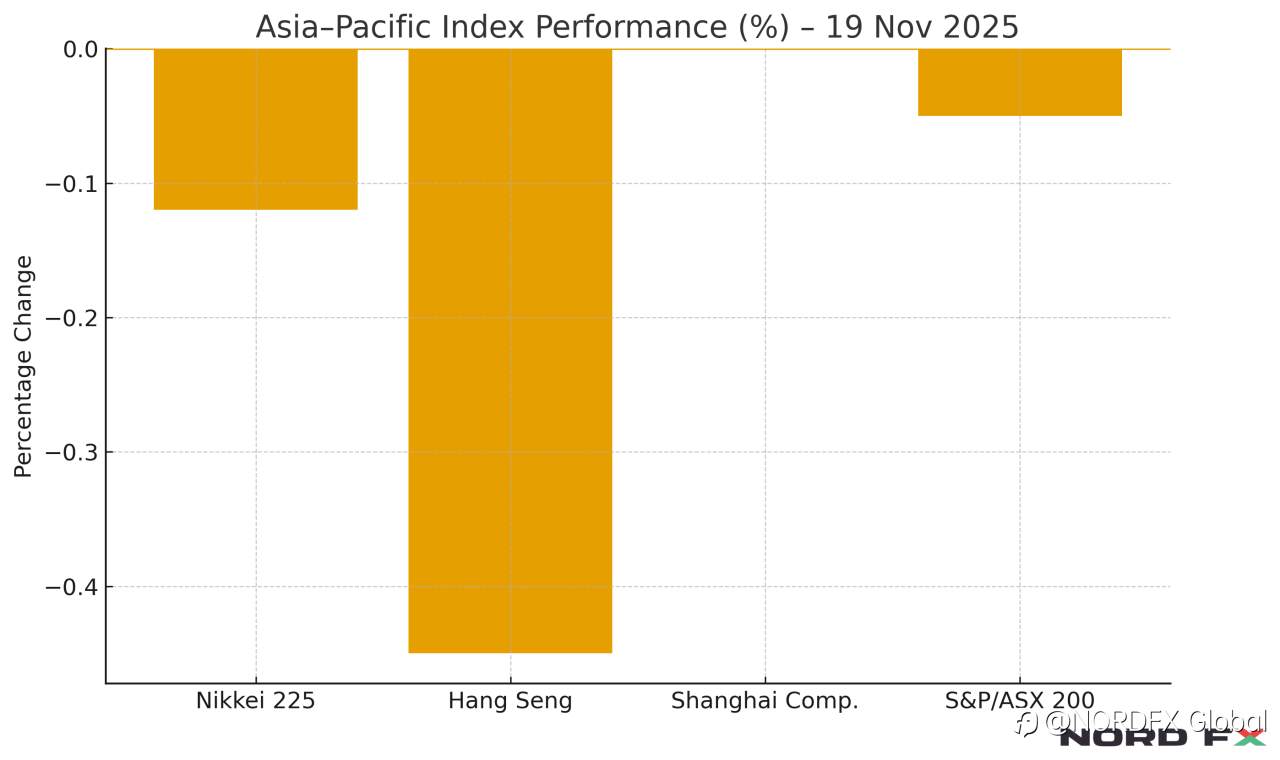

Asian markets opened the day on a weak note 😕. Japan’s Nikkei 225 slipped 0.12%, Hong Kong’s Hang Seng fell 0.45%, the Shanghai Composite stayed almost flat, and Australia’s S&P/ASX 200 posted a mild decline.

European and US index futures are also pointing lower 📉, with European contracts showing slightly stronger downside pressure.

Economic signals from Australia and New Zealand were mixed 🇳🇿🇦🇺. New Zealand’s PPI undershot expectations, while Australia’s wage growth matched forecasts but showed softer momentum in the private sector.

Risk aversion continues to shape currency markets 💱. AUD and NZD are underperforming, while the yen and euro remain in demand. Japan’s PM Sanae Takaichi announced a stimulus package exceeding 20 trillion yen, supported by a sizeable supplementary budget. The BoJ governor met with top ministers to address economic risks, especially the yen’s sharp moves.

Tensions resurfaced after reports that China may reinstate a ban on Japanese seafood imports 🇯🇵🇨🇳.

Meanwhile, the US and Saudi Arabia announced strategic agreements across defence, nuclear cooperation, raw materials and AI 🤝. Riyadh plans to buy around 300 US tanks and later F-35 jets.

President Trump indicated he has probably chosen the next Fed chair, with finalists soon to be presented. Names still in circulation include Kevin Hassett and Kevin Warsh 🇺🇸.

WTI oil is down 0.2% today after API data signalled a larger-than-expected build in inventories 🛢️.

Gold and silver are recovering strongly: GOLD +0.67%, SILVER +1.42% ✨.

Crypto is struggling again, with Bitcoin retesting the USD 90,000 level after another pullback.

Today, markets will closely track Nvidia’s earnings 💻, UK inflation data 🇬🇧, comments from central bankers, and the FOMC minutes from the United States

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发