一笑飞泓

他点赞了

How to build your own trading system

The trading system is a very complicated system that can be perfected after a long period of tempering. It’s easier said than done. If I want to say how long it takes to build this, how much does it cost? I feel that I should have experienced at least 2 years of complete trading and at least 2 more

他点赞了

跟随收益

563.5

USD

- 品种 WTI

- 交易账户 #4 80019598

- 交易商 AvaTrade

- 开/平仓价格 55.08/53.5

- 交易量 卖出 0.35 Flots

- 收益 553.00 USD

他点赞了

他点赞了

他点赞了

What is the core logic of the trading?

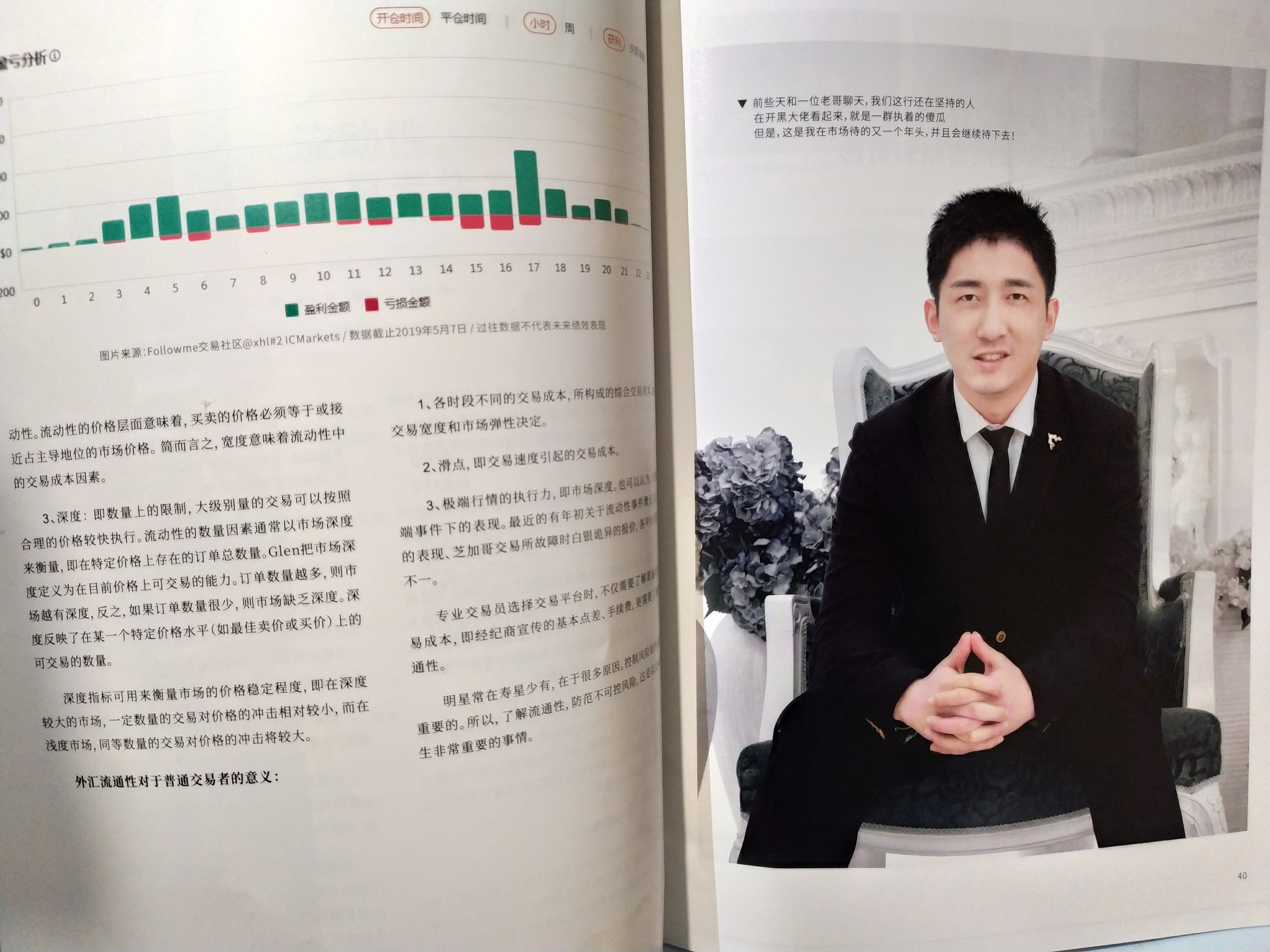

In this case, and this problem exists in various signal forums or in the follow-up community. Often the community will rank transactions based on historical trading conditions for a period of time, based on different dimensions, such as: trading profit ratio, maximum retracement, risk control abilit

他点赞了

他点赞了

Do you have a dream?

Today, I will talk about this topic. Can I make a profit with the order?

In fact, the essence of this problem is also trading, if you think that the transaction can not make money, or it is difficult to make money, then the same as the single.

