🌅 Morning Update | 22 December 2025

📈 Global equities: Futures signal a cautiously optimistic start to the week. Asian index contracts are higher, with JP225 extending last week’s rebound. JP225 is up 0.25%, US100 adds 0.4%, while Germany’s DE40 slightly underperforms, down nearly 0.1%.

💴 FX – JPY in focus: USD/JPY pulled back from morning highs near 157.75 to around 157.25. Yen demand was supported by verbal intervention from Japan’s chief “currency diplomat” Atsushi Mimura, who warned against “unilateral and violent” moves and pledged action against excessive volatility.

🌏 FX – AUD & NZD rebound: The Australian and New Zealand dollars are recovering more strongly. By contrast, sentiment remains weaker in the US dollar and the euro. EURUSD briefly retested support near 1.1700, but buyers stepped in to defend the level.

🇨🇳 China: The PBoC left benchmark lending rates unchanged for the seventh straight month despite soft November data. The one-year and five-year LPRs remain at 3% and 3.5%, respectively, affecting new loans and mortgages.

🛢 Oil: WTI crude is up nearly 1.1% amid rising geopolitical tensions, including the US seizure of a Venezuelan tanker over the weekend. Ongoing Israel–Iran tensions have also helped restore a modest risk premium.

🥇 Precious metals rally: Silver continues its powerful long-term uptrend, surging about 3% today to a fresh all-time high above $69 per ounce. Gold has also pushed back above $4,400, breaking into new record territory.

🔩 Broad metals strength: The rally extends beyond gold and silver. Platinum is up around 4%, while palladium jumps nearly 5%, underscoring the strong momentum seen across the precious metals complex for several weeks now.

🪙 Crypto: Digital assets are rebounding as well, with bitcoin up nearly 0.5% and Ethereum gaining about 1% today.

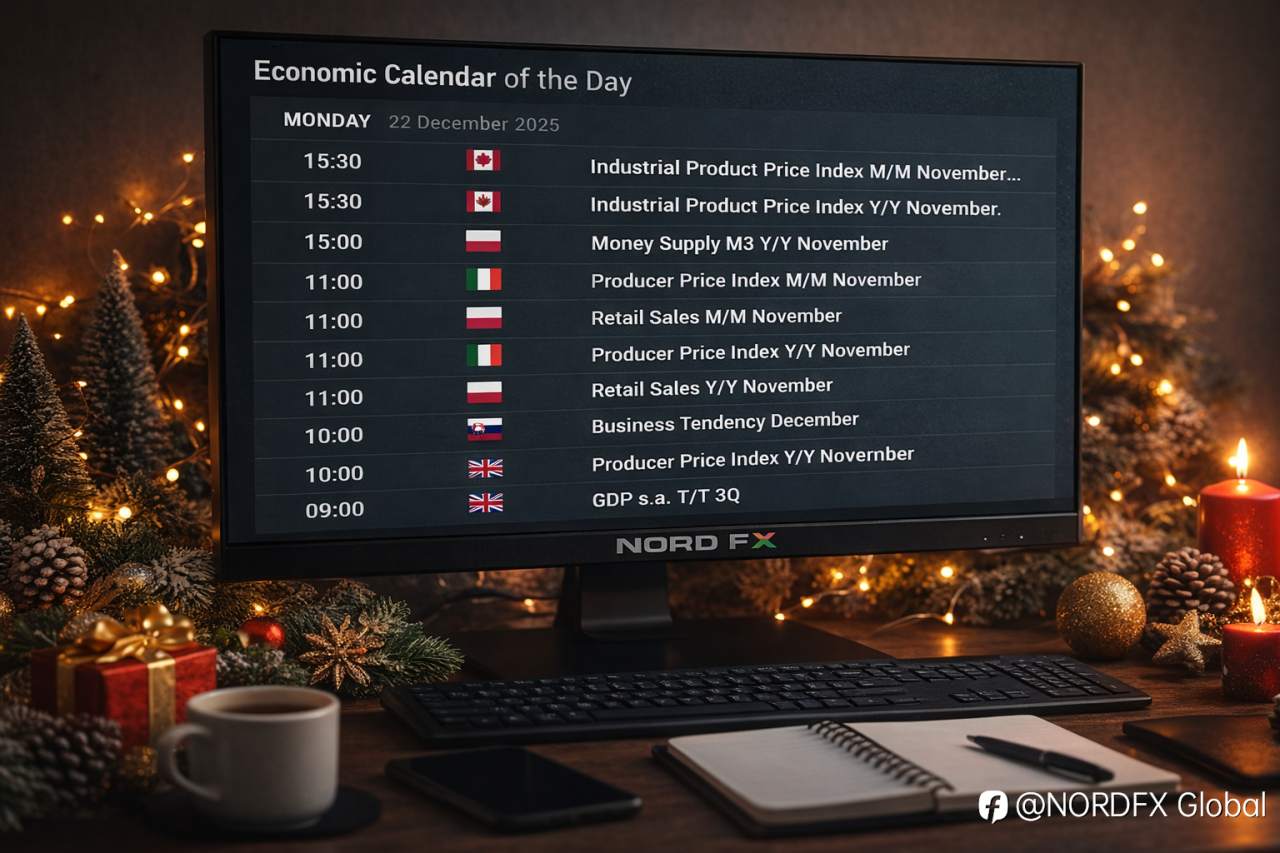

Stay tuned with NordFX and keep a close eye on how these moves shape the week

风险提示:本文所述仅代表作者个人观点,不代表 Followme 的官方立场。Followme 不对内容的准确性、完整性或可靠性作出任何保证,对于基于该内容所采取的任何行为,不承担任何责任,除非另有书面明确说明。

暂无评论,立马抢沙发