So my answer is: hard or not.

So how can you handle this

他点赞了

他点赞了

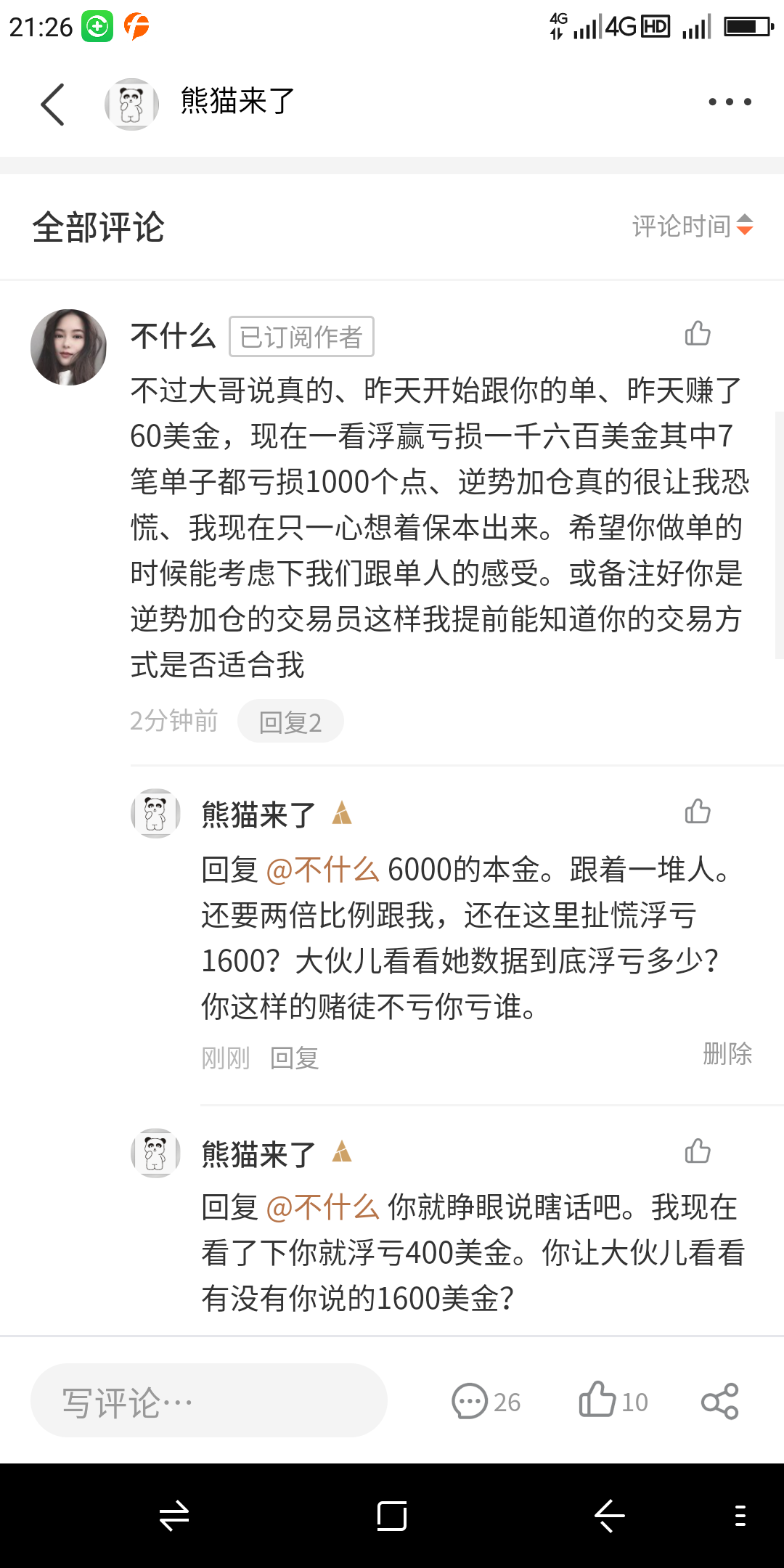

什么样的跟随策略会更容易亏钱?

翻了交易动态,点进去一看,交易员收益率看着都挺好,但跟随者收益为负。

那么,什么样的跟随策略会更容易亏钱?

1

高收益幻觉

有些交易账户的收益率非常高,而且是在短期内实现的。跟随者可能会出现误判:高收益可以复制。

格雷厄姆曾经说过,无论历史数据多么美好,也无法给予未来100%保障。

其次,历史数据具有存活者偏差的偶然。换个时间,换个行情,同样的方法就行不通。

统计学有个均值回归理论,放在交易员身上,体现为“高收益之后低迷,低迷之后高收益”。跟随者在交易员创造高收益之际冲进去,若恰好迎来低迷,会不会含泪止损?在终止跟随关系后,交易员也许会继续创造高收益,但已经和跟随者无关了。

正在加载中...